Bitcoin (BTC) is a significant store of value with a market capitalization of over $250 billion. Many refer to it as “Digital Gold”. Here we compare it with gold, establish some parameters – and discover surprising upside for Bitcoin, even just as a store of value.

Bitcoin (BTC) is a significant store of value with a market capitalization of over $250 billion. Many refer to it as “Digital Gold”. Here we compare it with gold, establish some parameters – and discover surprising upside for Bitcoin, even just as a store of value.

Store of Value Support

Bitcoin is a viable store of value, but currently it fails as a unit of account or as a medium of transaction (see Background below).

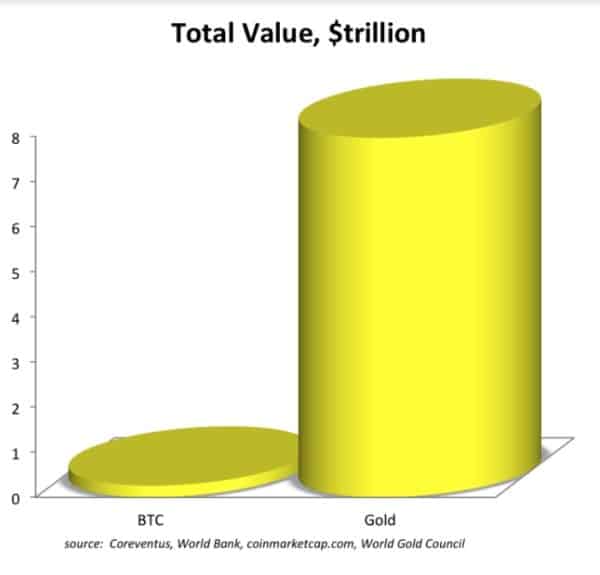

An investor looking to value Bitcoin should therefore be interested in the value of Bitcoin as a store of value. This value should set a support level for the price of BTC. A solid analysis should look at comparing Bitcoin with gold. Gold is the preeminent independent store of value in the world right now, and the largest, with a total value of $8 trillion today and daily trading volume of $140 – $275 billion in 2016, on exchanges according to the World Gold Council.

We believe that BItcoin is exposed to two sources of potential upside as a store of value. First, trade volume sensitivity and second, rebalancing.

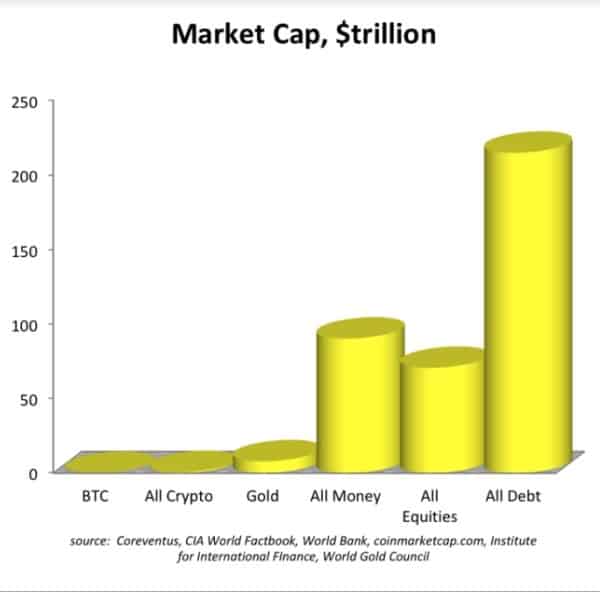

As an overview, we see that gold and Bitcoin are extremely small compared to global investments in securities, and all global currencies.

Rebalancing

Support Will Come From Some Investors Choosing BTC and Gold, or BTC Instead of Gold. With Bitcoin’s increasing maturity and market acceptance (think futures and ETFs, for a start), we are confident that it will be viewed as a viable store of value. We predict an increasing share of investors seeking a store of value will choose Bitcoin over gold. We also anticipate some investors will diversify existing stores to favour an increase in Bitcoin and a decrease in gold. At this point, it won’t need to be much – Gold’s market value is over 30 times that of Bitcoin.

Trade Volume Sensitivity

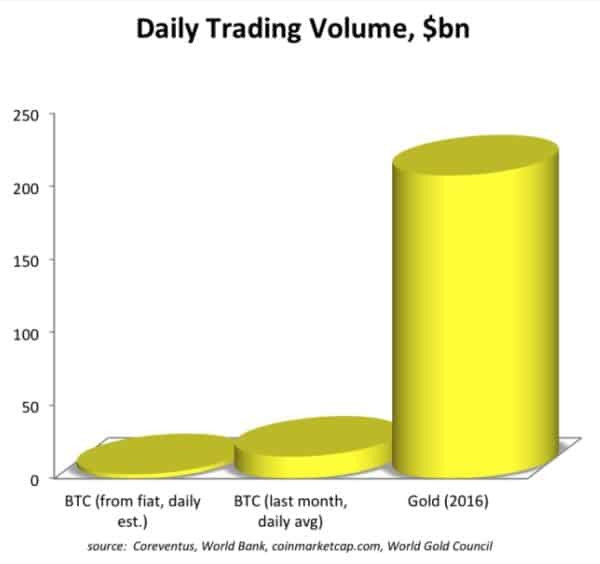

Support Will Come From BTC’s Relatively Small Size Compared to Gold. Most BTC trading is between BTC and other cryptocurrencies. About 1/5 of recent trading comes from fiat currencies, the majority of which is from the US$. Any move from gold to BTC would swamp daily trading volumes, dramatically pushing up the value of Bitcoin. It is easy to find whether Bitcoin is being purchased with fiat currency or other cryptocurrencies, by simply analyzing the volumes of trading pairs on exchanges (e.g BTC/USD, ETH/BTC). In our opinion, any increase in fiat purchases of BTC will be accurately perceived as an overall increase in demand for bitcoin (and parenthetically, further validating all crypto). An increase in demand, ceteris paribus, means there will be an increase in price. With the supply of Bitcoin capped at 21 million coins, price elasticity of demand is a reasonable assumption.

Background: Bitcoin is a Store of Value, But Fails the other Two Tests of a Viable Currency

A currency has three aspects: unit of account, means of exchange and store of value. Bitcoin is definitely a store of value. It currently fails the other two tests – but that could change.

A unit of account requires relative price stability. Many fiat currencies fail this test (Venezuela, Zimbabwe etc.) and all cryptocurrencies, except one. As of now, only Tether (USDT – $1.01) is a viable unit of account, as it is tied to the US$ and is also widely traded (more on Tether soon). BTC has moved from $12,350 to almost $18,000 and then backed off almost $3,000 – all in the last week. Too volatile for a unit of account for now.

A medium of exchange requires that the currency be usable on a day-to-day basis. Bitcoin transaction fees have recently soared to an average of $32.51 – and even at 1/10 that value, not useful as a day-to-day medium of exchange. (We’ve written more on this recently – click here). As well, a Bitcoin transaction can take days to confirm, with a recent average confirmation time of a day and a half. OK for buying a townhouse, but not OK for buying dinner.

A store of value requires a belief that the item retain its value over a reasonable time horizon, be exchangeable, and also in some cases be a safe haven from other economic trends. Bitcoin passes all of these tests, and is widely being talked up as a store of value from tech visionaries such as Apple cofounder Steve Wozniak and PayPal cofounder Peter Thiel.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment