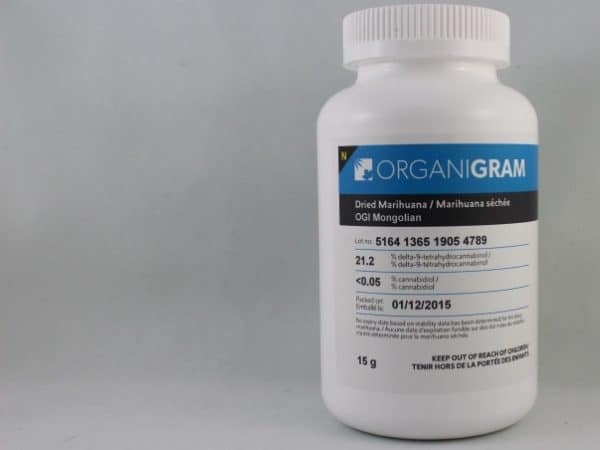

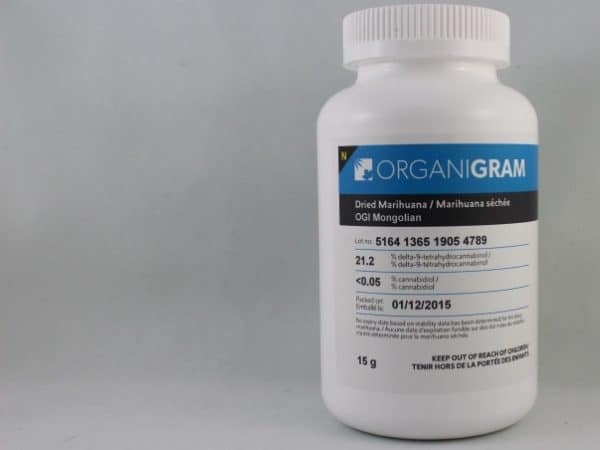

Following the closing of a bought-deal financing, GMP Securities analyst Martin Landry has resumed coverage or Organigram (TSXV:OGI) with a new, higher price target.

Following the closing of a bought-deal financing, GMP Securities analyst Martin Landry has resumed coverage or Organigram (TSXV:OGI) with a new, higher price target.

On Monday, Organigram announced it had closed a $57.5-million bought deal led by Eight Capital and syndicated by Canaccord Genuity, GMP, Mackie and PI. The company said it will use most of the proceeds to build an additional 255,000 of production space at its Moncton campus.

Landry say that with $103-million in the bank, Organigram has the cash to fund its Phase 3 expansion and other international or domestic grwoth initiatives. The analyst says the stock looks cheap compared to its peers.

“Since OGI’s large expansion announcement, shares are up only ~3%, underperforming the broader industry, and suggesting the upside potential from Phase 4 has yet to be priced in. This makes OGI’s current valuation quite attractive in our view which at 8x CY19 EV/EBITDA represents a ~50% discount to Senior LP peers. Given the above we maintain our BUY rating. Our target is derived from a DCF using: (1) a discount rate of 11% (11.5% previously), (2) avg. market share of 6%, and avg. EBITDA margin of 31% (29% prior), and (3) terminal growth of 3%.”

In a research update to clients today, Landry maintained his “Buy” rating, but raised his one-year price target on Organigram from $4.00 to $4.75, implying a return of 28.4 per cent at the time of publication.

Landry thinks Organigram will generate EBITDA of $10.4-million on revenue of $37.8-million in fiscal 2018. He expects those numbers will improve to EBITDA of $43.9-million on a topline of $118.5-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment