Following the company’s fourth quarter results, Echelon Wealth Partners analyst Ralph Garcea is maintaining his bullish target on Nanotech Security (TSXV:NTS).

Following the company’s fourth quarter results, Echelon Wealth Partners analyst Ralph Garcea is maintaining his bullish target on Nanotech Security (TSXV:NTS).

On Thursday, Nanotech reported its fourth quarter and fiscal 2017 results. In the fourth quarter, the company posted Adjusted EBITDA of $1.1-million on revenue of $2.7-million.

“Fiscal year 2017 was, by all accounts, a tremendous year for Nanotech Security,” CEO Doug Blakeway said. “Growing our revenues by 154 per cent and achieving $1.2-million of positive adjusted EBITDA far exceeds our goals for the year. With over $10.9-million in cash and no debt, the company is well positioned to continue our growth in 2018.”

Garcea notes that the quarter fell below his expectation of $3.0-million in revenue, but says the company’s EBITDA topped the $800,000 he had modeled. The analyst says one number in particular jumped out at him.

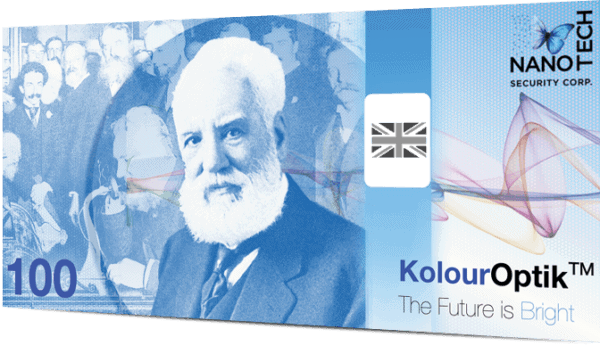

“Gross margin in the quarter was a very surprising 84% versus our 70% estimate, which resulted in NTS’ second cash flow positive quarter. NTS continues to work with its Asian customer to fine-tune specifications for its banknote – management remains optimistic in its ability to generate revenue from this customer, although timing is now uncertain,” the analyst explains. “F2018 financial guidance was provided: 20-40% revenue growth excluding the Asian OTF order and 15-20% Adj. EBITDA margins. In tax stamps, NTS’ nano-optics has become qualified with its Indian customer that is supplying several billion holographic tax stamps to the Indian government and is working towards a final agreement – this has led to other opportunities in India beyond tax stamps in the broader foil packaging market. Management is confident that both the Asian and Indian tax stamp opportunity will turn into revenue and we believe the latter will be realised before the former.”

In a research update to clients today, Garcea maintained his “Speculative Buy” rating and one-year price target of $2.50 on Nanotech, implying a return of 82 per cent at the time of publication.

Garcea thinks Nanotech will generate EBITDA of $2.9-million on revenue of $11.7-million in fiscal 2018. He expects those numbers will improve to EBITDA of $6.5-million on a topline of $18.7-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment