Editor’s Note: This multi-part primer on Blockchain is brought to you courtesy Canaccord Genuity. It is authored by analysts Robert Young, Michael Graham and Scott Suh. Please see the disclaimer at the bottom of this, Part One.

Wow! What a year.

About a year has passed since our initial white paper in November 2016, and blockchain, bitcoin, ethereum and other cryptocurrencies have had an eye-popping year. Bitcoin has appreciated ~540% relative to the USD over the past year as the leading cryptocurrency took further strides towards becoming mainstream.

The past year has also seen a wide range of other developments in and around the cryptocurrency space, including the meteoric rise in the value of ethereum, a “hard fork” for bitcoin and the prevalence of initial coin offerings (ICOs). In this update to our original white paper, we bring the reader up to date on recent developments related to blockchain and bitcoin, while exploring several new topics now relevant in the broader cryptocurrency landscape as follows:

1. Back to basics – what is blockchain? – We provide a review of blockchain and discuss different vectors for disruption within financial services;

2. Bitcoin – surging ahead – We review the fundamental topics related to bitcoin, including its transaction process, bitcoin mining, and competing currencies (including cryptocurrencies and gold);

3. Ethereum – the challenger cryptocurrency – We provide the reader with a deeper dive into the hottest cryptocurrency of 2017;

4. Bitcoin in 2017 –continued evolution– We highlight the most notable events from the past 12 months, including the bitcoin “fork” and China’s ICO ban;

5. Our revised cryptocurrency valuation framework – We provide an updated valuation framework incorporating other cryptocurrencies beyond bitcoin.

Back to basics – what is blockchain?

Blockchain technology represents a more efficient way of verifying transactions. It describes a process of forming and linking blocks of cryptographically signed data to form an immutable and perpetual database of records. “Blockchain” is often used interchangeably with the term distributed or decentralized ledger –it is both. A distributed ledger, or digital database, helps to spread computing power needed for verification authority across multiple locations, or nodes, in a network. A decentralized ledger allows nodes to make independent processing decisions without considering decisions from other network nodes. A distributed and decentralized ledger is a type of shared database where all nodes independently reach decisions then work together to reach a consensus, which helps to maintain the integrity and accuracy of the database. Peer nodes are responsible for maintaining the ledger, and a copy can be obtained from anyone in the group. This particular point –generating a consensus in a decentralized manner– is unique to blockchain. This differs from a traditional centralized network, where operational control is maintained from a single location and transactions are verified by a central authority.

Blockchain technology has inherent advantages, as it improves organizational and/or market transparency, security and efficiency. More broadly, blockchain technology can record and/or transfer ownership of digital property or physical assets (i.e., digital signatures, smart contracts, ownership of houses, cars, stocks and bonds, musical recording rights, healthcare records, voting records, etc. In a typical blockchain transaction, the transaction is encrypted, validated by the decentralized network of computers, and then is added as a new block in the database’s record.

Importantly, each transaction recorded on the blockchain refers to the transactions preceding it, and this linked record is copied and proliferates to all nodes on the network. This makes fraud and hacking nearly impossible. If a hacker wished to edit a transaction, he would have to also edit all related transactions on every network node. This contributes to blockchain being a highly reliable ledger.

Blockchain building blocks

Blockchain networks require a large amount of processing power and a network protocol to function effectively:

1) Network of computers: Blockchain is a decentralized (or distributed), digital database (also denoted as a ledger or registry) comprised of replicated copies of the database stored at different locations, called nodes. Each node contains a unique computer that donates computing power to store data. Data is thereby stored locally at multiple locations rather than at one centralized location. The network protocol, a set of rules, determines how nodes communicate with each other and verify transactions. When the blockchain is utilized for bitcoin, the nodes comprise a network that is responsible for broadcasting transactions and ensuring security.

2) Composition of a block in the blockchain: The database is composed of blocks which contain historical transaction data (including the price, seller, buyer and other transaction details) or digital ownership records (date of transfer, amount of transfer, parties involved, etc.).

3) Cryptographic hashing and the consensus mechanism: The computer network validates transactions by verifying digital signatures through an encryption technique, known as cryptographic hashing (hashing is a mathematical technique used in cryptography that transforms input data of any size to output data of a fixed size –it makes it very difficult to reverse engineer and determine the original input by looking at the output, and if any changes are made to the input, it produces a completely different output). Then, using digital signature verification, the sender sends a message that has been verified (digitally signed) by the sender’s private key and contains the recipient’s public key (which the sender must request initially) to the recipient. The recipient then can receive funds by matching his public key (contained in the message) with his private key, unlocking funds to be released. Note that private keys are never shared, helping to ensure secure transactions. The transaction must be validated at all nodes in order for the block to be validated – this is the consensus mechanism. Note that these private keys must be securely stored to safeguard assets. In bitcoin transactions, the consensus mechanism is called proof-of-work and is performed by bitcoin miners. The cryptographic hash function that is primarily used for bitcoin is called the SHA256 algorithm.

4) Completing the blockchain: The validated block is added to the chain of prior blocks, which are re-distributed to all the nodes in the network. If a particular transaction is incorrect at a node, the “consensus” generated by the network corrects faulty nodes, thereby helping to automatically preserve a consistent digital record of transactions and/or ownership of assets. There are two primary types of blockchain that can be employed depending on the particular use case required. Permissioned blockchains, or closed-protocol blockchains, are more applicable in the private sector, as they would set up a decentralized database that would only be accessible to certain parties. Bitcoin is an example of an unpermissioned blockchain, or an open-source protocol blockchain. In this case, there are multiple ledger copies, which are viewable by anyone and can be changed by anyone. Ethereum is an example of a hybrid blockchain; while it is distributed and observable by anyone, it is maintained in a centralized fashion.

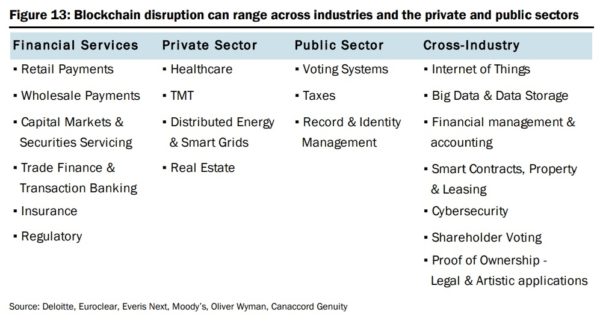

Blockchain should ultimately enjoy a multitude of use cases across industries Blockchain technology should have the potential to impact many industries and activities where there is a need to verify transactions with high levels of speed while reducing costs. Some of these are shown here:

In particular, the bitcoin blockchain should be an attractive way to process a lot of small payments where credit card fees may be too high to make a micro-payment economically feasible. We highlight a couple of opportunities within TMT to leverage blockchain to process large numbers of small transactions: 1) musical royalty payments, 2) publishing and 3) social network video platforms.

The first industry significantly impacted should be financial services Financial services is positioned to be the most near-term disruption vector for blockchain, and we have already begun to see this come into fruition at various financial institutions. This is because the technology enables a more efficient and less costly payments process due to the removal of third-party intermediaries, many of which charge significant transaction fees. This can radically alter the cost structure of some existing business verticals across multiple industry sub-sectors. This initial focus on financial services is corroborated by blockchain thought leaders as well, with 77% of those surveyed by CoinDesk concluding that financial services is where blockchain will have the greatest impact.

Widespread disruption: Within financial services, we think there are seven broad subcategories where blockchain may have an impact. In particular, we think retail payments, wholesale payments, capital markets & securities servicing and trade finance & transaction banking have the largest opportunities due to the friction points in traditional systems that could be alleviated by incorporating blockchain.

Attention from large industry players: Blockchain and bitcoin are garnering interest from the financial services industry. This is most evident when examining the amount of incumbents that are investing in or partnering with blockchain and bitcoin startups.

As with other new technologies in the financial services sector, we expect lots of innovation in startups to happen alongside development efforts at large financial institutions. While it may be difficult for these large institutions to innovate rapidly enough, a robust stream of consolidation of smaller technology-driven companies by the large players is likely.

Bitcoin – surging ahead

Bitcoin is the most popular and widely-used digital currency and represents a specialized use case of a non-permissioned blockchain. There are several advantages that bitcoin can offer over more traditional financial vehicles:

1) Transparency: The blockchain keeps an immutable and auditable record of all transactions.

2) Disintermediates the middle-man, reducing transaction costs: The traditional payments network charges, in some cases, significant fees for processing transactions. Bitcoin can be transferred with little to no cost.

3) Risk of chargeback fraud mitigated: From a merchant’s perspective, once payments are sent, they cannot be reversed by the sender.

4) Protection of sensitive information: Bitcoin transactions do not reveal sensitive financial information to the recipient. This reduces the risk that financial information can be compromised by hackers.

5) Shorter transaction settlement windows: Confirmation and clearing of transactions can take several minutes to an hour, which is far shorter than some traditional settlement and clearing windows.

6) Access to financial services: Bitcoin can be utilized as a mechanism to store value and facilitate money transfers in parts of the world where banking services are inadequate.

7) Security: The bitcoin network is secure, as it is underpinned by blockchain technology that incorporates cryptography and is decentralized by nature, which ensures that records are not compromised if data is lost at one location.

Stay tuned for Part Two of this report….

General Disclaimers

See “Required Company-Specific Disclosures” above for any of the following disclosures required as to companies referred to in this report: manager or co-manager roles; 1% or other ownership; compensation for certain services; types of client relationships; research analyst conflicts; managed/co-managed public offerings in prior periods; directorships; market making in equity securities and related derivatives. For reports identified above as compendium reports, the foregoing required company-specific disclosures can be found in a hyperlink located in the section labeled, “Compendium Reports.” “Canaccord Genuity” is the business name used by certain wholly owned subsidiaries of Canaccord Genuity Group Inc., including Canaccord Genuity Inc., Canaccord Genuity Limited, Canaccord Genuity Corp., and Canaccord Genuity (Australia) Limited, an affiliated company that is 50%-owned by Canaccord Genuity Group Inc.

The authoring analysts who are responsible for the preparation of this research are employed by Canaccord Genuity Corp. a Canadian broker-dealer with principal offices located in Vancouver, Calgary, Toronto, Montreal, or Canaccord Genuity Inc., a US broker-dealer with principal offices located in New York, Boston, San Francisco and Houston, or Canaccord Genuity Limited., a UK broker-dealer with principal offices located in London (UK) and Dublin (Ireland), or Canaccord Genuity (Australia) Limited, an Australian broker-dealer with principal offices located in Sydney and Melbourne.

The authoring analysts who are responsible for the preparation of this research have received (or will receive) compensation based upon (among other factors) the Investment Banking revenues and general profits of Canaccord Genuity. However, such authoring analysts have not received, and will not receive, compensation that is directly based upon or linked to one or more specific Investment Banking activities, or to recommendations contained in the research.

Some regulators require that a firm must establish, implement and make available a policy for managing conflicts of interest arising as a result of publication or distribution of research. This research has been prepared in accordance with Canaccord Genuity’s policy on managing conflicts of interest, and information barriers or firewalls have been used where appropriate. Canaccord Genuity’s policy is available upon request.

The information contained in this research has been compiled by Canaccord Genuity from sources believed to be reliable, but (with the exception of the information about Canaccord Genuity) no representation or warranty, express or implied, is made by Canaccord Genuity, its affiliated companies or any other person as to its fairness, accuracy, completeness or correctness. Canaccord Genuity has not independently verified the facts, assumptions, and estimates contained herein. All estimates, opinions and other information contained in this research constitute Canaccord Genuity’s judgement as of the date of this research, are subject to change without notice and are provided in good faith but without legal responsibility or liability.

From time to time, Canaccord Genuity salespeople, traders, and other professionals provide oral or written market commentary or trading strategies to our clients and our principal trading desk that reflect opinions that are contrary to the opinions expressed in this research. Canaccord Genuity’s affiliates, principal trading desk, and investing businesses also from time to time make investment decisions that are inconsistent with the recommendations or views expressed in this research.

This research is provided for information purposes only and does not constitute an offer or solicitation to buy or sell any designated investments discussed herein in any jurisdiction where such offer or solicitation would be prohibited. As a result, the designated investments discussed in this research may not be eligible for sale in some jurisdictions. This research is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. This material is prepared for general circulation to clients and does not have regard to the investment objectives, financial situation or particular needs of any particular person. Investors should obtain advice based on their own individual circumstances before making an investment decision. To the fullest extent permitted by law, none of Canaccord Genuity, its affiliated companies or any other person accepts any liability whatsoever for any direct or consequential loss arising from or relating to any use of the information contained in this research.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment