Mackie Research Capital analyst Andre Uddin has some tough love for Canadian biotech investors.

In a research report to clients today, Uddin outlined a call he made on the specialty pharma sector. In February, the analyst told investors that a seasonal strength pattern that was in effect from December 16 to February 18 had ended and the sector was up against “an unbreakable wall”.

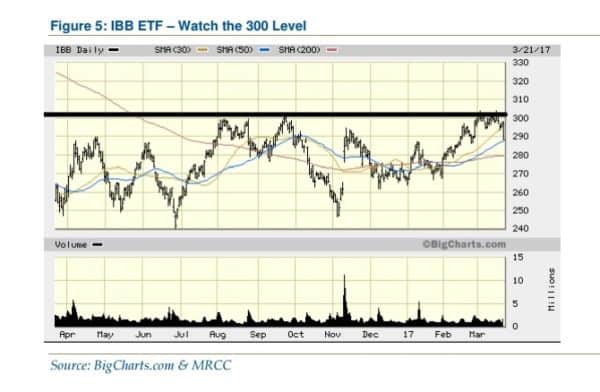

That wall, he said, was the 300 level on the IBB (NASDAQ Biotech Index ETF). The 300 level, he says, is a key barrier the pharma sector has failed to trump. If it were to, offer the analyst, we could see a 20 per cent upward move.

For now, Uddin says there is one class of stocks you should avoid like the plague.

“Canadian specialty pharma companies with legacy assets remain a mess – this is not a surprise as they overpaid for weak assets and are now filled with debt,” he said in the report to clients this morning.

So where should life sciences investors be looking. Uddin has one overriding thematic idea and a short list of stocks that fit the bill.

Innovation is always where it’s at and it’s going to be real important in 2017,” says the analyst. “To counter the risks associated with volatility in the biotech sector, our investment thesis remains unchanged – investors should remain focused on companies with clean balance sheets, disruptive R&D programs, late-stage assets and novel products to be or recently launched. Our top picks for 2017 remain Aurinia (AUPH-NASDAQ/AUP-T, SPECULATIVE BUY, US$11 Target Price) and Theratechnologies (TH-T, BUY, C$7.60 Target Price). A broader rally would occur if that 300 level on IBB is broken through, however, this level has been unbreakable YTD.”

Uddin says two other names to watch are Knight Therapeutics (TSX:GUD) and Pediapharm (TSXV:PDP). He has a “Hold” rating and one-year price target of $10.75 on the former, and a “Speculative Buy” rating and one-year target of $0.50 on the latter.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment