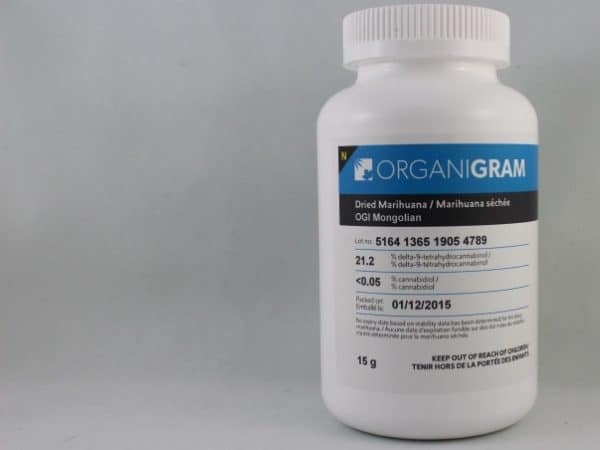

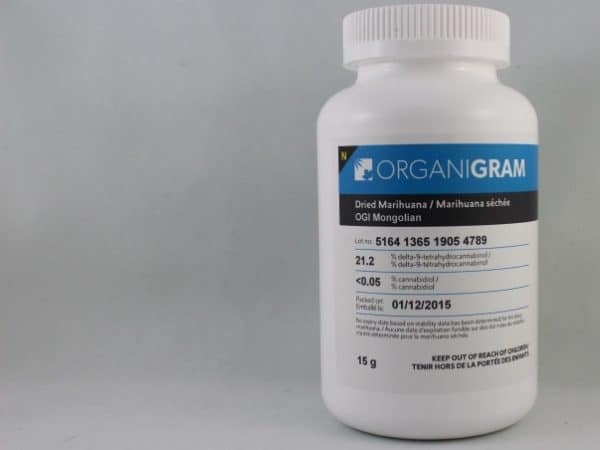

Like most all cannabis stocks, it has had a strong run in 2016. But Mackie Research Capital analysts Neil Gilmer and Andre Uddin think there is still upside in OrganiGram (OrganiGram Stock Quote, Chart, News: TSX:OGI).

Like most all cannabis stocks, it has had a strong run in 2016. But Mackie Research Capital analysts Neil Gilmer and Andre Uddin think there is still upside in OrganiGram (OrganiGram Stock Quote, Chart, News: TSX:OGI).

On Tuesday, OrganiGram reported its fourth quarter and fiscal 2016 results. The company reported break even EBITDA on revenue of $1.9-million in Q4.

“The emerging cannabis industry is developing at a rapid pace and Organigram as a company is evolving and preparing for what we believe is one of the most exciting commercial events in the history of the capital markets,” said CEO Denis Arsenault. While we are happy to have our first year of positive operating cash flow under our belt, this is just the beginning and we have never been more optimistic about our future. Our facility expansion is well under way, our branding initiatives are developing nicely and we have been fortunate enough to establish partnerships with some of the strongest platforms in the space.”

Gilmer and Uddin say OrganiGram’s fourth quarter results were slightly below their expectations; the analysts had modeled EBITDA of $200,000 on a topline of $2.2-million. Overall, the analysts are still bullish on the stock.

“While slightly disappointing we do not view it materially as investors should be focused on future growth opportunities,” the analysts said of the Q4 results. “We expect an improved growth profile for its Q1/F17 results with an increased license received in the quarter and a full quarter of oil sales. We believe that OGI’s advantageous cost structure will enable the company to generate solid earnings going forward.”

In a research update to clients today, the analysts maintained their “Speculative Buy” rating and one-year price target of $4.35 on OrganiGram, implying a return of 28 per cent at the time of publication.

The analysts believe OrganiGram will post EBITDA of $4.8-million on revenue of $14.5-million in fiscal 2017. They expect these numbers will improve to EBITDA of $12.7-milion on a topline of $31.3-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment