The information advantage.

In an age when big data is tossed about as the solution to most every business problem that arises, many are finding that the interpretation and application of data is of at least equal importance.

Founded in 2004, Calgary-based Zaio (Zaio Stock Quote, Chart, News: TSXV:ZAO) looked to disrupt the real estate valuation industry with a sophisticated and elegant solution that would put the power of information into the hands of those that needed it the most. Of course, even the most ambitious plans must be set to the side when the biggest housing crash ever happens smack in the middle of your business plan. The generational event sent shares of the fledgling company into a tailspin.

But Zaio survived. And now, in 2015, the firm appears set to deliver on its initial promise. With new regulations around loans and securitization, Zaio allows experts to quickly and accurately prepare valuation reports on a database that has surpassed 100-million properties. It’s a multi-billion dollar market that Zaio thinks it can take a sizable chunk of through its own hard-won information advantage.

Cantech Letter talked to CEO David King about the past, present and future of Zaio.

David, can you tell us about Zaio’s history?

Zaio was founded in 2004 with the goal of disrupting the antiquated real estate valuation industry with new data and technologies. We succeeded in many fronts by introducing new and patented data standards and technology. As we were gaining momentum with appraisers and lenders, the mortgage industry had a complete meltdown and many of our clients paused any new initiatives. At the same time, pending legislation was reshaping our industry through tough regulatory standards.

During that time, Zaio retooled its strategy for products and technology to the U.S. market. The goal had to be to create enabling data and technologies that can allow experts to rapidly and accurately prepare valuation reports that meet all the new regulatory requirements to be accepted for loans and securitization.

In 2014, we fulfilled this strategy by being one of the first appraiser-driven valuation products to take advantage of new banking guidelines for alternative valuations. Getting adoption of new products into the banking industry can be a daunting task. We’re pleased to report that we’ve not only gained some adoption, we’ve succeeded in something virtually unheard of as a newly reintroduced brand – we’ve been invited to have our GEAR™ products participate in proposals with several leading lenders.

Additionally, through acquisition, we’re complementing our proprietary data with technology with platforms and services that extend our reach into the largest lending and investment institutions in the U.S.

What gap in the market is Zaio filling?

Zaio provides proprietary valuation products, data and technology to the real estate valuation market. That not only includes what you would consider traditional lenders, but also investors and capital markets companies currently trading assets.

Consumers are more aware than ever that their home is their single most important asset. Providing them with professional-level data and tools would help them manage that asset. For that market, we may be looking at ten times more opportunity.

How large a space is this?

While over $7.6 billion spent a year to value over $23 trillion dollars in assets the ongoing need to keep an accurate pulse on the market has become a requirement ever since the mortgage crisis. But, that may be just the tip of the iceberg. Consumers are more aware than ever that their home is their single most important asset. Providing them with professional-level data and tools would help them manage that asset. For that market, we may be looking at ten times more opportunity.

Isn’t the home valuation issue already being addressed by Zillow?

Zillow isn’t really in the home valuation space. They are an ad-supported network that facilitates buyers and sellers, and provides an estimate to attract their audience. In the U.S., Zillow data and technology can’t be used to fund or securitize a loan, as they do not offer home appraisals. You simply can’t substitute the independent expertise of an appraiser or agent when it comes to assessing valuation drivers such as condition, view, location, and quality. There’s currently no standardized reliable publicly available data source for that data. That’s where we come in.

True story: a client recently purchased a portfolio of over 1,200 distressed assets. As part of their due diligence they used freely available information on the Internet to estimate the value and condition from photos. Photos are provided by listing agents and homeowners that have a vested interest in portraying the home in the best possible light. Plus, unless the property is very recently listed, there’s no way to clearly understand if the photo accurately reflects the current condition of the properly.

The client hired us to help with the valuation after the acquisition as he prepared and learned that the information they had used misled them on the property condition and value. Several homes were not even standing any more, or were in very poor condition. Unfortunately, they ended up losing millions of dollars on the trade.

What Zaio wants to do is use big data and technology to disrupt the investment and lending space the same way Zillow is currently disrupting the real estate transaction. We don’t feel that we compete with Zillow at all, as we are serving different market in the massive industry that supports US residential real estate.

Over these last few months, we’ve seen sustained revenue growth that continues to hit new records. On every level –data, technology, products, and services– we’re demonstrating to markets that the full pro forma companies are poised to take us where we need to go.

What kind of breadth and depth of information does Zaio have that your competitors don’t?

We have a growing data set of over 100 million properties, which includes standard publicly available data such as bed, baths, and living area. We collect and standardize key valuation drivers that can only be gathered by local experts — condition, quality, view and location. We are continually working on new technologies to allow local-market experts to more rapidly and accurately score properties for valuation, and to improve and streamline the workflow to make appraisals and valuations happen faster.

Can you tell us about the acquisitions you have made?

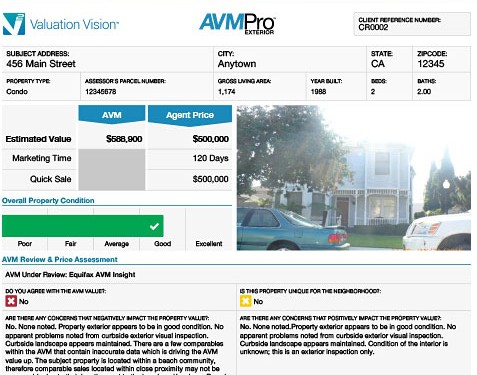

We’re currently in the process of acquiring two companies in the United States. Valuation Vision provides proprietary alternative valuation products to leading banks and capital markets. They developed a platform and valuation technology to cost-effectively engage thousands of local valuation experts to perform services. AXIS Appraisal Management is a highly respected AMC based in San Rafael, California. Because they are licensed nationwide, AXIS allows us to offer our appraiser-based solutions within the strict banking and regulatory compliance requirements. In addition to the technology and services capacity that these acquisitions bring, both have a long list of clients that they bring to the table from day one.

Why have your acquisitions taken so long to complete and integrate?

For a variety of factors, including all the regulatory requirements required for the Canadian Market. Acquiring private companies means we need to rebuild their financial statements to public company standards, and then have them independently audited over multiple years. This takes manpower and time to ensure that Zaio can meet its reporting standards both initially with its new subsidiaries, but on an ongoing quarterly reporting basis as well. We recently hired a CFO in the United States to lead the team effort required to get the massive audit requirements completed. On another note, our recent capital raise announced in December 2014, puts us on a clear path for completing the Acquisition of Valuation Vision. At this point, we’re finishing up the audit and regulatory work to finalize the deal, and the financing in December allowed us for the first time to hire the necessary finance staff to accelerate the audit and reporting process.AXIS and Valuation Vision are already strong strategic partners and already share a lot of business as we have integrated the companies. The companies have mutual agreements that allow them to closely collaborate and are incentivized to grow the business together.

Big data analytics and new product development will open massive new markets for us and will help our clients unlock the potential in the data. Some areas of the real estate market operate with little regulation, however disrupting the mortgage space with data and technology requires a much more strategic approach to get locked in.

Why did Zaio decide to terminate its license agreement with Zone Data Systems (ZDS)?

Zone Data Systems was a remnant of the initial strategy for licensing and distributing products and technology to the U.S. Market. The problem was that the U.S. valuation industry radically changed after regulations caused HVCC and Dodd-Frank. Terminating the agreement with ZDS set the stage to put AXIS Appraisal Management as the distribution arm because they have already passed all the regulatory hurdles. Many of the partners in ZDS are still involved with the data collection, fulfillment and distribution of Zaio products, and we made them shareholders of Zaio as well to align their interests with our shareholders. By using AXIS as the primary distributor, it allows Zaio to remain compliant with all the federal and state regulations.

You recently announced record pro forma revenue of (U.S.) $3.5-million for the February. What do you think this signals?

First, it signals that our strategy is sound and makes sense. Over these last few months, we’ve seen sustained revenue growth that continues to hit new records. On every level – data, technology, products, and services -– we’re demonstrating to markets that the full pro forma companies are poised to take us where we need to go.

Why does Zaio have so many shares outstanding?

Zaio is a ten-year-old company that invested millions in development prior to tough market conditions in 2009, forcing a restructuring of the company. Zaio’s share count today relates to financing for the re-start of the company starting in 2011 that led to the successful launch of our patented database technology into the US market. Additionally, we are utilizing both cash and stock to purchase Valuation Vision and Axis so that the principals of those companies become significant Zaio shareholders as well and have their interests aligned with all Zaio shareholders.

What do you want to accomplish in 2015 and 2016?

Of course closing our acquisitions so we can fully consolidate the results of operations remains our first goal. We’re on track and moving along on all fronts, and should be able to complete the requisite regulatory requirements to close Valuation Vision soon. Operating under one umbrella, post closing allows us to completely come to the market with integrated sales and marketing plans. It’s a great story, and we’ve already got some big fans in the industry buying our solutions. For 2016, it’s partially stay the course and manage our fantastic growth rates, but we will also continue to invest in our leading technology platform and refine our data for new uses. Big data analytics and new product development will open massive new markets for us and will help our clients unlock the potential in the data. Some areas of the real estate market operate with little regulation, however disrupting the mortgage space with data and technology requires a much more strategic approach to get locked in. That said, success can pay big dividends because once you set the standard, you can truly disrupt the market.

Disclosure: Zaio is an annual sponsor of Cantech Letter

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment