High flying healthcare player Patient Home Monitoring (Patient Home Monitoring Stock Quote, Chart, TSXV:PHM) has upped its previously announced financing.

The company, which has seen its shares more than quadruple since last fall, says it will now raise $58.5-million in a bought deal led by Mackie Research Capital with a syndicate that is comprised of GMP and Beacon. The company will sell 39-million units at $1.50 per unit. The units consist of a share and a half warrant priced at $1.80.

The news comes on the heels of a record quarter for the company, which plays in the in-home healthcare diagnostics market. On April 9th, PHM reported a Q1 in which it posted adjusted EBITDA it says exceeded $2.85-million on a topline of more than $13-million. The company did not post a profit and loss statement with the results.

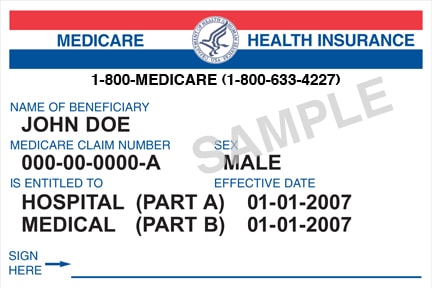

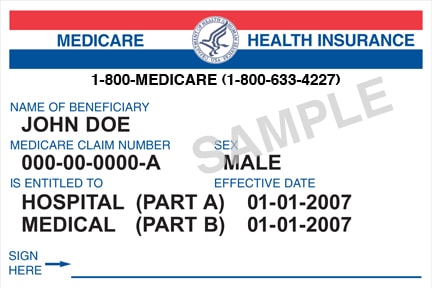

PHM, it says, is looking to roll up the in-home care space by acquiring small, profitable businesses that service chronically ill patients. The company says the market is large and fragmented and the beneficiary of the trends of an aging population and a push by U.S. Medicare to reduce costs by encouraging in-home healthcare services.

Chairman Michael Dalsin said he expects the company’s M&A activities will ramp up, but that the company is focused on being selective.

“In terms of our M&A pipeline, I do expect that we will close our four outstanding LOIs quite soon,” he said. “Since adding to our M&A staff, we have built a very large pipeline which, in my experience, should give us the ability to pick the very best deals. We continue to work with the larger acquisition targets to finalize deal terms and I am cautiously optimistic that we may land a larger deal soon as well. We will continue to focus on our large and growing pipeline of deals to ensure we can achieve our year end run rate revenue goal.”

At press time, shares of Patient Home Monitoring were down 2.3% to $1.69.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment