ViXS Systems’ (ViSX Systems Stock Quote, Chart, News: TSX:VXS) heavy investment in R&D will enable the company’s stock to rebound from a “free fall” following its IPO in July of last year, says Paradigm Capital analyst Daniel Kim.

ViXS Systems’ (ViSX Systems Stock Quote, Chart, News: TSX:VXS) heavy investment in R&D will enable the company’s stock to rebound from a “free fall” following its IPO in July of last year, says Paradigm Capital analyst Daniel Kim.

Since its offering, which was priced at $3.50, shares of Toronto-based ViXS Systems have experienced a protracted slide, with its most recent prices being the lowest.

But Kim says this result is wrong-headed.

“Investors have not given the company any benefit of future growth prospects, and we could not disagree more,” he said in today’s report.

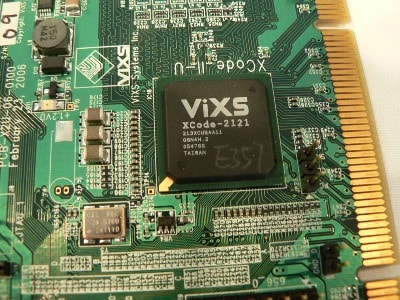

The analyst says investments into emerging technologies have made ViXs a world leader in video processing. He says that concurrent with its loss of market valuation, the company has been positioning itself with to capitalize on the increasing demand for the transcoding and processing of next generation 4K Ultra HD and HEVC content. He points to recent design wins that have added to an already impressive product portfolio. “Now having the benefit of time to “reset the clock” with a heavy investment in R&D, VXS has emerged stronger than ever,” he says.

Kim says the video processing market is being driven by expanding content and the proliferation of devices to view this content. He pegs the size of the company’s addressable market at more than $2-billion, with a compound annual growth rate of 17%.

In a research report to clients this morning, Kim initiated coverage of ViXS with a “Buy” rating and one-year target of $2.75, which implied a return of 150% at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment