Sandvine (TSX:SVC) could be on the cusp of a huge opportunity in wireless, says M Partners analyst Manish Grigo.

Sandvine (TSX:SVC) could be on the cusp of a huge opportunity in wireless, says M Partners analyst Manish Grigo.

In a research report to clients this morning, Grigo initiated coverage of Sandvine with a “Buy” rating and a one-year target of $4.50, implying a return of 38.5% at the time of publication.

Grigo says Sandvine’s story is one of large and powerful trends it is uniquely qualified to capitalize on. He notes that Cisco’s Visual Networking Index report, released in February of this year, predicted that mobile data traffic would grow to 15.9 exabytes per month by 2018, a staggering 11x rise over 2013. He thinks Sandvine is well positioned to take advantage of this increased demand because it is one of three companies that provide network intelligence solutions and has the largest market share and highest margins amongst its peer group, says the analyst. This, he says, makes Sandvine “best of breed”.

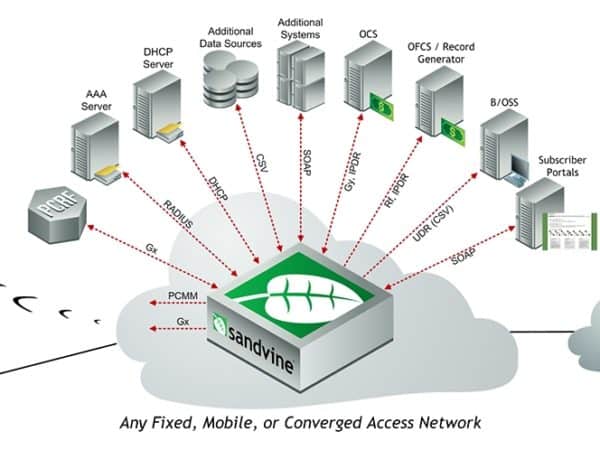

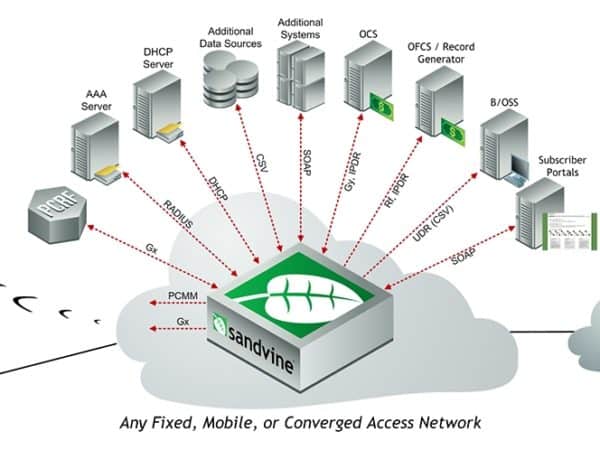

The M Partners analyst says the move towards the cloud might move Sandvine up the value chain. He says software-defined technology and virtualization could allow it to play in the higher margin Policy Rating and Charging space as opposed to simply being a stand-alone Deep Packet Inspection vendor.

Grigo says he believes Sandvine deserves to trade a premium to large vendors like Cisco, which aren’t pure play wireless solutions providers and have lower margins and growth than the Waterloo-based company. His target, his says, implies an EV/EBITDA multiple of 12.7x his fiscal 2015 EBITDA estimate of $36.9-million. He notes that direct comparable Allot (NASDAQ:ALLT) trades at a 2014 EV/EBITDA multiple of 17.4x, while Sandvine trades at just 10.2x.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment