With the announcement that Kodak’s former president will now lead Alcatel-Lucent’s patent monetization efforts, Envision IP analyzed ALU’s patent expiration and issuance activity versus its peers.

This past week, Alcatel-Lucent announced that Laura Quatela, former President and co-COO of Kodak, has been appointed as ALU’s Executive Vice President of Intellectual Property. Given Kodak’s demise, and the sale of what were once considered its most lucrative patent assets for a mere fraction of their estimated intrinsic value, it will be interesting to see how Quatela plans to monetize ALU’s patent portfolio. ALU’s failed monetization deal with RPX in 2012 fell short of expectations, and it did little to bolster ALU’s licensing efforts.

Envision IP identified 16,206 in-force US patents assigned to ALU and its various subsidiaries. This accounts for roughly half of ALU’s estimated 32,000 worldwide patents.

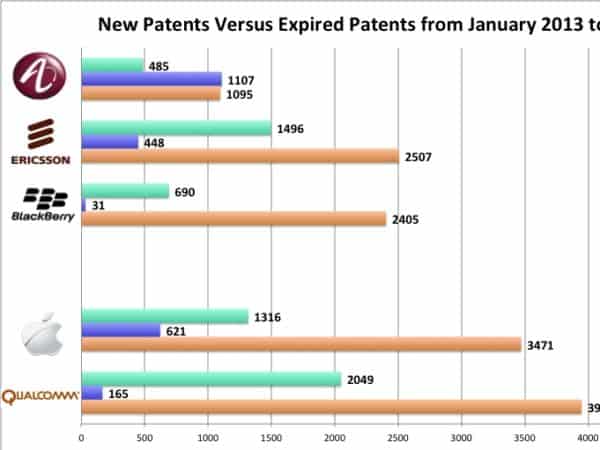

We analyzed US patent data of ALU, Ericsson, and BlackBerry from January 2013 to present to determine if these patent portfolios are growing or shrinking.

Since 2013, ALU had 1,107 patents expire, and during the same period, the company received 1,095 new issuances. ALU had 485 published patent applications filed during this period.

Ericsson, on the other hand, had 448 patents expire, with 2,507 new issuances and 1,496 published patent applications filed during this period.

BlackBerry lost the least amount of patents since 2013, with only 31 expiring. The company had 2,405 new issuances, and 690 published patent applications filed during period. Many of BlackBerry’s expired patents were patents acquired from Nortel, Motorola, Deutsche Telekom, and Ericsson.

In contrast to these former telecom giants, Apple and Qualcomm have dominated the group in terms of issuances since 2013, as shown above. Apple experienced 621 expirations, and Qualcomm only saw 165 expirations, during this period.

Envision IP’s analysis suggests that BlackBerry and Ericsson are continuing to innovate and obtain patent protection at comparable rates to each other, but at a much lesser rate than rivals Apple and Qualcomm. ALU lags far behind in terms of issuances and new patent application filings. However, more concerning is ALU’s rate of patent expirations, which is the highest amongst the group.

ALU’s grant:expiry ratio since 2013 is 0.98; meaning that for every patent expiration, ALU has less than 1 patent grant. This indicates that ALU’s patent portfolio is shrinking, albeit slowly. Ericsson and Apple’s both have a positive grant:expiry ratio during this period of about 5.6. Qualcomm’s grant:expiry ratio is 23.9, while BlackBerry has a staggering grant:expiry ratio of 77.5.

Overall, BlackBerry’s US patent portfolio is growing at the steepest relative pace, with 77.5 new patent issuances for every patent expiration. However, it is not clear if this trend will continue, as BlackBerry only has 690 patent application filings since 2013, compared to Ericsson’s more than double figure of 1,496.

In conclusion, amongst ALU, Ericsson, and BlackBerry, it appears that Ericsson and BlackBerry are making strides in patenting activity, and are experiencing growing patent portfolios. In contrast, ALU lags behind significantly in terms of new issuances and new filings, and as a consequence, its patent portfolio has shrunk since 2013.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment