After some unavoidable regulatory delays and technical reviews, the future is looking bright for NXT Energy Solutions (TSXV:SFD), says Mackie Research Capital analyst Raveel Afzaal.

In a research update to clients this morning, Afzaal maintained his “Speculative Buy” recommendation and $1.70 one-year target price on NXT Energy, implying a 31% return from the date of publication.

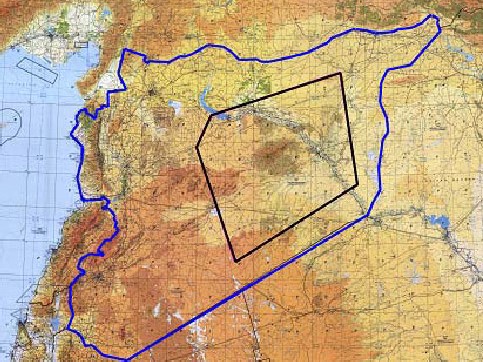

Afzaal believes that NXT Energy’s proprietary airborne Stress Field Detector technology is showing great promise in reducing the cost of conducting a seismic survey. He says his discussions with end users suggest a high correlation between anomalies detected by SFD and seismic surveys. This is important to note, he says, because SFD is “10 to 30 times cheaper” than the cost of conducting a traditional seismic survey.

After the Mexican state-owned petroleum company, PEMEX, awarded NXT a $5.8mm survey contract in 2012, the company’s stock subsequently raced to highs near two-dollars in 2013. While many were expecting a larger follow on contract, Afzaal notes that the possibility was muddied by regulatory changes to Mexico’s oil and gas market and a technical review by PEMEX itself.

Afzaal says that based on his discussions with management, a formal sign off on the initial contract has been completed, waiving the requirement for any further technical evaluation of the technology.

Internationally, notes Afzaal, NXT is in “advanced discussions” with the new customers in the United States, Pakistan, Bolivia, Malaysia and Argentina, a pipeline of opportunities worth $35-million, not including PEMEX.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment