A major shift in the way cable is being delivered and consumed is creating a huge opportunity for Espial Group (TSX:ESP), says Clarus Securities analyst Eyal Ofir.

In a research report to clients this morning, Ofir initiated coverage of Espial with a “Buy” rating and one-year target of $4.00.

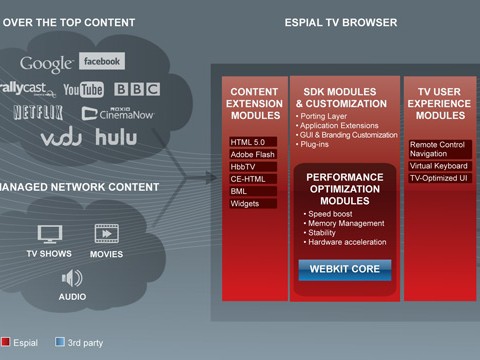

Ofir thinks Espial, which has spent years developing expertise in creating IPTV video services such as video-on-demand and TV web browsing, will soon find itself the beneficiary of a major change in the cable business. He says many operators are following the lead of Comcast and standardizing on the RDK framework (RDK stands for Reference Design Kit, a pre-integrated software bundle that provides a common framework for powering customer-premises equipment from TV service providers) and HTML5 so they can provide customers with next generation video services. He notes that the company is already in discussions with more than a a third of the top 70 global cable operators.

The financial implications of capturing a mere 10-20% of the cable market, says Ofir, are massive. In North America alone, he says, this represents represents mid-point one-time license revenue of more than $82-million, with recurring support revenue of more than $12-million annually.

You can also add the Smart TV market to the list of near-term opportunities for Espial, says the Clarus Securities analyst. The company has existing relationships with nine global television OEMs that position it neatly in a market that analysts predict will double to nearly a quarter-billion dollars by 2017, he notes.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment