After warning that its Q2 will be softer than expected, AgJunction (TSX:AJX) has had its target and rating cut by PI.

Analyst Pardeep Sangha yesterday changed his rating on the company from “Buy” to “Neutral” and chopped his one year target on the stock from $1.20 to $.90.

“General weakness within the agriculture markets in the first quarter of 2014 has continued into the second quarter of 2014, resulting in lower year-over-year sales volumes,” said AgJunction CEO Rick Heiniger in a press release in which the company said it did, however, expect to be profitable this year.

Sangha says the culprit is the current weakness in the overall agricultural industry. The silver lining for investors, he says, is that a lower share price could make the company an attractive acquisition candidate due to its agricultural focus, patent portfolio and low valuation multiple.

The PI analyst yesterday lowered his EBITDA and revenue expectations for fiscal 2014 and 2015. He now thinks the company will post EBITDA of $4.4-million on revenue of $52.3-million, down from his previous expectation of $6.7-million in EBITDA on a topline of $57.5-million. For the following year, he expects EBITDA of $5.2-million on revenue of $55-milion.

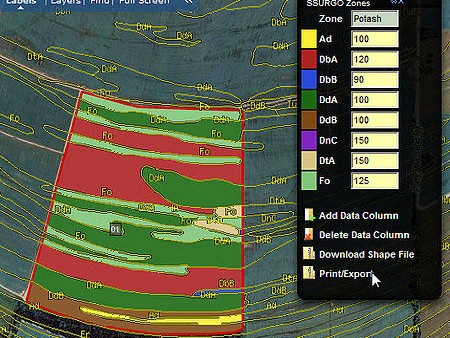

Formerly known as Hemisphere GPS, Agjunction sells hardware and software aimed at the burgeoning precision agriculture space.

At press time, shares of AgJunction were down 2.6% to $0.76.

____

Comment

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

I believe the press release stated that they DO expect to be profitable for 2014. #corrections

We did indeed make that mistake and have no corrected it. AgJunction management does expect the company to be profitable in fiscal 2014.