The way we consume media is evolving at breakneck speed while legacy networks and broadcasters scramble to get out of neutral. Everything we know about the media industry is being transformed by interactive and streaming technologies. There are incredible investment opportunities out there available for those who have done their homework and who know the right people.

The way we consume media is evolving at breakneck speed while legacy networks and broadcasters scramble to get out of neutral. Everything we know about the media industry is being transformed by interactive and streaming technologies. There are incredible investment opportunities out there available for those who have done their homework and who know the right people.

At Difference Capital, we’ve been talking to industry players, hanging out at trade shows (like NAB in Vegas and MIPCOM in Cannes), and watching the data closely to get the clearest read on this ongoing sector disruption. Our thesis is these new technologies will create significant wealth-making opportunities and as such, we have been investing in this space for some time now. Here are some of the battles we are watching:

• Web Streaming vs. Cable/Satellite

• Over The Top (OTT) vs. Broadcast

• On Demand vs. Linear TV

• Second Screen Participation vs. Passive TV Screen

• TV Anywhere vs. the Family room

• UHDTV (4K) vs. HDTV

• Netflix, Apple, Amazon, Microsoft, Google vs. NBC, ABC, CBS, Fox, Comcast

Just following these emerging battles makes for great entertainment! (No, please not another reality show idea!) But at Difference we are more than just watching, we are investing in this eco-system at several points – including at the content level (Thunderbird Films, Blue Ant Media, even Virgin Gaming) and at the technology level (iPowow, Quickplay Media, Cricket Media as well as Baanto & BTI Systems).

The first part of our thesis is that even with all this disruption, content continues to remain king and new distribution technologies only serve to enhance its power position – like Kevin Spacey’s “Frank Underwood”. Companies like Thunderbird Films and Blue Ant Media are taking advantage of the 50+ big media buyers out there (up from a handful a decade ago).

And the second part of our thesis is that there is a decade long battle emerging between legacy video providers and new IP-based entrants, and investing in the technology arms dealers will show handsome returns. iPowow and QuickPlay, amongst others, are serving to disrupt how established entrants approach the market.

In this report we highlight:

1. The IP-ization of TV

2. A TV in Every Pocket

3. Will Advertising Follow the Technology?

4. The Impact of 4K TV

5. Can the Pipes Handle It?

The IP-ization of television

Déjà vu! We’ve seen this movie before. At least a few of us old-timers have. IP technology has successfully disrupted

• Data networks (IP vs. ATM, TDM, etc)

• Voice networks (VoIP vs. circuits)

• Wireless networks (IP based LTE, 3G vs. GSM, CDMA)

Now IP is moving into Television networks with the same potential for disruption. Think of it as yet another Hollywood sequel “The IP massacre part IV”.

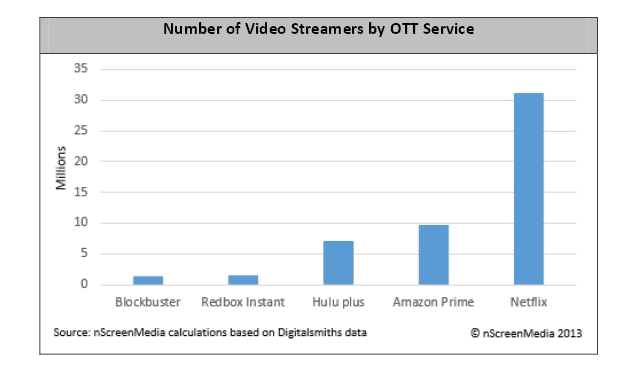

Even before the arrival of IP-based services, classic scheduled television has been under attack for some time now. First it was the DVR with the ability to skip commercials, then IP first appeared with pirated content shared over peer-to-peer (P2P) networks, but mostly it’s threatened by IP/Internet based Over-the-Top (OTT) streaming from the likes of Netflix, YouTube, iTunes and more recently by Amazon, Xbox and others. Sure, legacy networks have fought back with expanded Video on Demand (VoD) services and even more specialty channels, but Cable video subscribers continue to decline while streaming users continue to grow.

I suspect many households are like mine. First, we got an Apple TV for iTunes rentals of movies. Then my kids and my wife wanted to get Netflix (thanks Kevin Spacey) for $8/month, and since I am always looking for ways to reduce my $100/month cable TV bill I agreed to Netflix, but only if we dropped to a more basic cable package. The result is we saved $40 on the Cable bill, offset by the $8 Netflix bill. Oh, and yes we had to bump up our internet package by $20 to have a higher download cap.

My older kids who have recently moved to their own apartments are probably a good indication of the millennial generation in that they have no cable TV service at all, (or wireline phone) and get all their video and voice services over the internet (including live sports). The IP-everything generation.

These trends are clearly showing up in the data as indicated in the charts below.

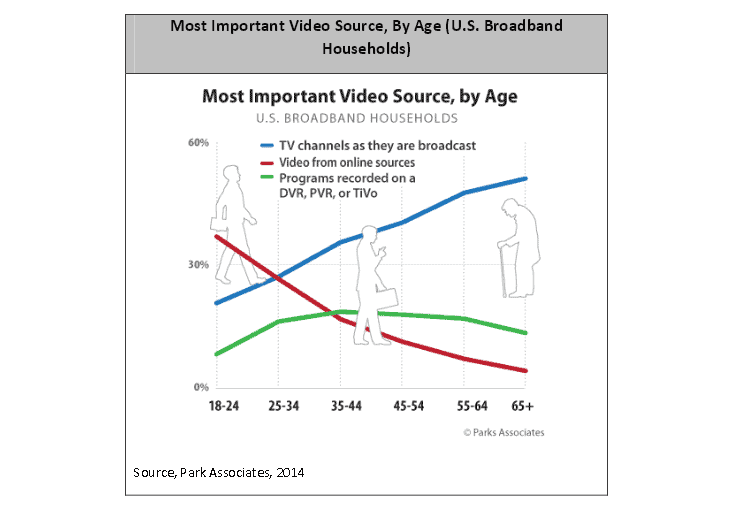

This chart says it all. The emerging generation of spenders get more of their video from online sources (the red line) than from broadcast. Sure, some of us old cranks will stick with the traditional networks, desperately looking for old re-runs of the “Sonny and Cher Show”, but that’s not where the growth will be. Expect the chart to rapidly shift to the right over the next few years as even more cable alternatives emerge.

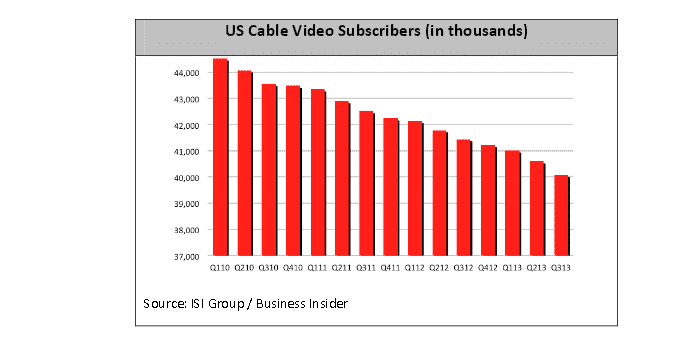

And the chart below shows how the shift is manifesting. This chart shows how US cable TV is losing its TV subscribers – a process known as cord-cutting. I suspect this understates the revenue loss as many subs that remain are doing what I did, which was to move to a more basic cable TV package for sports and news, and use OTT services for all other content. Governments are in on this too – the Canadian government has recently indicated its intention to restrict mass television channel packaging and move towards a “pick-and’pay” system. As well, the CRTC recently indicated that 2013 was the first year where the number of Canadians cutting the cord exceeded the number of new TV subscribers.

The offset for the cable company to this decline of course is they are making some of their television losses back on higher fees for their internet services needed for OTT services. FYI, I recently bumped my download cap to 300G/month!

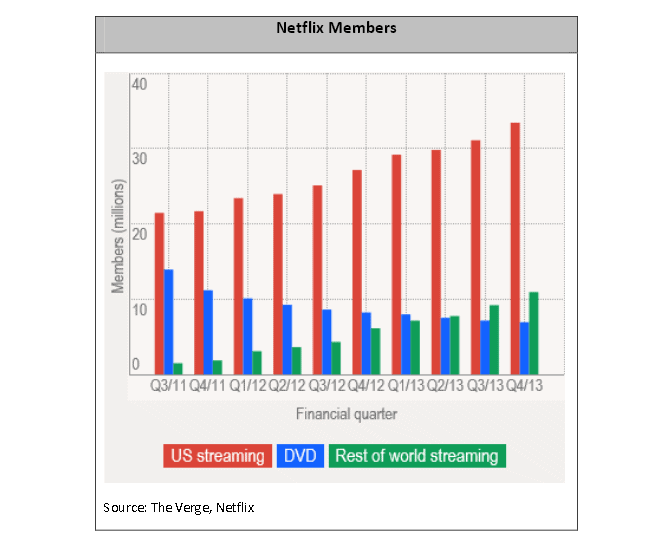

Meanwhile, streaming is coming on strong. The following chart shows how Netflix streaming is growing in all markets. Its recent quarter saw total subscribers (US and International) top 48 million. The traditional broadcasters recognize this – Hulu, arguably Netflix’s most visible competitor (and which just announced it has reached 6m subscribers) is a joint-venture between NBC, Fox and Disney/ABC.

And while Netflix is the largest, it’s far from the only game in town. Amazon Prime for example just acquired some key rights to older HBO content (like the Sopranos, etc). Microsoft is launching original content around its Xbox platform. And a very recent example is that of WWE (World Wrestling Entertainment) which just launched its first 24 hour OTT network and within six weeks had over 600,000 subscribers. This is a clear example that every content player should be looking at a streaming/OTT strategy. Note, one of our investments, Thunderbird Films, is now a supplier of content to Netflix and Hulu.

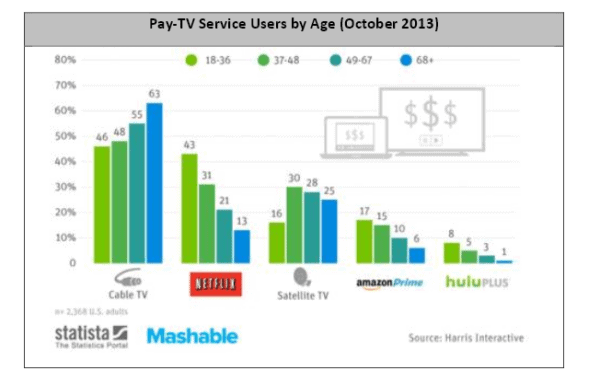

And as we’ve stated, the rush to cut the cord is being led by the young:

Here’s a really interesting stat: Video games now have more online spectators than traditional sports. A streaming service called Twitch, which features streaming video of video games, apparently is now the most popular live streaming site in the US. We see this driving upside to our investment in Virgin Gaming.

You’re less than halfway through this special report from Difference Capital, for the rest click here.

____________________________________________________________________________________________________________________

Comment

One thought on “Why We’re Investing in Massive IP disruption of TV, Broadcast and Media”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

This is a nice overview of the changing landscape. As well as streaming video services, there is an abundance of video all over the internet which is available for free. A recent Cisco study predicts that it would take more than 5 million years for a person to watch the amount of video that will cross global IP networks each month in 2017.

The challenge will be developing technologies to help us efficiently search for and consume video. My company has developed an app called MondoPlayer which is like a feed reader for video. The app is in beta now with an Android release coming soon. It gathers video from the web into continuous streams. As new videos are posted they are added to streams. This saves the time and effort of visiting various sites, finding videos you like and clicking to play them.. Here is an example of a stream http://www.mondotag.com/stream/General1

You talk about your kids not having cable. According to a recent study done for Pivot.tv 12% (8.64 million) American Adults aged 18 – 34 have broadband and use it to stream tv to their devices but they do not have traditional tv service. I think cable tv companies are beginning to face the same challenges as newspapers. The only people I ever see reading a paper newspaper are older folks. This was not the case only a couple of years ago.