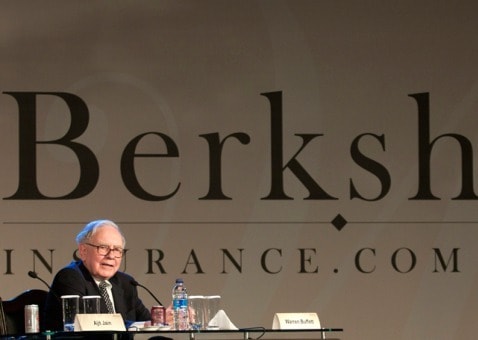

Constellation Software is really a private equity investment company along the lines of Berkshire Hathaway, says analyst Ralph Garcea, but it has a notable distinction that creates value.

Global Maxfin Capital analyst Ralph Garcea says it may be difficult for fast-growing Constellation Software (TSX:CSU) to continue its torrid growth, but with a healthy dividend and a near-term outlook that is solid, the company remains an attractive investment.

In a research report to clients this morning, Garcea initiated coverage of Constellation with a BUY rating and $240.00 one-year target.

Garcea notes that Constellation, which grows by acquiring vertical market software and now has more than 125 business units in its portfolio, has achieved a compound annual growth rate (CAGR) of 31% over the past decade. The company might not be able to match that going forward, but is still very attractive as an investment, he says.

The Global Maxfin Capital analyst thinks Constellation can grow its revenue to $2.3-billion by 2018, which is a 21% CAGR from 2012 levels.

Garcea says it is best to think of Constellation Software as a private equity investment company along the lines of Berkshire Hathaway or Onex, which which own portfolios of businesses that are unrelated to each other. But Constellation’s portfolio approach focuses strictly on vertical market software businesses, he says, and as a result its clients enjoy several strategic advantages. The company been extremely efficient at restructuring businesses and deploying capital, he says.

Shares of Constellation Software closed today down .4% to $200.50.

________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment