The “underbanked” -those people in the United States with poor access to mainstream financial services- are becoming heavier users of smartphones, and that bodes well for Vancouver-based Tio Networks (Tio Networks Stock Quote, Chart, News: TSXV:TNC), says Global Maxfin analyst Ralph Garcea.

TIO, a cloud-based bill payment processor, allows utility, telecom and cable companies to bill customers using a mobile payment solution that is increasingly popular with the financially underserved, a segment of the U.S. population that some may be surprised to hear exceeds 60-million. TIO today processes more than $1-billion annually in biller remittances, and has grown its revenue at a compound annual growth rate of 24% since 2008.

Garcea notes that The Federal Reserve has revealed that the mobile usage rate is 8% higher in the underbanked population compared to the average American, and he believes TIO will be a major benefactor of a general societal move to making bill payments on mobile devices.

In a research report to clients yesterday, Garcea initiated coverage of TIO Networks with a STRONG BUY recommendation and a 12-month target price of $0.65 per share, which implies 76% upside. He rates the risk profile of the company as “speculative”.

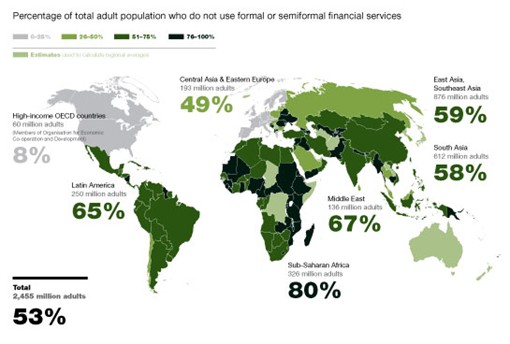

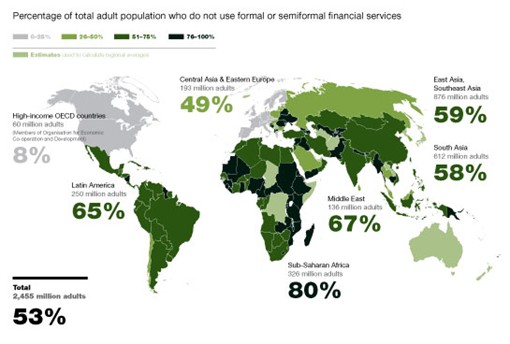

While the U.S. is a near-term focus, Garcea says the broader market is set up even better for TIO, as half the worldwide market is unbanked. At the same time, he notes, mobile penetration is increasing.

Africa, for instance, has 93-million mobile subscribers at just an 11% penetration rate, and the Asia-Pacific region has 895-million subscribers with just a 22% penetration rate. Latin America, he notes, reportedly has a 70% unbanked population, but 90% of the population owns a cell phone. The analyst says TIO is positioned to benefit from the large gaps that exist in “the cash-preferred global market.”

At press time, shares of TIO Networks were even at $0.335.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment