Pason Systems (Pason Systems Stock Quote, Chart, News: TSX:PSI) has shown an ability to buck unfavourable industry trends and continuously increase its revenue per rig, notes Industrial Alliance analyst Steve Li. He says the company will continue to grow organically, in part because it has been forward thinking, and has invested heavily in R&D.

On August 2nd, Pason reported its Q2, 2013 financials. The company lost $39.37-million on revenue of $82.4-million. The topline bested Li’s expectation of $80.7-million.

The larger story from the quarter, though, was the settlement of a decade-old patent infringement suit relating to the company’s AutoDriller. On August 1st, Pason and the plaintiff in the case negotiated a final resolution. Despite a payment of $115.8-million, Li notes that the company still holds a “pristine” balance sheet with $195-million in cash and no debt.

In a research update to clients this morning, Li raised his rating on Pason from HOLD to BUY and raised his one-year target price from $18 to $21.

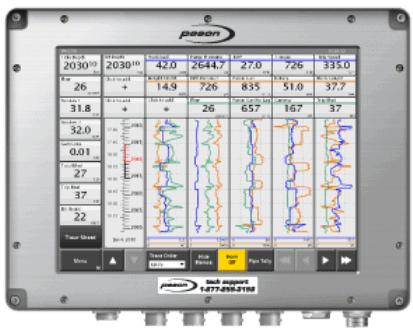

Li notes that that industry drilling days and rig counts have declined more than 11%, and bad weather in Western Canada hasn’t helped. But Pason has employed increased product penetration with its Electronic Drilling Recorder peripherals, such as SideKicks and Workstations, which were, in fact, the quarter’s main driver.

Shares of Pason Systems closed today up 3.8% to $20.06.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment