The increase in mobile data, television, radio and telecommunication services is a boon to Cambridge-based Com DEV (Com DEV Stock Quote, Chart, News: TSX:CDV), which has carved out a strong position in satellite communications, says Global Maxfin Capital analyst Ralph Garcea.

On Friday, Garcea initiated coverage of Com DEV with a BUY rating and one-year target of $5.00. He says the veteran company is not without risks, namely the potential for government budget cuts and sales cycles that can be especially long.

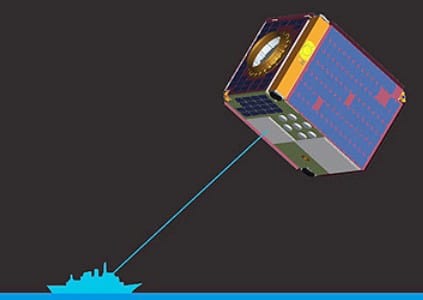

But there is real upside in the company’s current product offering, which since 2010 has included it majority-owned subsidiary exactEarth, a company that monitors ships by satellite and ground infrastructure, he says.

Garcea notes that since launching in 2010, exactEarth has grown its capacity and its customer base, and is addressing a market with mandated demand. The International Maritime Organization has stipulated that that Automatic Identification Systems (AIS) now be aboard all ships greater than 300 gross tonnage. Garcea says globally this market will exceed $100-million within five years.

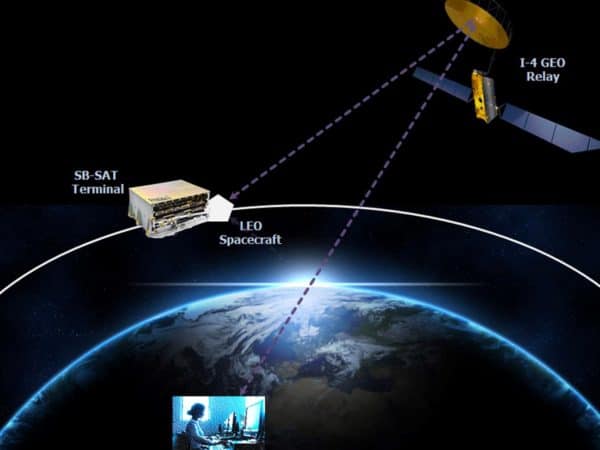

Garcea says COM DEV’s space segment provides investors with broad overall exposure to the satellite space, as it sells things such as multiplexers, filters, switches, and signal processors to nearly all the major satellite prime contractors and many government space agencies.

At press time, shares of Com DEV were up 2.9% to $4.28.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment