Cantor Fitzgerald analyst John Safrance says Innergex Renewable Energy’s (Innergex Renewable Energy Stock Quote, Chart, News: TSX:INE) setback this week with its Upper Lillooet and Boulder Creek projects will have a “negligible” long term impact.

Cantor Fitzgerald analyst John Safrance says Innergex Renewable Energy’s (Innergex Renewable Energy Stock Quote, Chart, News: TSX:INE) setback this week with its Upper Lillooet and Boulder Creek projects will have a “negligible” long term impact.

On Monday, the Squamish-Lillooet Regional District board voted against granting temporary use construction permits for Innergex Renewable Energy’s Upper Lillooet Hydro Project, citing concerns over land tenures and backcountry access.

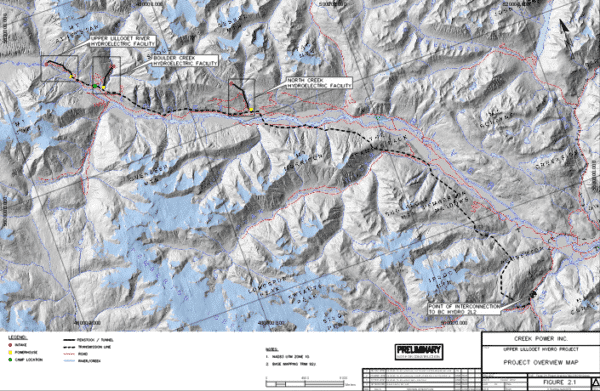

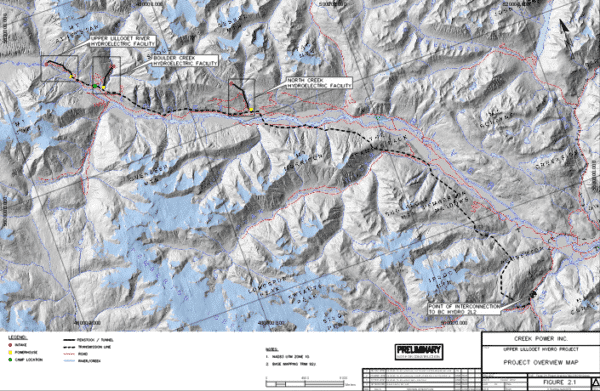

The Upper Lillooet Hydro Project includes two proposed run-of-river, clean energy generation facilities located in B.C.’s Pemberton Valley; the 81.4 megawatt Upper Lillooet River Hydroelectric Facility and the 25.3 megawatt Boulder (Pebble) Creek Hydroelectric Facility.

Innergex spokesman Bas Brusche said the company was disappointed with the outcome.

“Obviously, we had hoped and expected that the SLRD would have approved our Temporary Use Permit applications,” he told local paper Question. “The SLRD staff had given a positive recommendation on that, and (indicated we) had met all the requirements for the permits, so we were somewhat surprised that during the meeting, new conditions were brought up outside the scope of those initial requirements.”

Safrance says a recent selloff prompted him to upgrade his rating on Innergex to a BUY, and these developments do not change his opinion. Late in March, shares of Innergex tumbled after rating agency DBRS lowered its credit rating on the company. The agency dropped the company to a “non-investment grade” BB from BBB, which is a “low” grade.

Safrance says there are three likely scenarios; the company is ultimately granted temporary use permits on the promise of additional amenities, it initiates litigation, and the worst cast result; an abandonment of the project. The Cantor Fitzgerald analyst says he believes the chance of Innergex walking away from the project is “quite low”, but that this result would impact his target by as much as $0.40.

But the upside on Innergex’s stock, says Safrance, is compelling with or without the Creek Power project. He says with it, he sees 27% upside, without it 21%. In a research update to clients yesterday, Safrance reiterated his BUY recommendation and $10.50 one-year target.

Shares of Innergex Renewable Energy closed today down 1.2% to $8.79.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment