Stifel Nicolaus analyst Blair Abernethy says Absolute Software’s (Absolute Software Stock Quote, Chart, News: TSX:ABT) acquisition of Palisade Systems is part of an overall broadening of its product offering that the company is executing well.

This morning, Absolute announced that it had acquired the assets of privately held data security and data loss prevention provider Palisade Systems, which is based in Des Moines, Iowa. Financial terms were not disclosed.

Absolute Software CEO John Livingston said the pickup would strengthen his company’s offering in the governance, risk management, and compliance space.

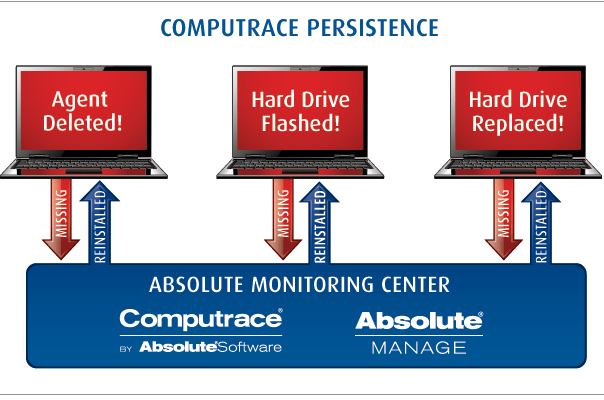

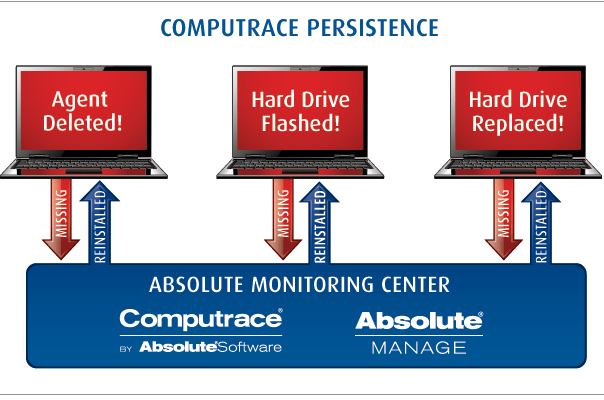

“Our customers have been requesting that we add this type of end point DLP capability to Computrace, our end point GRC offering. The technologies are complementary. We can now provide our customers with an expanded GRC offering that allows them to not only remotely invoke security commands to prevent and mitigate data breach scenarios, including data delete, data retrieval and device freeze, but also to now pro-actively monitor and manage data at risk on the end point,” he said.

Abernethy says he views today’s move as a positive because it is another in a series of moves Absolute has made that increase its relevance with key customer verticals. He notes that Palisade has been positioned by Gartner in the niche quadrant of the 2013 Magic Quadrant for Content-Aware Data Loss Prevention.

Today’s pickup follows last November’s acquisition of helpdesk software provider LiveTime Software, the acquisition of FailSafe and Freeze Anti-Theft Assets from Phoenix Technologies in 2010, and the 2009 pickup of LANrev, all of which added key components to the Absolute Software of today, says Abernethy.

In a research update to clients this morning, Abernethy maintained his BUY rating and $9 one-year target on Absolute Software. He says the company’s stock is currently trading 2.4x his estimate of its fiscal 14 EV/S, which is well below U.S. comparable SaaS peers.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment