Assembling BlackBerrys used to be a big part of Celestica’s (Celestica Stock Quote, Chart, News: TSX:CLS) gig. But with that relationship having drawn to a close recently, the company is proving it can soldier on.

Celestica this morning reported its Q1, 2013 results, and while the results weren’t spectacular, they showed the company’s transition to higher margin business might well be underway.

Celestica earned $10.5-million, or $.16 a share in Q1 on revenue of $1.37-billion. Taken on a year-over year basis the numbers weren’t great, but the company’s heavily scrutinized bottom-line numbers were at the high end of their own estimates.

CEO Craig Muhlhauser warned that the macro environment was still iffy.

“Celestica delivered first quarter revenue consistent with our expectations, while achieving profitability at the high end of the guidance range driven through solid execution and disciplined cost management,” he said. “With the overall economic outlook expected to remain challenging, we continue to focus our efforts on delivering value to our customers through strong operational performance, and on improving our financial performance through productivity improvements and effectively managing our costs and resources, while making the necessary investments to support our longer-term objectives.”

Last July, Celestica announced a restructuring aimed at improving its margins. Management says the estimated cost of the move will be in the range of $55-million to $65-million, $44 million of which it says it ate in 2012.

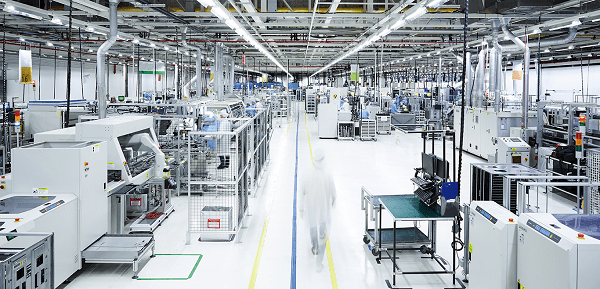

Manufacturing BlackBerrys, as well as other consumer products such as XBoxs and iPhones, was once Celestica’s bread and butter. But the IBM spinoff saw continual valuation woes as its electronics manufacturing services faced increased competition from China. This meant margins in an already difficult business were becoming razor thin. More recently, Muhlhauser, a former exec with Ford and GE who joined Celestica in May 2005, has looked to move the company up the value chain to replace the business it recently ended with BlackBerry, which once represented almost a quarter of Celestica’s total revenue.

Revenue from BlackBerry now accounts for close to zero for Celestica, falling from 20% of its total in Q4, 2011 and 10% in the third quarter of fiscal 2012. Management says it still relies too heavily on too few customers, something it is looking to remedy. Its top ten customers represented 67% of its revenue in 2012, down from 71% in 2011.

At press time, shares of Celestica on the TSX were up 5.2% to $8.24.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment