Oncolytics Biotech (TSX:ONC) today announced it has closed a previously announced underwritten public offering of 8.0 million common shares, at a public offering price of (US) $4 per share.

The company said it intends to to use the net proceeds from the offering to fund its clinical trial program, manufacturing program and for general corporate and working capital purposes.

In its recently reported Q3, 2012, Oncolytics Biotech lost $9.24-million. In fiscal 2011, the company, which has yet to generate revenue, lost $29.4-million.

Owing to a recent upswing in the company’s shares, today’s financing is less than half as dilutive than it would have been just a short time ago.

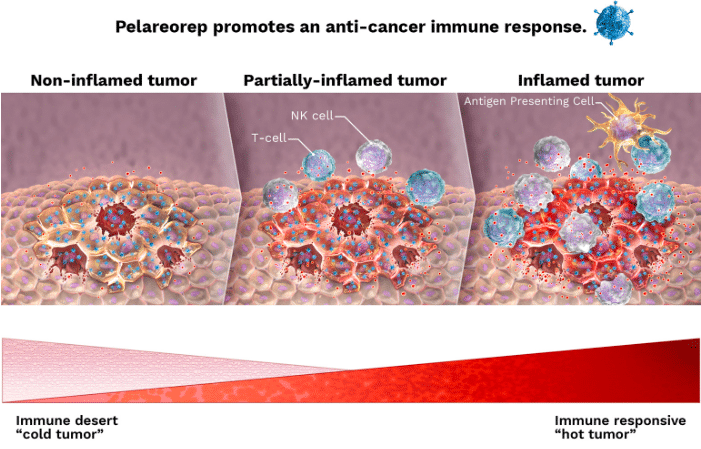

Earlier this month, Shares of Oncolytics spiked after the company announced that a Phase Two study showed its Reolysin treatment was 95% effective in treating tumours. The trial showed that 19 of 20 patients who had squamous cell carcinoma of the lung exhibited overall tumour shrinkage.

The stock has moved from a low of $1.70 on November 15th, to recent a recent high of $4.75.

Oncolytics Biotech’s history can be traced to discoveries made in the Department of Microbiology and Infectious Diseases at the University of Calgary in the 1990′s The company has since poured ten of millions of dollars into the development of a cancer treatment based around a formulation of reovirus, a family of viruses that can affect the gastrointestinal system and have shown to have oncolytic, or cancer killing properties. Oncolytics Biotech has become a world leader in the area, with nearly three-hundred patents to date.

At press time, shares of Oncolytics Biotech on the TSX were down .5% to $4.01.

____________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment