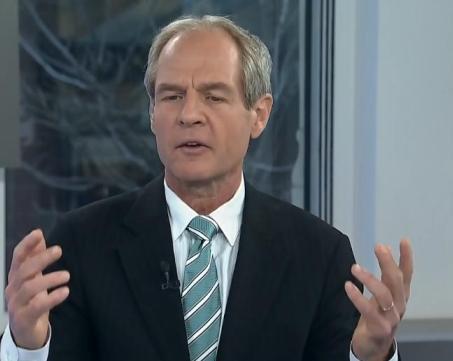

Cantor Fitzgerald analyst Tom Liston says the rise in specialty drug spending bodes well for Catamaran Corp. Cantor Fitzgerald analyst Tom Liston attended the Pharmacy Benefit Management Institute’s (PBMI) Drug Benefit Conference in Las Vegas earlier this week.

Liston says a dominant theme at the conference was the dramatic growth in specialty drug spending. Those in the industry, he says, are now projecting that specialty drugs will account for 30% of pharmacy benefit expenditures by 2016, and more than 40% of drug costs by 2030.

Liston says this bodes well for one of his perennial top picks; Catamaran Corp. (TSX:CCT). He points out that Catamaran also believes the specialty market could be worth up $2 billion in the short to medium term. In a research update to clients this morning, Liston maintained his BUY recommendation on Catamaran, and raised his target to $65, up $5 from his previous target.

Specialty medications are different from the norm because they are developed through intensive research and require special handling. They are mostly likely to be prescribed for chronic conditions such as cancer, cystic fibrosis or multiple sclerosis. The drugs are administered to only a small portion of the population, but are extremely expensive. Liston points out that in 2011, Prime Therapeutics, a Pharmacy Benefits Manager that was established by Blue Cross Blue Shield of Minnesota, disclosed that just 0.4% of its total prescriptions dispensed were specialty drugs, but these prescriptions contributed 15.4% of total spend.

Liston’s says he raised his target price on Catamaran because he upping his 2014 multiple on the stock from 24x fiscal 2014 earnings to 25x and increasing his forecasts. He notes that management has grown adjusted EPS at a Compound Annual Growth Rate (CAGR) of 59% between 2008 and 2011. His forecasts are based on a CAGR in excess of 44% between 2011 and 2014.

Shares of Catamaran on the TSX closed today down 1.2% to $55.32

____________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment