Catamaran (TSX:CCT) yesterday reported its Q3 2012 results. The company earned $19.4-million on revenue of $3.2-billion, which was 148% better than the $1.3-billion topline the company delivered in the same period last year.

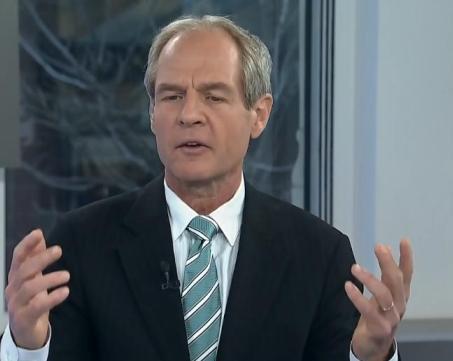

Mark Thierer, Catamaran CEO, said the company’s impressive momentum is showing no signs of weakening:

“The third quarter was the start of a truly transformative time for our company,” said Thierer, adding: “We began the full-scale integration of Catalyst into our operations and launched the rebranding of our combined company as Catamaran. In the midst of the merger integration and rebranding launch, we continued to execute on our operating plan. Our focus on the operating plan allowed us to deliver another quarter of great results, and we began to see some expected synergies from the two companies come to fruition. We are energized with what the combined Catamaran can achieve and look forward to the new wave of opportunities coming our way as a result of the merger and the cost containment solutions we are able to deliver to the marketplace. Catamaran is in a great position to deliver a record-setting 2012 and continued growth going forward.”

Cantor Fitzgerald analyst Tom Liston is the street’s most persistent champion of Catamaran, having initiated coverage of the stock when it was barely a dollar and known as SXC Health, and he was an analyst with Versant Partners.

Since then Catamaran has enjoyed a growth trajectory that is unparalleled in the recent history of Canadian tech. In 2011, the company took home top spot in Fortune Magazine’s 100 fastest-growing companies list.

Liston says the Catamaran party is far from over, and the company will continue be a significant disruptor into 2014, at least. He points to the recent client win of The Target Corporation, which has the fourth largest employee count amongst Fortune 500 companies, as evidence of this. In a research update to clients this morning, Liston maintained his BUY recommendation and raised his target price on Catamaran to $60 from his previous target of $59.

_________________

VANCOUVER EVENT. NOVEMBER 8TH, 2012

Are you a private company looking to learn more about TSX and TSXV?

Discover How Canadian Entrepreneurs are Utilizing TSX and TSXV as Platforms for Growth

Event Details: Thursday, November 8, 2012 – Morris J Wosk Centre for Dialogue, 580 Hastings Street

• Canadian and international market update

• Best practices for going public

• Finance panel discussion with leading Canadian investment banks

Who Should Attend? This event is for CEOs, CFOs, and COOs

Email Maureen Butcher for availability as space is limited: maureen.butcher (at) tsx.com

__________________

Liston says a number of drivers are contributing to Catamaran’s rise. First, he says, the merger of Express Scripts and Medco has created uncertainty for pharmacy benefit management customers, some of whom are seeking an alternative vendor.

Next is the rise in specialty drugs, which is a major revenue and margin driver for the company.

The third factor is healthcare reform in the US. Liston says Catamaran is already working with current and prospective customers to prepare for potential changes in payment models and requirements, but will benefit regardless of who wins next Tuesday’s US Presidential election.

Shares of Catamaran on the TSX closed today down 3.1% to $49.42.

___________________

_____________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment