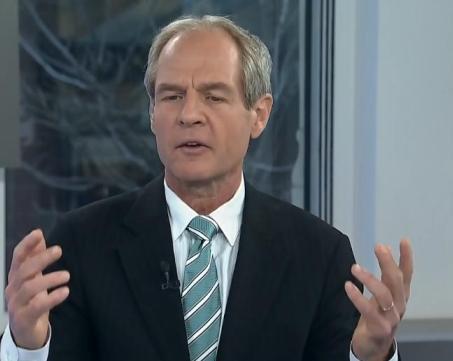

Last Thursday, Tom Liston, Director of Canadian Research for Cantor Fitzgerald, was on BNN’s “The Street” with hosts Tony Keller and Saijal Patel.

While tech has struggled this year, Liston says the troubles of Research in Motion are overshadowing the successes of companies such as Constellation Software, which is up 189% in the past three years, and Catamaran (formerly SXC Health), which recently topped $5-billion in revenue and was number one on Fortune’s 2011 “100 Fastest-Growing Companies” List.

Liston’s visit came a day after the Cantor Fitzgerald Growth Technology Conference in Toronto, which he said was intended to shine a light on a Canadian tech sector he believes is healthier than at any time since the dot-com crash. While the Cantor analyst says it may take time to filter to the public markets, the VC activity of just three funds; OMERS Group, Wellington West, and Innovia, which have raised a half-billion dollars recently and made major investments into Canadian innovators such as Hootsuite and Desire2Learn, is a clear sign that things are happening.

__________________________

This article is brought to you by Cantech Letter sponsor BIOX (TSX:BX). The largest producer of biodiesel in Canada, BIOX’s proprietary production process has the capability to use a variety of feedstock, including recycled vegetable oils, agricultural seed oils, yellow greases and tallow. For more information CLICK HERE.

____________________________

Wednesday’s jam-packed Cantor Conference featured some of Canada’s largest and most successful techs, including Catamaran, CGI Group, Wi-LAN, and Descartes Systems.

Another sign that things may picking up for Canadian tech happened in August, when Liston’s old form, Versant Partners, announced that Cantor Fitzgerald Canada had entered into an agreement to hire the sales and trading, research, and investment banking team of Versant. Cantor Fitzgerald CEO Shawn Matthews said the firm made the move because it is bullish on Canada.

Cantor Fitzgerald’s 1,600 employees serve clients through over 30 locations, including the Americas, Europe, Asia/Pacific and the Middle East. In the U.S. , the company is one of 21 primary dealers authorized to trade U.S. government securities with The Federal Reserve Bank of New York.

___________________________

___________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment