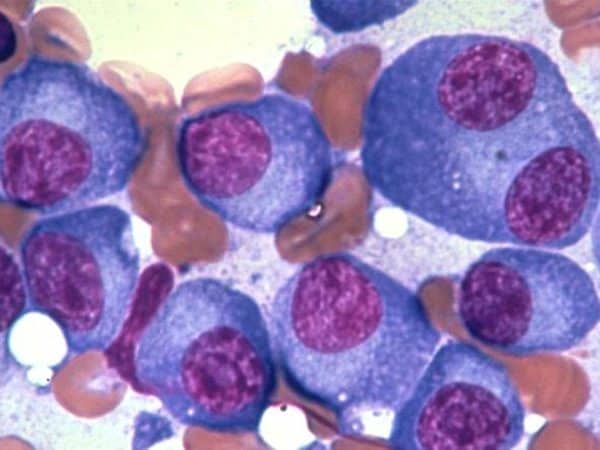

On April 2nd, shareholders of Quebec-based oncology/endocrinology drug maker AEterna Zentaris (TSX:AEZ) had a very bad day. That morning, the company announced that its lead offering, perifosine, failed to meet its primary endpoint. That day the stock fell from $2.14 to $.71 cents and has continued to fall, dipping below the $.40 cent mark in mid-June.

Yesterday, a sign that management thinks the slide may be nearing an end. AEterna Zentaris’s President and CEO, Jürgen Engel, bought 40,000 shares of the company’s stock in the open market at $.45 cents. The buy averages down Engel’s purchase of 20,000 shares at $.55 cents in May.

In 2006, Aeterna Zentaris began to slide on the back of a continued losses and the disappointment of cetrorelix, a prostate treatment that failed to meet its primary endpoint and led to the termination of its partnership with Paris based pharmaceutical giant Sanofi-Aventis.

_________________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

__________________________________

In 2010 and 2011, it looked like AEterna Zentaris was finally on the right track. The company’s stock perked up on the potential of perifosine. In July of 2011, nearly eight years after initially filing, the cancer therapy candidate was granted a patent by the European Patent Office. By the end of that month, the Quebec-based drug maker had completed recruiting 465 patients for its perifosine phase 3 trial for refractory advanced colorectal cancer. And by October, two articles reporting positive phase one and two results perifosine had been published in the October, 2011 on-line issue of the Journal of Clinical Oncology.

The bad news on perifosine has led to two pressing problems for Aeterna Zentaris. First, the company is facing a delisting from Nasdaq because its stock has failed to meet the minimum bid price for thirty consecutive days. Second, the company is facing a class action suit from New York-based securities law firm Faruqi & Faruqi LLP, who say Juergen Engel and AEterna’s chief financial officer Dennis Turpin misled investors about the timing and success of AEterna’s perifosine clinical trial.

Shares of AEterna Zentaris on the TSX closed Friday down 4.5% to $.42 cents.

________________________________

________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment