iCo Therapeutics pipeline. The Vancouver-based company, which was founded in 2005, is a biotech that focuses on redosing or reformulating drugs that already have a clinical history.Shares of Vancouver-based iCo Therapeutics (TSX:ICO) hit a fifty-two week high Friday as shareholders cheered the company’s recently expanded financing plans.

iCo’s stock began to perk up early in 2012, after the company announced it had secured a $10-million equity line facility with the Dutchess Opportunity Cayman Fund Ltd. a division of Dutchess Capital, a fund manager with offices in Boston, New York, London and Beijing. Ico’s short form prospectus, filed June 13th, will raise up to $25-million and is an expansion of the December agreement between Dutchess and Ico.

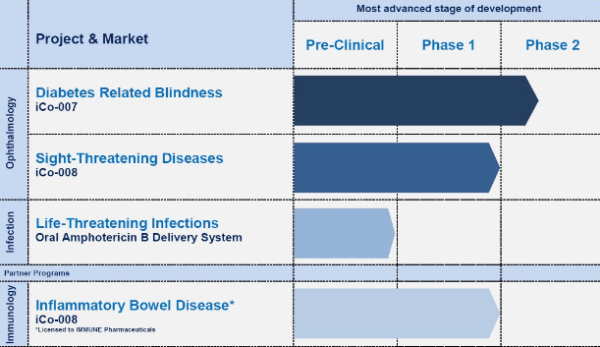

iCo Therapeutics, which was founded in 2005, is a biotech that focuses on redosing or reformulating drugs that already have a clinical history. The company owns the exclusive worldwide rights to two products. iCo-007, is a Phase I for the treatment of Diabetic Macular Edema. iCo-008, a treatment for severe ocular allergies and Wet Age Related Macular Degeneration, is a product with Phase II clinical history.

________________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

_________________________________

The company also owns an exclusive option to license iCo-009, a oral reformulation of Amphotericin B for sight and life threatening diseases. The company says iCo-009 also represents a new drug delivery technology with the “potential to reprofile other IV administered drugs to the oral route of administration.”

That delivery system, which the company describes as “the gold standard for systemic anti-fungal drugs,” recently became he source of more financial security as the company was awarded $1.1-million from the National Research Council of Canada to explore the treatments effectiveness with HIV patients.

iCo lost $791,761 in the first quarter of 2012, which it reported at the end of May. The company said the losses were driven increased expenses around the iCo-007 diabetic macular edemawe study, which it says is the largest phase 2 study of its kind.

Shares of iCo Therapeutics closed Friday up 6% to $.53 cents.

____________________________________

______________________________________

Comment

One thought on “iCo Therapeutics shares spike as company shores up finances”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Could be a massive year for iCo Shareholders…. very under valued company at these levels…