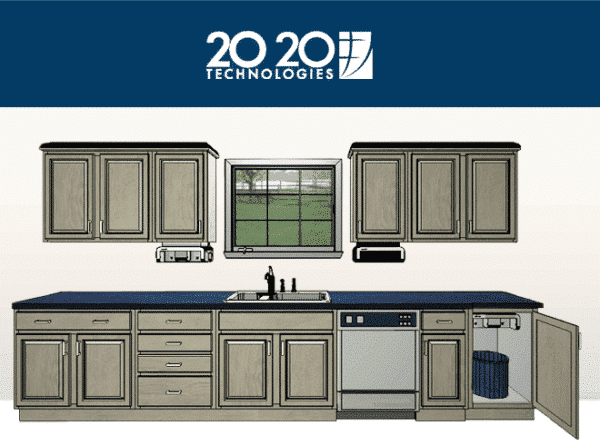

20-20 Technologies began in the 1980′s as a small Quebec cabinet manufacturer and morphed into the world’s leading provider of computer-aided design and manufacturing for the interior design industry.Another one bites the dust.

A Canadian tech sector that has seen some of our best and brightest companies sold to larger, US based companies and private equity firms lost another one this morning.

Quebec’s 20-20 Technologies (TSX:TWT) announced it had entered into a definitive arrangement agreement to be acquired by an affiliate controlled by San Francisco-based private equity firm Vector Capital.

Vector, which manages more than $2-billion in equity capital, will acquire 20-20 for $4 a share, or a total of approximately $77-million.

20-20 CEO Jean-Francois Grou said: “Much has been done in the last 25 years to build 20-20 Technologies into what is now the world’s leading provider of computer-aided design, business and manufacturing software tailored for the interior design and furniture industries. We are pleased to be partnering with Vector to leverage their global capabilities, industry knowledge and financial resources to further our shared long-term vision for the corporation and benefit our customers.”

______________________________

This story is brought to you by Serenic (TSXV:SER). Serenic’s cash position as of May 31st, 2012, $4.45-million, was greater than its market cap as of July 23rd, which was $3.64-million. The company has zero long-term debt. Click here for more info.

______________________________

Until the economic crisis of 2008, when the US housing sector tanked, it was smooth sailing for 20-20. The company, which began in the 1980′s as a small Quebec cabinet manufacturer, morphed into the world’s leading provider of computer-aided design and manufacturing for the interior design industry. Revenue grew rapidly until 2008, when 20-20 battled through by cutting costs. Fiscal 2010 started to show signs that the company might turn things around, as it earned $2.3 million on revenues of $65.2 million, which was up a few percentage points over fiscal 2009. In 2012, the recovery improved further; 20-20′s Q2 revenues of $17.9-million were a 5.2% improvement over the same period in 2011.

The sale of 20-20 continues an accelerating trend. Recently, The Branham Group reported that last year, forty-five Canadian tech firms were acquired by foreign buyers. Many notable TSX listed companies, including Zarlink, Bridgewater, Ruggedcom, Mosaid and Miranda Technologies have been bought out.

Shares of 20-20, which had been halted this morning, had not yet traded at press time, and closed Friday at $4.03.

______________________________

______________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment