Still, with a massive exodus from commodities now fully underway, is it just a matter of time before money starts flowing into Canadian technology stocks, driving a tighter correlation between what analysts think a stock is worth and what it actually trades for?

The stocks listed here all trade at a deep discount to current analyst targets. Cantech Letter compares the closing price of each, as of November 1st, 2011 with the median analyst target, as provided by Thomson/First Call. We eliminated stocks that had just one analyst opinion. The percentage shown represents the difference between the current price and the median target.

1. Allon Therapeutics (TSX: NPC) 1058%

November 1st Price: $.19

Median Analyst Target: $2.20

Shares of Allon Therapeutics were cut in half in September after a Q2 that saw the company lose $2.91 million. But don’t feel too bad for the Vancouver based biotech. After all, Allon was recently granted a US patent for its lead product davunetide, a potential treatment for schizophrenia. The success it has had with the drug was the main reason the company recently won BIOTECanada’s National Gold Leaf Award for Early Stage Company of the Year, Health.

2. AEterna Zentaris (TSX:AEZ) 424%

November 1st Price: $1.67

Median Analyst Target $8.75

After a tough few years, 2011 was a bit of a bounce back for shareholders of Quebec City’s Aeterna Zentaris. Nearly eight years after initially filing, the company’s cancer therapy candidate, Perifosine, was granted a patent by the European Patent Office. The patent, which is effective July 13th and will expire on July 28, 2023, actually covers the treatment of benign and malignant tumours, prior to and or during the treatment with approved anti-tumour anti-metabolites.Continued losses; the company lost $10.56-million (U.S.) in its recently reported Q2 after losing $23.2 million in 2010, clearly aren’t impacting the optimism analysts have for the company prospects.

3. Tekmira Pharmaceuticals (TSX:TKM) 344%

November 1st Price: $1.69

Median Target: $7.50

Burnaby’s Tekmira is one of a handful of companies around the world developing therapies based on RNA interference, and the company is clearly an early leader in the space. So what is RNA interference? Basically it’s a process that cells use to turn down, or silence, the activity of specific genes. RNA interference works by blocking the molecular messengers of a a cell, rendering the cell useless. RNAi has already shown great potential with viruses such as HIV and Hepattis C. Tekmira has three internal RNA interference (RNAi) product candidates, one to treat hypercholesterolemia, or elevated cholesterol, one for Ebola and an anti-tumour drug in the treatment of cancer. This is big stuff; in the Q3 of 2010 Tekmira secured a contract for up to US$140 million from the U.S. Government for the Ebola treatment alone. 2011 has been a tough year for the company, as it spent a lot of time in the courtroom with Alnylam Pharmaceuticals, whom its sued for misusing trade secrets and confidential information.

4. Electrovaya Inc. (TSX:EFL) 304%

November 1st Price: $1.22

Median Target: $4.93

Shares of Electrovaya rocketed after the company was chosen by Chrysler Group as the battery supplier for 140 Ram plug-in hybrid electric vehicles in a demonstration program. The company gained 170% in 2010, increasing the company’s market cap from $60 million to $163 million. 2011, for the most part, whittled away at those gains. While the market struggled to peg a valuation on the fledgling company, Electrovaya has quietly added value to the mix; revenue from its most recently reported Q3 was up 109% to $2.7 million.

5. CriticalControl Solutions (TSX:CCZ) 292%

November 1st Price: $.275

Median Target: $1.08

It’s been a tough year for shareholders of Calgary’s CriticalControl Solutions. Shares fell from a high of $.79 cents in March to recent lows of $.25 cents. The company, which makes composition management, gas chart integration and field device control technologies for the oil and gas industry has seen its revenue flatline, but is still perennially profitable, earning $200K in its most recently reported Q2.

6. Theratechnologies (TSX:TH) 201%

November 1st Price: $2.99

Median Target: $9.00

Last November, Montreal’s Theratechnologies got marketing approval for Egrifta, a treatment that has been shown to reduce excess visceral abdominal fat in HIV-infected patients with lipodystrophy, from the FDA. This made the Montreal based company “one of the very few Canadian biotechnology companies to have successfully discovered, developed and brought a drug to the market on our own” a company press release noted. Theratechnologies achievement triggered a milestone payment of $25-million from EMD Serono Inc. a German based Merck affiliate, and after untangling the web of regulatory approvals, Theratechnologies began selling Egrifta to EMD Serono. Sales of the treatment reached $5,681,000 in the nine-month period ended Aug. 31, 2011.

7. Azure Dynamics (TSX:AZD) 187%

November 1st Price: $0.115

Median Target: $0.33

Yet another stock that has had a rough 2011. Azure, which makes electric and hybrid vehicles and the batteries and drive trains that power them, has fallen from $.385 cents in January to just over a dime today. The company, which was founded in 1993, and is now headquartered in Oak Park, Michigan, has forged partnerships with giants like Ford and DHL, but can’t stem the tide of red ink; the company lost more than $28 million in fiscal 2010.

8. Cardiome Pharma (TSX:COM) 179%

November 1st Price: $3.18

Median Target: $8.88

It’s been a long road for Vancouver based Cardiome, but the recent success of the company is important. Important enough, in fact, that it may be a shot in the arm to the whole BC biotech industry, which desperately needed a company to run the table and bring a major treatment from infancy to commercialization. In 2009, Cardiome saw a huge leap in revenues that were milestone payments from Merck, and are associated with Cardiome’s drug ververnakalant, which is designed to treat atrial fibrillation, or an abnormal heart rhythm. Ververnakalant had met an important phase 3 end point, triggering a milestone payment. The exciting thing for Cardiome investors is that the $50 million leap in revenues, which continued on into 2010, is dwarfed by the potential of all milestone payments from Merck, which could mean more than half a billion in revenue.

9. Burcon NutraScience (TSX:BU) 162%

November 1st Price: $8.20

Median Target: $21.50

Vancouver’s Burcon Nutrascience has not produced revenue, yet the company commands a market cap of a quarter-billion dollars. The reason? Burcon has already become a world leader in a space that seems to have few limits to its size. Burcon owns 127 patents around the extraction and purification of protein from plants. Many believe that as the world population grows traditional sources of protein, such as those derived from animals, will become expensive and unsustainable. The World Bank estimates that global grain production will have to climb by 50 percent and meat production by 85 percent to meet the projected global demand in the next 20 years. In August of 2010, Burcon received a no-objection letter from the FDA approval for their Puratein and Supertein canola protein isolates, used in food and beverage applications. These products are expected to compete with soy, dairy and egg proteins in the multi-billion dollar global protein ingredient market. It appears that multinationals are waking up to the potential, as Burcon partnered with food giant Archer Daniels Midland this past march.

10. GLG Life Tech (TSX:GLG) 150%

November 1st Price: $1.80

Median Target: $4.50

Making things sweet is big business. The global market for sweeteners is approximately $58 billion. Sugar still dominates with more than 90% of

the market, but other sweeteners are starting to chip away at that share. Vancouver’s GLG Lifetech produces no calorie sweeteners derived from

the South American herb Stevia. According to market research firm Mintel, Stevia recently surpassed saccharin and aspartame in terms of dollar

sales. The European Food Safety Alliance last year joined the US in ruling that Stevia is safe for food and GLG may be perfectly positioned to benefit. Nonetheless, it’s been a brutal year for the company, as it has defended itself against claims that it misrepresented its financial statements. The company vehemently denies these claims, but the stock has fallen from $12 in February.

11. YM Biosciences (TSX:YM) 149%

November 1st Price: $1.76

Median Target: $4.38

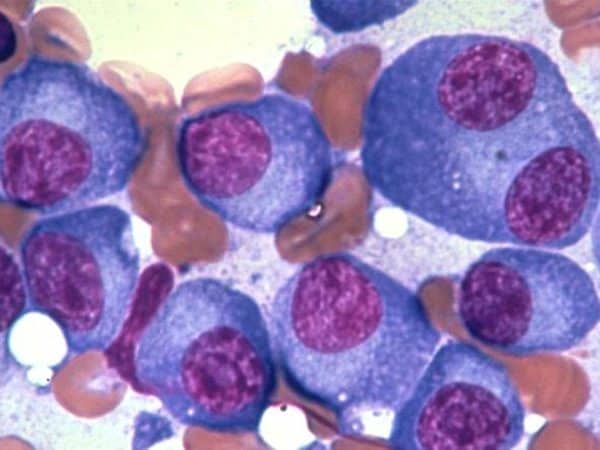

Revenue has slowed to a trickle of outlicensing contracts and interest income for Mississauga’s YM Biosciences, but the company has had success in raising money to further its hematology and oncology-focused treatments. Late in 2010, the company completed a $43.3 million financing led by Roth Capital Partners, a financing the company intends to dwarf; in July the company filed a prospectus to raise another $125 million.

12. Ram Power (TSX:RPG) 146%

November 1st Price: $.305

Median Target: $.75

Renewable energy company Ram Power has spent much of 2011 getting its financial house in order, but things still appear to be in flux. Shares of the company plunged this past spring after it warned the San Jacinto Project, which was scheduled to take eighteen months to complete would take twenty-one. The company also faced $15 to 20 million in additional construction costs, mostly associated with material and labour. With a cash and short term investments position that had dwindled to under $30 million by January 31st of this year, a capital raise was inevitable. When the financing was completed, $10 million of the proceeds was immediately used to repay a bridge loan for critical path items associated with the construction of the phase I expansion at San Jacinto. More uncertainty followed as the company was deleted from the S&P/TSX Composite Index and John O’Neill, the company’s Vice-President and CFO resigned.

13. Guestlogix (TSX:GXI) 134%

November 1st Price: .$. 47

Median Target: $1.10

At the M Partners Technology Conference last month in Toronto, Guestlogix CEO Tom Douramakos warned that airlines have plucked all the low hanging fruit. Douramakos said all little extras; a fee for your second bag, a surcharge for reserving your seat in advance, are actually saving the industry, producing close to $60 billion in revenue last year. Without this ancillary revenue, the airline industry would still be a losing game. But in order to sustain the industry airlines are going to have to find ways to produce revenue without increasing the weight of the plane. In other words, non-physical items such as theatre or transportation tickets.That’s where Guestlogix comes in. The Toronto company was formed in 2002 and has since become a dominant player in the business of delivering ancillary revenue to airlines, with contracts to service more than a billion trips annually. Guestlogix revenue has grown from just $5.43 million in fiscal 2007 to $25.72 million in fiscal 2010. The company graduated to the TSX on March 1st of last year.

14. TSO3 Inc. (TSX:TOS) 121%

November 1st Price: $1.54

Median Target: $3.40

Quebec’s TS03, which was founded in Quebec City in 1998, has developed and marketed a sterilization process for heat-sensitive medical instruments using ozone as a sterilizing agent. The company is currently filing for commercial clearance in the United States, but with its partner 3M, TS03 is already shipping sterilizers intended for worldwide destinations, which helped make its recently reported Q3 its best ever, revenue wise.

15. Carmanah Technologies (TSX:CMH) 119%

November 1st Price: $.405

Median Target: 0.89

Carmanah went public in 2001 and graduated to the TSX in 2005. By 2006 the company, which had matured into one that provided solar lights for a variety of industrial off the grid applications, including hazard lights and lights for airport runways, had grown to near $63 million in revenue. As 2008 turned to 2009, however, it was becoming clear that many of the product lines the company was engaged in, such as its roadway signage and distribution business, were not profitable and probably weren’t going to be.

In June of 2008 Carmanah began to slash staff; 37 people or 40% of the company’s staff were cut. While noting the move was particularly hard for employees, CEO Ted Lattimore told the Victoria Times Colonist that the company would not have to suffer through “baggage and suffocation of businesses that are losing money.” Though 2009 produced only half the revenue of the previous year , it also produced something else unfamiliar to its investors; a profit. New CEO Bruce Cousins, who served as an exec at Xantrex Technology and at Ballard Power Systems hopes to return the company to its glory days.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment