10 Moments in Canadian Tech Stock History that Changed the World

10 Moments in Canadian Tech Stock History that Changed the World

by Nick Waddell

Is it inevitable? No. Is it probable? Yes. If you are a Canadian inventor, and your work is of the highest importance, it will probably be commercialized in the United States. One way or another, this is the fate of many of the best Canadian inventions. Ask Henry Woodward, who sold US Patent 181,613 to Thomas Edison in 1874 -that was for the light bulb. Or talk to James Gosling, the Calgary tech geek who invented the Java programming language while working for Sun MicroSystems. Or even George Retzlaff, a CBC director in Toronto, who invented instant replay during a 1950 episode of Hockey Night in Canada and was actually prevented by the CBC from reusing it.

Every now and then, however, a Canadian inventor not only hangs on to an invention, but the intellectual property ends up in a Canadian listed public company. Perhaps without even being aware of it, millions of Canadians have had a financial stake in some of our greatest achievements, and supported Canadians who have changed the world. This is the criteria we put forward for this list. What are the greatest Canadian achievements that we all could have, in some way, owned a piece of in our RRSP’s (before the Canadian only ban was lifted on those savings plans)? Consolidated Edison (NYSE:ED), for example, is out. Even though The Company was founded on a Canadian invention, it’s strictly a US listing. Although Research in Motion has a NASDAQ listing, it’s also listed in Canada, so it’s in. Many Canadians have owned, and continue to own RIM in their RRSP’s. Now that we’re clear on the criteria, let’s get right to the list:

1. “Mr. Watson, come here. I want to see you.”

Although these famous words, spoken by Bell to his assistant Thomas Watson on March 10th, 1876 have secured their place in history, Watson was actually in an adjoining room when they were spoken. Later that summer, a less heralded -yet equally important- moment happened in Brantford, Ontario when voices could be heard clearly over a call placed over four miles away. This proved that the telephone could work over long distances. A decade later there were over 150,000 telephones in the United States and, with 1,497 shares, Alexander Graham Bell was the largest shareholder of The Bell Telephone Company. Bell Canada is now part of BCE Inc. and trades under the symbol BCE on the Toronto Stock Exchange.

2. The Dynamic Duo Join Forces

In 1989, Jim Balsillie graduated from Harvard with an MBA. He surprised some of his peers by taking a job with a small Kitchener tech firm called Sutherland Schultz. It was here his paths would cross with Mike Lazaridis, as Sutherland Schultz bought circuit boards from RIM. After Lazaridis rebuffed take out attempts by Sutherland Schultz, Balsillie joined RIM as VP Finance. He invested $125,000 of his own money for a 33% stake in the fledgling company. It turned out to be a pretty good investment. Balsillie and Lazaridis would eventually become co-CEO’s and RIM would become one of the most successful and innovative companies in Canadian history, with revenues now near $15 billion.

3. Nortel Rises and Falls

It ended badly, very badly, for a staggering number of Canadians. At its peak, in 2000, Nortel had a market value of $350 billion. At one time, the stock represented 36% of the entire value of the Toronto Stock Exchange. It’s likely that no stock has ever been owned by more Canadians, either directly or through pension plans and mutual funds.

Out of nowhere, it seemed, cracks began to emerge. October 25, 2000, CEO John Roth warned, for the first time, that Nortel would not meet its sales targets. The stock fell from $96 to $71 that day. By 2002, half of the company’s 90,000 workers had been laid off. And then it got worse. Debt downgrades, missed reporting deadlines and financial restatements killed a meager rally in the stock. It spun out of control and never recovered. Nortel declared bankruptcy on January 14, 2009.

Now that we live in the post-Nortel world, what to make of this? It’s cold comfort to those who lost their jobs, homes, savings or all of the above, but some believe that Canada will continue to derive benefit from Nortel. In an editorial in the July 14th, 2009 Financial Post, Sue Spradley, North American head of Nokia Siemens Networks talked about Nortel’s legacy after Nokia Siemans had submitted a $650-million bid to buy certain Nortel assets. “Consider that over the years hundreds of companies have sprung from Nortel, generating immeasurable innovation and untold economic benefits for Canada.: she said. “Nortel’s labs were destinations for the brightest and best students that Canadian universities turned out. It was a magnet for the brightest and best from many of the world’s top universities as well. In fact, Nortel is largely responsible for the fact that Canada has one of the world’s most enviable telecommunications systems, and that it is a global incubator for the industry.”

At year end 2007, Nortel had approximately 3,650 US patents and approximately 1,650 patents in other countries. It is estimated that these patents could garner over a billion dollars in revenue. Some speculate that Research in Motion may be an aggressive bidder in this process; RIM Co-CEO Mike Lazaridis has called Nortel’s fourth generation LTE or Long Term Evolution technology a “national treasure.”. In fact, RIM today owns approximately 1,300 patents and nearly 10% of these cite Nortel patents.

4. Mike and Terry lose some Lawnmowers

Mitel. “Mike and Terry Electronics” or “Mike and Terry’s Lawnmowers”? While Michael Cowpland has shot down the latter explanation of the origin of the company’s name, the reasoning is based on an actual event. In 1973, Cowpland and Terry Matthews, who had met at Nortel forerunner Bell Northern Labs, intended to import and sell cordless electric lawnmowers. Only trouble was their first shipment was lost at sea. This must have been taken as some kind of sign to the now-legendary partners, because they immediately forgot about the lawnmower business and began to produce a telephony tone receiver product that was based on Cowpland’s Ph.D. thesis. By 1981, Mitel had reached the $100 million dollar annual revenue mark. In 1985 British Telecom acquired a controlling interest in Mitel, making Matthews a billionaire. Matthews then went on to form Newbridge Networks which was sold for more than 7 billion to Alcatel in 2000. Matthews, who emigrated to Canada in the 1960’s became the first billionaire in the history of Wales. Cowpland went on to found Corel which, at one point, was Canada’s largest tech company.

5. Roger That

In 1925, Edward (Ted) Rogers, Sr. invented the world’s first alternating current radio tube. This invention enabled radios to be powered by ordinary household electric current. This was a dramatic breakthrough in technology and it became the key factor in popularizing radio reception. Ted Sr. died young, at the age of 38. While his then five year old son didn’t turn out to be the inventor his father was, his business acumen commercialized his fathers invention to a greater degree than he could have imagined. Ted Rogers Jr. founded Rogers Radio Broadcasting Limited, which became the earliest proponent of the FM signal in North America. A couple years later, Roger’s CHFI-FM quickly became Canada’s most listened to FM radio station and also became the most popular and profitable FM radio station in Canada. Rogers’ interests in radio led him to cable television in the mid-1960s. In 2009, Rogers Communications (TSX:RCI.A) did nearly $12 billion in revenue.

6. Canada Lends an…Arm

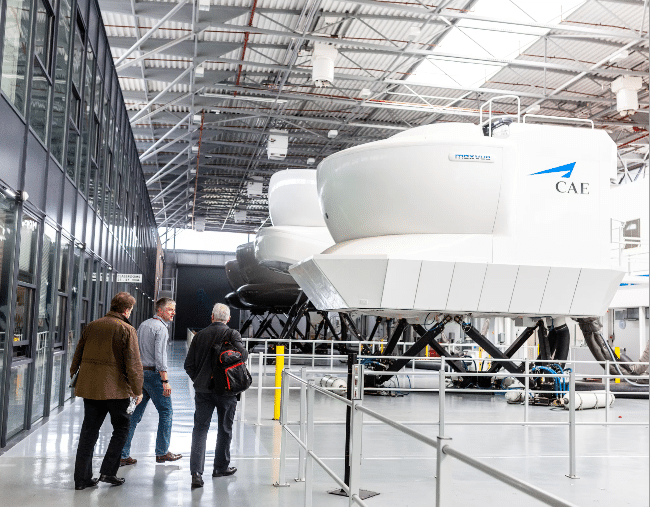

If you were a taxpayer in Canada in the 1970’s and early 80’s you may have felt that the Canadarm was built to deliver a solid uppercut to your pocketbook. The Government of Canada invested $108 million in designing, building, and testing the first one. The program, which was carried out by The National Research Council of Canada, featured an industrial team that was lead by Spar Aerospace, which was ultimately acquired by MacDonald Dettwiler (TSX:MCD). The project also included engineers from CAE Electronics (TSX:CAE), who built the display and control panel as well as the hand controllers located in the Shuttle aft flight deck. The Canadian taxpayer eventually shook off the effects of the Canadarm’s intial hit; the original investment resulted in nearly $700 million in export sales, including the sale and maintenance of 4 Canadarm systems to NASA, the sale of robotic components to Japan and Europe, the sale of simulators, and the development of robotic systems for the nuclear industry. It also helped stem the “brain-drain” establishing Canada as a world player in the fields of advanced manipulator systems and robotics.

7. Ski Dog

In 1937, a Quebec mechanic named Joseph-Armand Bombardier dreamed of dreamed of building a vehicle that could “float on snow.” A few years later schoolchildren in rural parts of that province were among the first people in the world to ride snowmobiles, which began as large, multi-passenger vehicles. Bombardier’s invention was actually called the “Ski-Dog” as it was intended to replace dog sleds. A painter actually misread the info and painted “Ski-Doo” on an early model. By the time of Bombardier’s death, in 1964, his eponymous Company had sales of $20 million. Bombardier’s later ventures into aerospace and railway grew the company to the internationally recognized giant it has become, now nearing $20 billion in revenue.

8. Open Text becomes a Synonym for Innovation

Before there was Google, there was Open Text. In January 1985, the University of Waterloo established the Centre for the New Oxford English Dictionary, a collaboration with the Oxford University Press to computerize the OED. This engineers on this project realized that it required developing search technologies that could be used to quickly index and retrieve information. The search technology developed for this project, which incorporated full-text indexing and string-search technology, was recognized as being useful for other electronic applications. In 1991, at about the same time the Internet was emerging, the results of this project were commercialized by a private spin-off called Open Text Corporation.

As the Internet expanded in usage, Open Text grew as organizations found they needed to index and search their existing and growing stores of electronic information. In 1994, Open Text began hosting its Open Text 4 search engine on the World Wide Web, competing directly with the AltaVista Web search engine. In 1995, Open Text provided the search technology used by Yahoo! as part of its Web index.

By 2009 Open Text had $725.5 million USD in revenue, and is recognized as a world leader in enterprise content management (ECM) software solutions.

9. SXC Health goes Public.

Since 2006 SXC Health, founded in Milton, Ontario has experienced the kind of growth we see perhaps once a decade in Canada. The Company’s revenues have gone from about $80 million in 2006 to more than $1.4 billion in 2009. But if it weren’t for the unique way that Canada’s venture markets operate, this Canadian success story might never have happened.

Frequent Cantech Letter contributor, and Caseridge Capital boss Adam Adamou, who as a fund manager in the mid-1990’s was an early private equity investor into SXC and later as an investment banker worked with the broader public market and venture capital participants to finance the company through various acquisitions and restructurings, says that estimates of the size of Canada’s venture capital market almost always miss the mark because they fail to understand our hybrid system.

“In Canada, the venture capital market and the public equity markets need to work in tandem for technology companies to have access to the capital that they need in order to compete globally”, says Adamou. “Private equity companies in Canada often attempt to replicate the Silicon Valley venture model, the all private equity to a huge IPO model, and that model just doesn’t exist here in the same way.”

Many investors in SXC today may be unaware that the seemingly unconventional method that SXC used to go public -a reverse takeover of a publicly listed shell, allowed the Company to raise $10 million in 1997 which was followed by further and larger rounds by venture capitalists and institutional fund managers over a period of over 10 years before SXC finally “hit it big” with a sizable initial public offering on the NASDAQ exchange in 2009. This is actually a very common method of raising venture funds in Canada and in this case the hybrid system provided not only the capital but also the support from the greater investment community of venture capitalists, investment bankers, research analysts, retail brokers and institutional fund managers that allowed the company to build a sustainable long term business model over an extended period of time. SXC Health stands today as perhaps the best example of the flexibility and the value added by the Canadian hybrid system.

10. Canada’s Immigrant Experience -A Graphic Example.

In 2006, the City of Toronto was home to 8 per cent of Canada’s population, but hosted 30 per cent of all recent immigrants. One would be hard pressed to come up with a better GTA rags-to-riches story than that of K. Y. Ho, who co-founded ATI Technologies in Markham, ON with fellow immigrants Lee Ka Lau and Benny Lau. Born into poverty in mainland China, Ho moved to Canada in 1984 and founded ATI (originally called Array Technologies) the next year. Throughout the next two decades ATI would become a world leader in 3D graphics chips, competing with Nvidia and Intel for supremacy in the graphics industry. In 2006, after posting revenue of (US) $2.22 billion the previous year, ATI was acquired by Advanced Micro Devices for $5.4 billion.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.