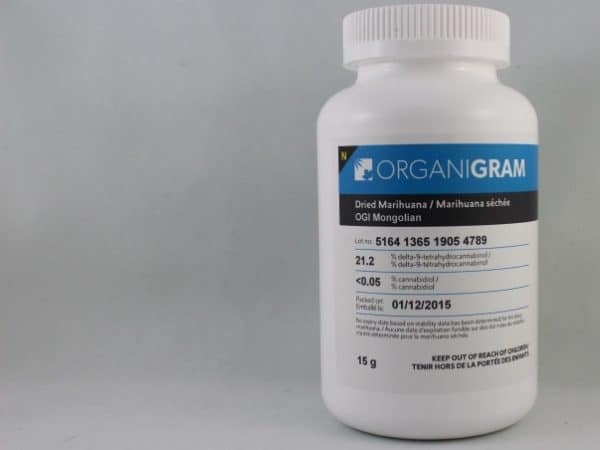

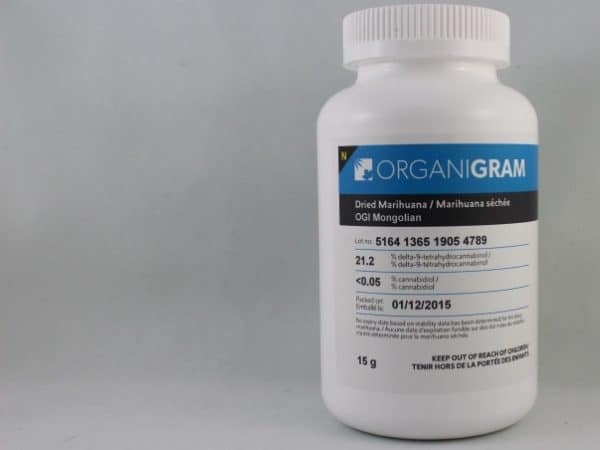

PI Financial lowers target on OrganiGram, maintains buy rating

Decent Q1 results from OrganiGram (OrganiGram Stock Quote, Chart, News: TSXV:OGI) were overshadowed by uncertainty related to a recent recall, says PI Financial analyst Jason Zandberg.

Decent Q1 results from OrganiGram (OrganiGram Stock Quote, Chart, News: TSXV:OGI) were overshadowed by uncertainty related to a recent recall, says PI Financial analyst Jason Zandberg.

This morning, OrganiGram reported its Q1, 2017 results. The company lost $755,547 on revenue of $2.23-million, a 117 per cent topline increase over the same period last year.

“Organigram, like many of the first movers in this emerging industry, has experienced incredible growth in our business, operating infrastructure and within our team,” said CEO Denis Arsenault. “We have also faced challenges and setbacks as the regulations that govern our industry and the market in which we operate continues to evolve. Thanks to the prompt action of our team, the understanding and loyalty of our patients and investors, the support of our licensed testing counterparties, and the collaboration and oversight of our industry’s regulators, the company has been able to address these challenges and setbacks immediately and definitively.”

Zandberg says Q1 fell victim to a recall that may have broader implications, including the advantage the company currently possesses as certified organic producer.

“In our Q4 update we indicated that a large shipment of product had slipped from Q4 into Q1,” notes the analyst. “Unfortunately, that shipment was returned and was not recognized as revenue in Q1. This particular shipment was part of the recall announced in late December. OrganiGram recognized a $0.5M write-down in inventory related to its recall. The reason for not writing down the entire $4.5M in inventory is that there may be economic value to this product (which has been recalled) if the dried product is converted to oil. The ability to convert to oil and re-sell is still uncertain so there may be additional write-downs moving forward. This represents additional risk for shareholders. The product recall may impact OrganiGram’s organic certification. Future production will likely be both organic (depending on certification) and non-organic. We believe the non-organic market demand is significant and is large enough to replace the Company’s organic demand (if needed) but without the higher organic selling price.”

Zandberg thinks OrganiGram’s Q2 will be weak because of a lack of dried bud inventory to sell.

In a research update to clients today, Zandberg maintained his “Buy” rating on OrganiGram, but lowered his one-year price target from $4.50 to $3.75. Shares of the company closed today up 2.3 per cent to $2.67.

The analyst thinks OrganiGram will generate EBITDA of $2.12-million on revenue of $8.72-million in fiscal 2017. He expects these numbers will improve to EBITDA of $9.05-million on a topline of $27.4-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.