Northleaf’s Venture Catalyst Fund gets to work

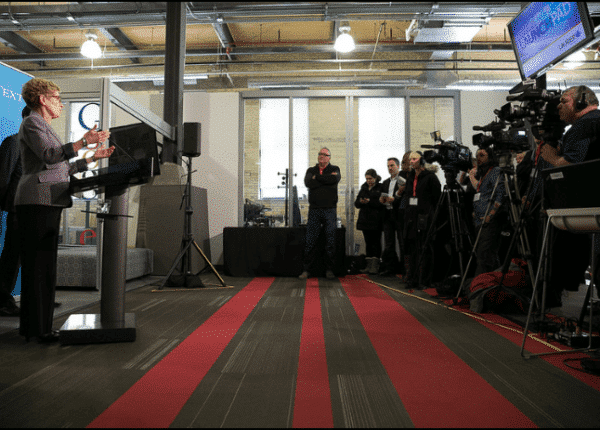

Ontario Premier Kathleen Wynne announces that Ontario will partner with the federal government on the Northleaf Venture Catalyst Fund. Depending on your point of view, things are either going quickly or they’re not when it comes to the execution of the Federal government’s Venture Capital Action Plan. Announced formally in January 2013, the Federal goal was to put another $400 million to work in the innovation ecosystem.

The tools chosen by Ottawa were appropriate, given their public policy choices:

– $250 million to establish new, large private sector-led national funds of funds (a funds of funds portfolio consists of investments in several venture capital funds) in partnership with institutional and corporate strategic investors, as well as interested provinces;

– Up to $100 million to recapitalize existing large private sector-led funds of funds, in partnership with willing provinces;

– and An aggregate investment of up to $50 million in three to five existing high-performing venture capital funds in Canada.

In 2013, the government allocated the “Direct” piece. $50 million went to CTI Life Sciences Fund II ($15M), Summerhill Ventures II ($15M), Real Ventures Fund III ($10M) and Lumira Capital II ($10M). These were fabulous choices, and the four funds in question gave the Feds exposure to two different firms in both the life sciences and information & communication technologies sectors. That they are all based in central Canada speaks to the consolidation that has occurred in the Canadian VC space over the past decade. Vancouver no longer has standard bearer Ventures West, for example, but one can hope that the $100 million Alberta Enterprise program has done the trick in that part of the country.

Given the relative dollars, whether or not each individual VCAP LP commitment will have a defining difference to the GP in question could be argued, but none of the VCs in question, nor their eventual entrepreneurial partners, will turn down the opportunity to have a slightly larger fund. And there’s the very positive brand impact of being designated by the government as having “demonstrated strong investment performance” in your earlier fund(s). Everyone appreciates third-party affirmation (see prior post “Wellington Financial named to Preqin’s list of ‘Consistent Performing Fund Managers’” Feb. 24-14), after all.

Click here for the rest of this article.

______________________________________________________________________________________________________________

Mark McQueen

Writer