Ron Shuttleworth’s 2014 Tech Predictions and Picks

This time last year, we made our 2013 predictions and picks for Cantech Letter.

The year was characterized by a resurgence of technology in the Canadian markets, and I am happy to report that our returns were very strong and the majority of our predictions on trends were solid, some much stronger than anticipated.

Here are the stocks that were our Top Picks for 2013

Descartes Systems Group DSG-TO: +57% $877M Market Cap

Redknee RKN-TO: +229% $606M Market Cap

Mitel MNW-TO +216% $521M Market Cap

Solium Capital SUM-TO: +182% $321M Market Cap

Mean: 171% return

Here are the macro themes we predicted in 2013.

Canadian Tech and our top picks would benefit from global employment growth.

We predicted that employment growth would help to drive revenue growth and earnings for employee-sensitive companies such as Mitel (MITL-Q) and Solium Capital (SUM-TSX). Economists predicted moderate employment growth of approximately 2.0M new jobs for the US economy, whereas actual job growth was reported at just under 2.4M, or about 15% ahead of expectations. Solium Capital, in particular, performed up to 20% ahead of expectations on a quarterly basis. When looking deeper into jobs creation approximately 50% of the new jobs created were in jobs that would typically include some equity compensation. By consolidating the US private equity market with acquired companies, Solium Capital gained access to start-ups that have created the most equity-based compensation.

Companies that sell to the enterprise would benefit from increased budgets.

We began detecting increases in CAPEX spending budgets in H2 2012, and predicted that the trend would continue. We also noted that consumer technologies could influence demand. Not only did enterprise spending increase at an accelerated rate during 2013, we also observed more demand for cloud-based systems, and non-traditional subscription-based licensing, which is more often associated with consumer-based technologies. Descartes Systems Group (DSG-TO) performed approximately 5% ahead of our forecasts due, in part, to better than expected market conditions in the EU which represents approximately 40% of its total business.

Reduced EU credit risk would improve conditions for Canadian Tech selling into Europe.

Not only did EU credit risk decline during h2 2013, but by mid-year the region exited a prolonged recession. This trend positively impacted many small cap Canadian technology companies that have operations in the region. In particular, Descartes Systems Group (DSG-TO) performed approximately 5% ahead of our forecasts due, in part, to better than expected market conditions in the EU which represents approximately 40% of its total business.

Canadian technology stocks would benefit from sector rotation by Canadian institutional investors.

We believed that some observed improvement in liquidity during 2012, along with expanding earnings multiples, was due to some early rotation into the technology sector by Canadian institutional investors. Entering 2013, at an aggregate 10.6X EV/EBITDA multiple, the RES30 index exceeded the main TSX/S&P index (9.7x) for the first time since 2007. By the end of this year the RES30 index multiple was 13.1x. In addition, liquidity increased by approximately 40% over 2012. During 2013, the number of investible technology companies listed on the TSX and TSXV increased to 120 from 108 due primarily to three liquidity related conditions. First, as high quality stocks became more expensive, microcap stocks that fell below our $5M threshold attracted more adventurous investors, which increased their market caps above our threshold. In addition, there were several initial public stock offerings during year in the tech sector. Finally, unlike previous years, there was minimal “churn” of listings caused by acquisitions. We believe that as Canadian investors pushed tech stock multiples higher, the enterprise value gap between Canadian companies and US counterparts declined, making Canadian companies less attractive for acquisition.

We Identified Several Risks…

Brinkmanship policy tactics in United States.

Although the Federal Government actually shut down for a two week period and cost the US economy approximately $10B, the policy tactics had minimal impact on global stock markets

Expansion of Syrian war.

Although tragic, the Syrian war did not expand into a regional conflict despite spilling over temporarily into Lebanon and Turkey.

Destabilization of Egypt.

Although Egypt has remained unstable throughout the year, it has not had a meaningful impact on global markets.

Return of EU credit risk.

During 2012, flare-ups of the EU credit crisis had significant short-term impact on the markets in Q1’12 and then again in Q3’12. Although we believed that the crisis was ending, policy confusion that caused flare-ups in 2012 were still a possibility entering 2013.

Ben Bernanke was largely vindicated by the market for his aggressive accommodating monetary policies.

Quantitative easing helped to drive volumes on stock markets globally, and in the absence of US fiscal

policy, the Federal Reserve began to expand the objectives towards future employment objectives.

Things that surprised us in 2013…

The sector rotation into Canadian Tech was much stronger than we anticipated.

Starting in Q1’13, nearly every new listing and equity-based capital raise was oversubscribed. By Q4’13 IPOs and capital raises were two to four times over-subscribed. Total trading volumes were 40% higher than the previous year.

Ben Bernanke was largely vindicated by the market for his aggressive accommodating monetary policies.

Quantitative easing helped to drive volumes on stock markets globally, and in the absence of US fiscal policy, the Federal Reserve began to expand the objectives towards future employment objectives. Gold bugs finally threw in the towel on the risk of hyperinflation and the price of gold declined throughout the year, ending the near the $1200 mark.

Our top picks delivered 171% mean return in part due to:

1. Rotation of capital into the tech sector. Sector rotation helped to expand multiples in the sector from approximately 11x EV/EBITDA in Q4’13 to approximately 13.1x in Q4’13. The good news is that for the last two quarters, multiples have peaked at about 13x.

2. Employment growth. Employment growth in the US was reported approximately 15% ahead of economist expectations for the full year. In addition, the employment conditions in the EU improved,helping to spur recovery in that region.

3. Increased enterprise spending. Considering that all of our top picks for FY’13 were vendors that supplied technology to the enterprise, we were depending upon an uptick in enterprise spending. Infrastructure budgets expanded across the board.

4. Recurring revenue. Descartes Systems Group and Solium Capital represent over 90% recurring revenue, which is highly predictable and also delivers exceptional earnings margins. The earnings that are derived from recurring revenue are valued more by investors, and as a result should capture higher earnings multiples than their non-recurring revenue counterparts and peers. Prior to the 2013 sector rotation, these revenue streams were not well understood and remained undervalued. Both SUM and DSG experienced strong earnings multiple expansion. DSG and SUM EV/EBITDA multiples expanded from 13.0x to 16x during the year. Both MITL and RKN have indicated strong expansion of recurring revenue as a percentage of total revenue during the year, also resulting in margin expansion. We anticipate continued high revenue growth as Avigilon benefits from CCTV upgrade cycles from low-res analog to HD digital cameras.

Potential Forecast Drivers for 2014:

Multiple expansion should moderate, while revenue growth should accelerate

Although the capital markets rotation should continue, we anticipate that it may cause less upward share price pressure than in 2013. More listings entering 2014 versus 2013, combined with fewer perceived bargains could contribute to moderating multiples. After two consecutive quarters of nearly identical EV/EBITDA multiples at 13x, we may already be seeing some plateauing, which we think is a positive development in the market. The primary driver of share price growth in the Canadian Technology Sector during 2014 should be revenue growth – both organically and through M&A. While share price multiples are expanding, Canadian companies are poised to be buyers in this market. At 4.1% for Q4’13, the U.S. economy grew at a faster pace than economists had been predicting, which is a good indicator that the global economy should grow at a faster pace in 2014 than in any previous year since the 2008 recession. Economist are predicting US GDP growth of between 3.0% and 4.5% for 2014.

Expanding enterprise budgets will help drive outsized revenue growth in Canadian Tech

With a growing economy, and after several years of austerity, we anticipate that enterprises will allocate more operational and capital budgets to technology replacements and upgrades as they attempt to remain competitive while protecting margins during this economic growth cycle. So, as long as there are no destabilizing macro events, we believe that companies that service the enterprise market should grow revenue at an accelerated pace for the next 24 months, which should outpace revenue and earnings growth by consumer-oriented peers, and listings in most other sectors.

Although earnings leverage remains for some companies, margins should moderate

With higher revenue growth comes higher operating expenses related to sales and marketing. Higher relative selling overhead should result in moderating operating earnings margins, measured as EBITDA. Most companies should be expanding operating budgets to support higher organic revenue growth –including SaaS companies.

Anticipate more new listings and more deals

Due to easier access to equity-based capital, we anticipate that high quality publicly listed Canadian technology companies will continue to shore up balance sheets with equity capital raises during 2014. As a result, we anticipate more liquidity in the market, and higher transaction activity during the year. After several successful IPOS launched during 2013, we expect that more high quality late-stage venture-backed technology companies will consider launching IPOs in 2014. A quick poll of sell-side brokers reveals that there could be between five and ten potential new tech IPOs in 2014

There should be stronger positive correlation between multiples and recurring revenue

Although in general we see margins moderating in 2014, investors should still target growth stocks with high residual recurring revenue. Recent regression analysis reveals that there is no significant correlation of earnings multiples to proportional recurring revenue. We think that this is an exploitable market inefficiency in the Canadian Tech Sector.

Even as investors target companies with high, or expanding recurring revenue, we would recommend refinement. As more companies head towards recurring revenue streams, there will likely be fewer switching costs. As a result, we believe that the highest quality stocks will be those with recurring revenue AND high customer/client satisfaction, which should moderate customer churn.

Here are our picks for 2014

NASDAQ MegaCap:

Microsoft (MSFT-Q) is well aligned to the tech replacement cycle with a modern operating system that, unlike in the past, unifies across multiple devices and both personal and work environments.

Canadian Large Cap:

Avigilon (AVO-TSX) is possibly one of the best recent IPOs in the Canadian market. We anticipate continued high revenue growth as Avigilon benefits from CCTV upgrade cycles from low-res analog to HD digital cameras. Additionally, we anticipate that Avigilon will continue to upgrade its solution to deliver stickier platform capabilities such as data analytics for increased recurring revenue.

Canadian Mid-Cap

We believe that our top picks from last year should benefit from accelerating trends from last year.

The Descartes Systems Group (DSG-TSX) should experience higher organic growth as global manufacturing continues to recover (especially throughout northern Europe where manufacturing indices are peaking). As retailing continues to transition online, the company’s new same day delivery business should also contribute to higher organic growth rates. Additionally, we anticipate that the company could execute a significant acquisition within the year, which could drive revenue further.

Mitel Networks (MITL-Q) is expected to finalize its acquisition of Aastra (AAH-TSX) early in the New Year. We anticipate that there will be a multiyear upgrade opportunity to transition both North American and European clients to software-based communications solutions.

Redknee Solutions (RKN-TSX) should continue to cross-sell and up-sell customers it acquired in the NSN transaction. We expect that the company will continue to announce meaningful contracts throughout 2014, while we anticipate that recurring revenue should increase due to price increases and to more SaaS deployments.

Canadian Small Cap

Solium Capital (SUM-TSX) should continue to benefit from an acceleration of employment globally, along with better stock markets, and an increasingly dominant position in private equity management. In particular, SUM could report exceptional results in Q1 when employees transact most actively. We also believe that after recently raising a little over $20M of capital, the company has sufficient cash and equivalents available to potentially acquire regional equity compensation portfolios in Europe and the United States.

Guestlogix (GXI-TSX) is at an early stage of rolling out its onboard payment system with In Flight Entertainment (IFE) vendors Thales and Panasonic Avionics. The rollout, along with deployments to Chinese airlines could add over $10M to its topline and more than double 2013 earnings in 2014. We don’t think that this potential is priced into the stock.

QHR (QHR-TSX) after selling its hospital management business to Logibec, QHR is positioned as a pure play EMR vendor with the potential to expand via acquisition in both Canada and the United States. We believe that revenue multiples should expand because a higher percentage of revenue is recurring, and more earnings leverage is likely in outlying fiscal years.

Canadian Micro Cap

Espial (ESP-TSX) announced a major long-term contract with Rogers in 2013 which should help to increase revenue growth and earnings for the next several years. In fact, this contract could double current revenue streams once the program is rolled out. We also believe that there is sufficient demand among multiple residential network providers for Espial’s TV-based browser.

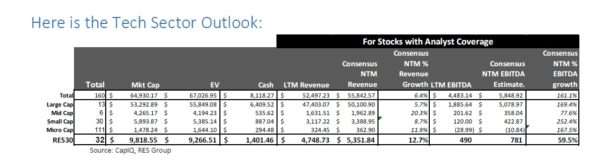

Here is the Tech Sector Outlook:

First, we have seen significant progress in total market cap for the technology sector, which grew by 35% year-over-year.

Secondly, we saw significant growth in the mid-cap sector due to small cap companies in 2012 graduating to mid-cap in 2013. There were 6 mid-cap companies at the end of 2013, and a combined market cap of 4.2B, which is 121% higher than the previous year.

In aggregate, the small cap market only grew by 4% year over year but that was probably due to a general flow through of companies to the mid-cap group.

For the RES30, EBITDA grew by 7% to $490M, while EV grew by 35% to $9.2M.

Analysts are forecasting EBITDA growth of 161% for the entire sector, and 59% growth for the RES30 for NTM on 12.7% revenue growth. Although the revenue growth seems reasonable given the growth in the economy and general upgrade cycles, we find that analysts, in aggregate, may be aggressive in their earnings forecast because we believe that increasing OPEX spending should moderate earnings leverage.

In 2013, analysts covered 65 stocks versus 57 stocks in 2012.

Disclosures: I own MITL, RKN, SUM.

The opinions expressed herein are my own, and are unassociated with Extuple.

Ron Shuttleworth

Writer