Wealth Minerals Enters into Letter Agreement to Acquire the Andacollo Oro Gold Project

Announces Private Placement

Vancouver, British Columbia–(Newsfile Corp. – September 25, 2025) – Wealth Minerals Ltd. (TSXV: WML) (OTCQB: WMLLF) (SSE: WMLCL) (FSE: EJZN) (the “Company” or “Wealth”) announces it has entered into a binding letter agreement (the “Letter Agreement”) made as of September 24, 2025 to acquire an indirect 100% royalty-free interest in the Andacollo Oro Gold Project (“AOG Project”), located in Chile (the “Transaction”).

AOG Project Overview1

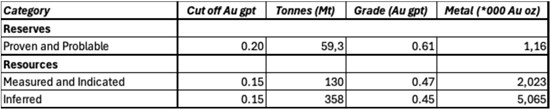

- Historical Estimate of 2.02M oz Au in the Measured and Indicated Categories for 130Mt at 0.48 Au grams per tonne

- Historical Estimate of 5.06M oz Au in the Inferred Category for 358Mt at 0.45 Au grams per tonne

- Contained within the Historical Measured and Indicated Resource Inventory is a Historical Mineral of 1.16M oz Au in the Proven & Probable Category of 59.3Mt at 0.61 Au grams per tonne (at a cutoff grade of 0.20 Au grams per tonne)

- Location: Coquimbo Chile (adjacent to Teck Resource’s Carmen del Andacollo mine)

- Past Operation: Open pit heap leach

- Past Total Production: 1.12M oz Au (1998 to 2018)

- Past Production mining throughput: 20,000 tpd

- Past peak production rate: 135,000 oz Au/year

- Existing permits: mining rights, land title and water rights

1 Source: CMID SPA Mina Andacollo Oro Project, NI 43-101 Technical Report by GEOINVEST S.A.C E.I.R.L., August 23, 2021 & Updated Report for Resources by GEOINVEST S.A.C E.I.R.L. November 2024) (the “Historical AOG Report”).

Henk van Alphen, Wealth’s CEO, said, “The chance to acquire the AOG Project is an opportunity management believes is the right choice for shareholders. Gold, an asset class that has been around for millennia, is now “new” to the capital markets as investors increasingly worry about governments’ monetary and fiscal policies globally. I see no reason to expect the drivers of this worry to change, and I expect gold’s favor amongst investors to continue. The merits of the AOG Project are obvious and alluded to in this news release. Wealth will continue to advance its lithium project portfolio and seek ways to create shareholder value. Management believes that the best way for the Company to get value for the lithium projects is to have a company that has the overall scale and capital market footprint to attract capital and attention in the global mining industry. I look forward to continuing to advance Wealth’s assets and this acquisition demonstrates Wealth’s continued commitment to working in Chile and builds on the success of Wealth engaging with stakeholders, as demonstrated by Wealth’s joint venture with the Quechua Indigenous Community of Ollagüe to develop the Kuska lithium project, and the recent inclusion of the Salar de Ollagüe in the new simplified procedure for the assignment of a Special Lithium Operating Contract (CEOL) implemented by the Chilean authorities.”

Andacollo Oro Gold Project

The AOG Project is located in Region IV, the Province of Coquimbo, Chile, 60km from the Coquimbo port and 480km north of Santiago. Historically, the AOG Project produced cumulatively 1.12 million ounces of gold from 1995 to 2018 before production was suspended due to relatively low gold prices at the time.2 The AOG Project’s peak annual production was 135k ounces in 1999. During the time it was operational, the AOG Project mine was a 20,000 tonne per day, open pit heap leach operation.3 The AOG Project includes mining licenses rights, land title and water rights. Extensive earth works and infrastructure are present at the site and there is significant tonnage of mineralized material stacked on the AOG Project’s three leach pads that could potentially be utilized for early-stage ramp-up of operations.

The geology of the AOG Project has been extensively studied by past operators, with historically 2,547 holes drilled for a total of 287,222m.4 The AOG Project exploited a low sulphidation epithermal manto-type gold deposit.

The Historical AOG reported the following historical estimates:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4437/267928_267928wlthmintb1.jpg

2,3,4 Source: Historical AOG Report.

A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves, and Wealth is not treating the historical estimate as current mineral resources or mineral reserves.

The AOG Project is adjacent to Teck Resource’s Carmen de Andacollo copper mine, which produced 40k tonnes of copper in 2024 (Source: https://www.teck.com/). Readers are cautioned that the Carmen de Andacollo copper mine is an adjacent property, and Wealth has no interest in or right to acquire any interest in such property. Mineral deposits on adjacent properties and any production therefrom or economics with respect thereto, are not in any way indicative of mineral deposits on the AOG Project or the potential production from, or cost or economics of, any future mining on the AOG Project.

Terms of the Letter Agreement

Under the terms of the Letter Agreement and subject to acceptance by the TSX Venture Exchange, it is currently proposed that the Transaction will be effected by way of a share purchase and sale transaction, pursuant to which Wealth (or a subsidiary of Wealth) will acquire a 100% ownership interest in an arm’s length private Chilean company (the “Target”). The purchase price for the acquisition of the Target will be 12.5 million (post-Consolidation (as defined below)) common shares in the capital of Wealth, subject to adjustment for dilution prior to closing of the Transaction. In consideration for the Target granting Wealth a 30-day exclusivity period for Wealth to conduct due diligence, Wealth has paid a US$350,000 cash payment to the Target.

It is a condition to the closing of the Transaction that the Target will have closed its acquisition of a 100% royalty free interest in the AOG Project (the “Underlying Transaction”), subject to the following deferred purchase payments to be assumed by Wealth of an aggregate US$30 million cash, of which up to US$7 million can be paid in shares, over a period of 48 months (US$250,000 of which has already been paid) as follows: (i) US$1,750,000 cash on the closing of the Underlying Transaction (the “Underlying Closing Date”); (ii) US$1,000,000 cash on or before December 30, 2025; (iii) US$2,000,000 within 12 months from the Underlying Closing Date; (iv) US$4,000,000 within 24 months from the Underlying Closing Date; (v) US$6,000,000 within 36 months from the Underlying Closing Date; and (vi) US$15,000,000, of which US$7,000,000 may be paid in cash or its equivalent in shares, within 48 months from the Underlying Closing Date.

Completion of the Transaction is subject to, among other things, the satisfaction of customary conditions precedent, including, without limitation, receipt of all necessary shareholder, board and regulatory (including TSX Venture Exchange) consents and approvals.

Private Placement

In connection with the Transaction, Wealth announces a non-brokered private placement offering of a minimum of 41,666,666 units (the “Units”) at a subscription price of $0.12 per Unit for minimum gross proceeds of $5,000,000. Each Unit consists of one common share (each, a “Share”) and one-half of one common share purchase warrant (each such whole warrant, a “Warrant”). Each Warrant will entitle the holder thereof to purchase one common share in the capital of the Company (each, a “Warrant Share”) at an exercise price of $0.18 per Warrant Share for a period of 24 months (the “Offering”). In the event that the Company’s shares trade at a closing price of greater than $0.36 per share for a minimum of ten consecutive trading days at any time after the closing of the Offering, the Company may accelerate the expiry date of the Warrants by providing notice to the shareholders thereof and in such case the Warrants will expire on the 30th day after the date on which such notice is given by the Company.

Finder’s fees may be payable to qualified finders, and all securities issued in the Offering are subject to a four-month and a day hold period in Canada during which time the securities may not be traded. Closing of the Offering is subject to the approval of the TSX Venture Exchange. Proceeds of the Offering will be allocated to finance the acquisition, exploration and development costs of the AOG Project, including drilling, permitting work, and geotechnical work. Approximately $1,000,000 will be used for general working capital and corporate purposes, including transaction-related expenses.

The securities offered have not been and will not be registered under the United States Securities Act of 1933 (the “U.S. Securities Act”), as amended, or any applicable state securities laws and may not be offered or sold in the United States or to “U.S. persons”, as such term is defined in Regulation S under the U.S. Securities Act, absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

Wealth intends to rely on the “part and parcel pricing exception” provided for in the corporate finance policies of the TSX Venture Exchange.

Share Consolidation

Wealth further announces that it intends to undergo a consolidation of its issued and outstanding common shares on the basis of one post-consolidation Wealth common share for up to seven pre-consolidation Wealth common shares (the “Consolidation”). There are currently 362,363,191 Wealth common shares outstanding, and Wealth anticipates completing the Consolidation prior to the completion of the Offering and the closing of the Transaction. Assuming completion of the Consolidation prior to the completion of the Offering and the closing of the Transaction, Wealth expects that following completion of the Consolidation there will be approximately 51,766,170 Wealth common shares outstanding (on a non-diluted basis). The number of post-Consolidation Wealth common shares to be received will be rounded up to the nearest whole number for fractions of 0.5 or greater or rounded down to the nearest whole number for fractions of less than 0.5.

The Consolidation is subject to TSX Venture Exchange approval. The Company is undertaking the Consolidation to be in a better position to attract capital to advance its projects. The Company’s name and trading symbol are expected to remain unchanged. The issue prices and securities offered under the Offering are disclosed on a pre-Consolidation basis and will be adjusted to reflect the prior implementation of the Consolidation (assuming completion of the Consolidation prior to the completion of the Offering).

Chad Williams

Wealth also announces the appointment of Chad Williams as a strategic advisor to the Company. Mr. Williams is the Founder and Chairman of Red Cloud Mining Capital. He was the CEO of Victoria Gold from 2007 to 2011 and a gold analyst and Head of Mining Investment Banking at Blackmont Capital from 2004 to 2007. Mr. Williams holds a degree in Mining Engineering and Business from McGill University

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Sergio Alvarado, P.Geo. (CIM Nº 144815), an independent Qualified Person as defined by NI 43-101. Mr. Alvarado, Principal Geologist with GEOINVEST S.A.C E.I.R.L., has reviewed the technical information and consents to the form and content of this news release.

About Wealth Minerals Ltd.

Wealth is a mineral resource company with interests in Canada and Chile. The Company’s focus is the acquisition and development of lithium projects in South America. Presently the Company is working to diversify its asset base to include precious metal projects.

The Company opportunistically advances battery metal projects where it has a peer advantage in project selection and initial evaluation. Lithium market dynamics and a rapidly increasing metal price are the result of profound structural issues with the industry meeting anticipated future demand. Wealth is positioning itself to be a major beneficiary of this future mismatch of supply and demand. In parallel with lithium market dynamics, Wealth believes other battery metals will benefit from similar industry trends.

For further details on the Company readers are referred to the Company’s website (www.wealthminerals.com) and its Canadian regulatory filings on SEDAR+ at www.sedarplus.ca.

On Behalf of the Board of Directors of

WEALTH MINERALS LTD.

“Hendrik van Alphen”

Hendrik van Alphen

Chief Executive Officer

For further information, please contact:

Marla Ritchie, Michael Pound or Henk van Alphen

Phone: 604-331-0096 or 604-638-3886

For all Investor Relations inquiries, please contact:

John Liviakis

Liviakis Financial Communications Inc.

Phone: 415-389-4670

For all Public Relations inquiries, please contact:

Nancy Thompson

Vorticom, Inc.

Office: 212-532-2208 | Mobile: 917-371-4053

Follow Us:

Facebook – https://www.facebook.com/WealthMineralsLtd

Linkedin – https://www.linkedin.com/company/wealth-minerals

Twitter – https://www.twitter.com/WealthMinerals

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release, which has been prepared by management.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward looking statements”) within the meaning of applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the completion of all conditions precedent to the Transaction, the completion of the Transaction, the completion of the Offering and the use of proceeds therefrom, and the completion of the Consolidation, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: “believes”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “would”, “will”, “potential”, “scheduled” or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained gold and lithium demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the Transaction in a timely manner, the availability of financing on suitable terms for the continued operation of the Company’s business and its ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, requirements for additional capital, actual results of exploration activities, including on the Company’s projects, the estimation or realization of mineral reserves and mineral resources, future prices of gold and lithium, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals (including TSX Venture Exchange acceptance of the Transaction), permits or financing or in the completion of other planned activities, risks relating to epidemics or pandemics, including impacts on the Company’s business, financial condition and results of operations, changes in laws, regulations and policies affecting mining operations, title disputes, the timing and possible outcome of any pending litigation, environmental issues and liabilities, as well as the risk factors described in the Company’s annual and quarterly management’s discussion and analysis and in other filings made by the Company with Canadian securities regulatory authorities under the Company’s profile at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake any obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

Cautionary Note to US Investors

The disclosure in this news release and referred to herein was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”). The terms “proven mineral reserve”, “probable mineral reserve”, “mineral reserves”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource”, used in this news release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Definition Standards”), which definitions have been adopted by NI 43-101. Accordingly, information contained in this news release providing descriptions of mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, “Inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to corresponding definitions under the CIM Definition Standards. Information regarding mineral resources or reserves contained or referenced in this news release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral reserves or mineral resources reported as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the reserve or resource estimates been prepared under the standards adopted under the SEC Modernization Rules.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267928