Thesis Gold Announces Positive Prefeasibility Study for Lawyers-Ranch Project: After-Tax NPV5% of $2.37 Billion and 54.4% IRR

All dollar amounts are in Canadian dollars (“$”) unless otherwise indicated.

VANCOUVER, BC, Dec. 1, 2025 /CNW/ – Thesis Gold Inc. (“Thesis” or the “Company”) (TSXV: TAU) (WKN: A3EP87) (OTCQX: THSGF) is pleased to announce positive results from an independent Prefeasibility Study (“PFS”) for its 100% owned Lawyers-Ranch Project (“Lawyers-Ranch” or the “Project”) in the prolific Toodoggone Mining District of British Columbia.

The PFS was prepared by Ausenco Engineering Canada ULC. (“Ausenco”), Mining Plus Canada Ltd. (“Mining Plus”), Knight Piésold Ltd. (“Knight Piésold”), Equilibrium Mining Inc. (“Equilibrium”), P&E Mining Consultants Inc. (“P&E”), pHase Geochemistry Inc., Frank Wright Consulting, and SLR Consulting Ltd. (“SLR”) in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The NI 43-101 PFS Technical Report will be filed on SEDAR+ at www.sedarplus.ca and Thesis Gold’s website www.thesisgold.com within 45 days of this announcement.

The PFS outlines a plan for developing the combined Lawyers-Ranch Project using both open pit and underground mining methods, with ore processed at a single facility.

PFS highlights are summarized below:

- Strong Economics at US$2,900 per ounce of gold (oz Au) and US$35 per ounce of silver (oz Ag):

- Pre-tax: 73.5%, internal rate of return (“IRR”) and $3.73 billion net present value at a 5% discount rate (“NPV5%”)

- After-tax: IRR of 54.4% and an NPV5% of $2.37 billion

- At US$4,100/oz Au and US$51/oz Ag:

- Pre-tax: 117.4% IRR and $6.86 billion NPV5%

- After-tax: 87.8% IRR and $4.36 billion NPV5%

- Strong Early Production: Strong gold-equivalent (“AuEq”)* annual production rates for the first three years averaging 266,000 ounces**, and 187,000 ounces** over the Life of Mine (“LOM”).

- Increased Tonnes Processed, Increased Throughput Rates and Extended Mine Life: Despite the removal of Inferred Resources from the mine plan, total tonnes processed rose by 18% (relative to the 2024 Preliminary Economic Assessment). Process plant throughput increased by 9% to 13,700 tonnes per day (t/d) and the mine life increased to 15-years, based solely on Measured and Indicated Resources.

- Mineral Reserve: Maiden Mineral Reserve statement with 76.16 million tonnes of ore grading 0.97 g/t Au and 28 g/t Ag for a total AuEq* grade of 1.33 g/t.

- Low All-in Sustaining Costs (“AISC†”): Average AISC† of US$1,185 per AuEq** ounce.

- Silver: Silver production accounts for approximately 23% of revenue.

- Quick Payback: The Project offers an after-tax payback period of 1.1 years at US$2,900 Au and US$35 Ag.

- Capex: Initial capital expenditure is estimated at $736.2 million, with a compelling after-tax NPV5%:initial capital ratio of 3.2:1. The initial capital estimate does not consider a potential revenue of $91.1 million in pre-production revenue from processing stockpiles as part of the initial commissioning and ramp-up plan.

- Project Upside: Significant project upside exists both in the potential to further optimize engineering design through a Feasibility Study, and in the project-wide exploration potential that remains untapped. The section entitled “Project Upside” further details the opportunities present at Lawyers-Ranch.

*AuEq reported for the mined materials/mill feed in mineral resource estimate and mineral reserve estimates assumes a conversion of 80:1 for Ag to AuEq based on expected average expected recoveries of 93% Au and 86.1% Ag at US$2,000/oz Au and $24.50/oz Ag.

**AuEq production values are based on payable ounces as calculated by the financial model and have varying gold and silver recoveries by deposit at a US$2,900/oz Au and US$35/oz Ag.

AISC† costs consist of mining costs, processing costs, mine-level G&A, offsite charges, royalties, sustaining capital, expansion capital, and closure costs.

Dr. Ewan Webster, President and CEO, commented, “With the prefeasibility results announced today, Thesis Gold is positioned as one of the strongest value-creation stories in the sector. An after-tax NPV of $2.37 billion, a 54.4% IRR, and a 1.1-year payback places Lawyers-Ranch firmly among the top tier of development-stage gold projects globally. The study strengthens the technical rigor of the project, increases total tonnes processed, and delivers a substantially improved payback period while preserving an exceptionally strong early-year production profile. I’m extremely proud of our team, Ausenco, and our technical partners, whose work provides the foundation for advancing Lawyers-Ranch through permitting and toward construction. Importantly, this is not the end of the growth story. With significant resource expansion and discovery potential still ahead of us, we view this PFS as both a validation of what we’ve discovered to date and as the foundation for the next phase of value creation.”

Bill Lytle, Non-Executive Chairman, added, “I am looking forward to advancing the project through Feasibility Study and permitting, as we look to create significant value for all our stakeholders by responsibly developing the Ranch-Lawyers project.”

The Company will host a webcast call to discuss the results of the PFS on Monday, December 1st at 10:00 am Eastern time. To join the call: visit https://app.webinar.net/G0lQbExeaRm, or dial 1-289-815-3444 (Toronto), or 1 (800) 715-9871 (toll free North America). For more details, visit https://thesisgold.com/investors/.

PFS Project Enhancements

A comprehensive review of the 2024 PEA was undertaken to identify and incorporate optimizations that would strengthen overall project economics as the study advanced to PFS-level engineering, cost estimating, and confidence.

The review identified mine sequencing as the primary opportunity to strengthen Project economics. Optimization work brought high-margin ore forward, increased mill throughput, and reshaped the production schedule to improve the IRR and shorten the payback period. This work highlighted the economic importance of Ranch ore, from the Ranch portion of the Project (the “Ranch Area”), the value of prioritizing higher-grade underground feed, and the benefits of a stockpiling approach. As a result, the Ranch Area was advanced to the first three years of production, and the underground cut-off grade was increased to 2.2 g/t AuEq* to maximize margins.

In addition to optimized mine-sequencing of the four pits in the Lawyers portion of the Project (the “Lawyers Area”) as well as the eight Ranch Area pits, the larger pit shells at the Lawyers Area were subdivided into staged pushbacks to improve operational flexibility, bring additional ounces forward, and reduce strip ratios in the early years of the LOM. In parallel, the project incorporated a 9% increase to process plant throughput and a slight reduction in the open-pit cut-off grade over the LOM.

The PFS outlines a 15-year LOM processing 76 million tonnes, with average annual production of 266,000 AuEq** ounces in the first three years to support a rapid payback. Total life-of-mine production is 2.84 million AuEq** ounces.

The results of the PFS were compared to the 2024 PEA and are detailed in Table 1 below:

|

General |

Unit |

2025 PFS |

2024 PEA |

Change |

|

After-Tax NPV (5%) |

$M |

2,370 |

1,277 |

+86 % |

|

After-Tax IRR |

% |

54.4 |

35.2 |

+55 % |

|

Payback Period |

yrs |

1.1 |

2.0 |

-45 % |

|

Payable AuEq** |

koz |

2,837 |

3,025 |

-6 % |

|

LOM |

yrs |

15.2 |

14 |

+7 % |

|

After-Tax NPV:Initial Capital |

ratio |

3.2:1 |

2.1:1 |

+52 % |

|

AISC†/AuEq** oz |

US$oz |

1,185 |

1,013 |

+17 % |

|

Open Pit Stripping Ratio |

W:O |

4.6 |

5.0 |

-8 % |

Project Upside

Opportunities to potentially further improve the project in the planned future Feasibility Study, include the following:

- Pre-Concentration: Pre-concentration of Ranch Area ore to increase average grade and reduce haulage costs from Ranch Area to the process plant located at the Lawyers Area site. An initial assessment, conducted by ABH Engineering Inc. with test work performed by Tomra Mining in Germany, shows promising results for Ranch Ore Sorting.

- Crown Pillar Recovery: The PFS did not include recovery of the crown pillar between the open pit and underground workings. With further study there is an opportunity to increase the mineable ore from underground without impacting the open pits.

- Pit Geotechnical Optimization: Opportunities exist to steepen portions of the Ranch pits in key locations where ground conditions permit; additional drilling and improved rock-mass granularity will help refine and optimize these zones.

- Construction and Commissioning Optimization: Additional opportunity exists to optimize the construction and commissioning phase, specifically evaluating alternative sources to borrow materials to reduce initial capital costs.

- Mine Life Extension:

- Inferred Mineral Resources from both Ranch and Lawyers are not captured within the PFS mine plan. Upgrading the classification of these Inferred ounces through additional drilling presents an opportunity to potentially expand the mineable materials.

- Numerous early-stage and undrilled targets exist across the entirety of the Lawyers-Ranch tenure, and Thesis is focused on a comprehensive, systems-based approach to unlocking additional exploration potential in an emerging porphyry district.

PFS Overview

The PFS considers a conventional truck and shovel open pit mining (“OP”) operation at the Lawyers Area, with common equipment sizing feeding a 13,700 (t/d), industry standard processing plant that includes crushing, grinding, flotation, leaching and a Merrill Crowe recovery circuit, to produce both precious metals concentrate and gold-silver doré bullion on site.

The PFS considers a crossover to underground mining (“U/G”) using longhole stoping to feed up to 1,640 t/d from the Dukes Ridge and Cliff Creek deposits during operational years one to seven. The PFS includes contract mining at the Ranch Area, during the first three years of operations.

The PFS is based on an update of the Mineral Resource Estimate with an effective date of October 16, 2025, and the first Mineral Reserve Statement for the Project, with an effective date of October 27, 2025.

Ausenco was appointed as lead consultant in January 2025 to prepare the PFS in accordance with NI 43-101 standards. Ausenco was assisted by Mining Plus Canada Ltd. (“Mining Plus”) for mining and Mineral Reserve, Knight Piésold Ltd. (“KP”) for tailings management facility (“TMF”), waste rock storage facility (“WRSF”) design, and site-wide water management, Equilibrium for open pit and underground geotechnical assessment, Frank Wright Consulting Inc. (“Frank Wright”) for metallurgy, P&E Mining Consultants Inc. for Mineral Resource estimation, pHase Geochemistry Inc. for material characterization, and SLR Consulting Ltd. for environmental and permitting.

PFS Parameters and Assumptions

The financial modeling for the PFS was completed by Ausenco and included the following parameters and assumptions:

|

Production |

Unit |

First 5-year Avg |

LOM Total / Avg. |

|

Mine Life |

yrs |

n/a |

15 |

|

Total Processed Feed Tonnes |

kt |

25,168 |

76,156 |

|

Waste Mined |

kt |

119,746 |

341,960 |

|

OP Stripping Ratio |

W:O |

6.5 |

4.6 |

|

Head Grade – Au |

g/t |

1.25 |

0.97 |

|

Head Grade – Ag |

g/t |

35.76 |

28.1 |

|

Head Grade – AuEq* |

g/t |

1.68 |

1.31 |

|

Recovery Rate – Au |

% |

92.9 |

92.8 |

|

Recovery Rate – Ag |

% |

79.4 |

81.6 |

|

Total Payable Au |

koz |

924 |

2,198 |

|

Total Payable Ag |

koz |

21,460 |

52,940 |

|

Total Payable AuEq** |

koz |

1,183 |

2,837 |

|

Average Annual Production – Au |

koz/yr |

185 |

145 |

|

Average Annual Production – Ag |

koz/yr |

4,292 |

3,482 |

|

Average Annual Production – AuEq** |

koz/yr |

237 |

187 |

|

General |

Unit |

LOM |

|

Au Price |

US$/oz |

2,900 |

|

Ag Price |

US$/oz |

35.00 |

|

Exchange Rate |

USD:CAD |

1.35 |

|

Operating Costs |

Unit |

LOM Avg. |

|

Mining |

$/t Processed1 |

25.53 |

|

Processing |

$/t Processed1 |

15.36 |

|

G&A |

$/t Processed1 |

5.64 |

|

Total |

$/t Processed1 |

46.53 |

|

AISC† |

US$/AuEq** oz |

1,185 |

|

Capital Cost |

Unit |

LOM Total |

|

Initial Capital |

$M |

736.2 |

|

Sustaining Capital |

$M |

789.4 |

|

including U/G Sustaining Capital of: |

$M |

227.3 |

|

Closure Capital |

$M |

71.8 |

|

Salvage Credit |

$M |

(56.3) |

|

Total Capital |

$M |

1,541.1 |

|

Pre-Tax Financials |

Unit |

LOM |

|

NPV (5%) |

$M |

3,730 |

|

IRR |

% |

73.5 |

|

Payback Period |

Yrs |

0.8 |

|

After-Tax Financials |

Unit |

LOM. |

|

NPV (5%) |

$M |

2,370 |

|

IRR |

% |

54.4 |

|

Payback Period |

Yrs |

1.1 |

|

After-Tax NPV:Initial Capital |

Ratio |

3.2:1 |

|

1 |

Excluding pre-production operating costs and tonnes. |

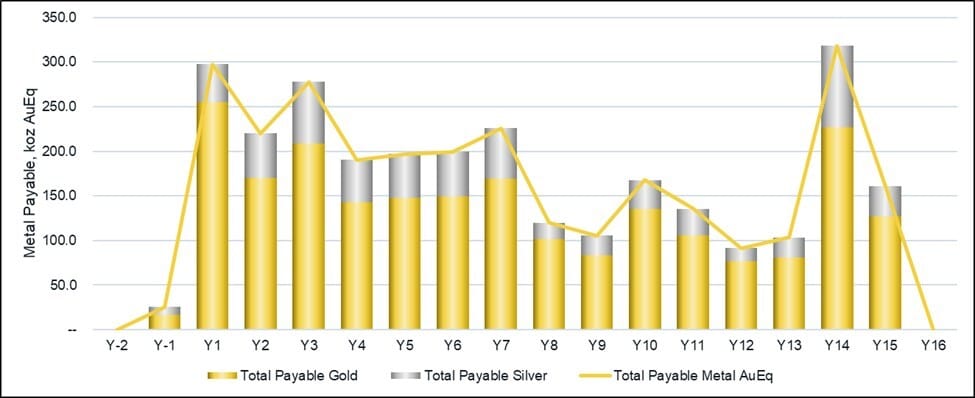

The annual production of total payable gold and silver is presented in Figure 1.

Sensitivity Analysis

A sensitivity analysis to metal prices was performed and the impacts on the Project’s key economic indicators are summarized below:

|

Base Case |

Spot1 |

||||

|

Gold Price ($US)/oz |

2,000 |

2,500 |

2,900 |

3,500 |

4,100 |

|

Silver Price ($US)/oz |

24.00 |

28.00 |

35.00 |

43.00 |

51.00 |

|

Pre-Tax |

|||||

|

NPV5% ($M) |

1,429 |

2,608 |

3,730 |

5,295 |

6,861 |

|

IRR |

34.9 % |

55.8 % |

73.5 % |

96.3 % |

117.4 % |

|

After Tax |

|||||

|

NPV5% ($M) |

909 |

1,658 |

2,370 |

3,364 |

4,357 |

|

IRR |

25.9 % |

41.2 % |

54.4 % |

71.2 % |

86.9 % |

|

NPV5%: Initial Capex |

1.2 |

2.3 |

3.2 |

4.6 |

5.9 |

|

Payback Years |

2.5 |

1.7 |

1.1 |

0.8 |

0.6 |

|

1 |

Assumed spot price as of November 24, 2025. |

Mineral Resource Estimate

The PFS is based on the Mineral Resource Estimate prepared by P&E Mining Consultants Inc., and APEX Geoscience Ltd., with an effective date of October 16, 2025. It is summarized below (Table 5). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

|

Mineral |

Cut-off |

Classification |

Tonnes |

Au |

Ag |

Cu |

AuEq |

Au |

Ag |

Cu |

AuEq |

|

Pit-Constrained Mineral Resource Estimate |

|||||||||||

|

Lawyers Area |

0.25 |

Measured |

50,674 |

0.91 |

31.9 |

0.00 |

1.31 |

1,482 |

51,920 |

0 |

2,131 |

|

Indicated |

61,778 |

0.77 |

21.0 |

0.00 |

1.03 |

1,527 |

41,737 |

0 |

2,049 |

||

|

M&I |

112,452 |

0.83 |

25.9 |

0.00 |

1.16 |

3,009 |

93,657 |

0 |

4,179 |

||

|

Inferred |

8,583 |

0.59 |

16.3 |

0.00 |

0.80 |

164 |

4,509 |

0 |

220 |

||

|

Ranch Area |

0.25 |

Measured |

376 |

3.91 |

1.3 |

0.02 |

3.93 |

47 |

16 |

0 |

47 |

|

Indicated |

3,502 |

1.77 |

10.1 |

0.06 |

1.90 |

200 |

1,137 |

2 |

214 |

||

|

M&I |

3,878 |

1.98 |

9.3 |

0.06 |

2.10 |

247 |

1,153 |

2 |

261 |

||

|

Inferred |

5,785 |

1.50 |

4.7 |

0.10 |

1.56 |

279 |

876 |

6 |

290 |

||

|

Total |

0.25 |

Measured |

51,049 |

0.93 |

31.6 |

0.00 |

1.33 |

1,529 |

51,936 |

0 |

2,178 |

|

Indicated |

65,281 |

0.82 |

20.4 |

0.00 |

1.08 |

1,727 |

42,874 |

2 |

2,263 |

||

|

M&I |

116,330 |

0.87 |

25.3 |

0.00 |

1.19 |

3,256 |

94,810 |

2 |

4,441 |

||

|

Inferred |

14,369 |

0.96 |

11.7 |

0.04 |

1.10 |

443 |

5,385 |

6 |

510 |

||

|

Out-of-Pit Mineral Resource Estimate |

|||||||||||

|

Lawyers Area |

1.20 |

Indicated |

1,173 |

2.20 |

81.5 |

0.00 |

3.21 |

83 |

3,073 |

0 |

121 |

|

Inferred |

1,334 |

1.72 |

51.7 |

0.00 |

2.36 |

74 |

2,216 |

0 |

101 |

||

|

Ranch Area |

1.20 |

Indicated |

26 |

1.89 |

6.6 |

0.09 |

1.98 |

2 |

5 |

0 |

2 |

|

Inferred |

530 |

1.80 |

4.2 |

0.16 |

1.85 |

31 |

71 |

1 |

32 |

||

|

Total |

1.20 |

Indicated |

1,199 |

2.19 |

79.8 |

0.00 |

3.19 |

84 |

3,078 |

0 |

123 |

|

Inferred |

1,863 |

1.74 |

38.2 |

0.05 |

2.22 |

104 |

2,286 |

1 |

133 |

||

|

Total Mineral Resource Estimate |

|||||||||||

|

All |

Combined |

Measured |

51,049 |

0.93 |

31.6 |

0.00 |

1.33 |

1,529 |

51,936 |

0 |

2,178 |

|

Indicated |

66,480 |

0.85 |

21.5 |

0.00 |

1.12 |

1,811 |

45,952 |

2 |

2,386 |

||

|

M&I |

117,529 |

0.88 |

25.9 |

0.00 |

1.21 |

3,340 |

97,888 |

2 |

4,564 |

||

|

Inferred |

16,232 |

1.05 |

14.7 |

0.04 |

1.23 |

547 |

7,671 |

7 |

643 |

||

|

Source: APEX (2025) |

|

Notes: |

|

|

1. |

Mr. Eugene Puritch, P.Eng., FEC, CET, and Mr. Yungang Wu, M.Sc., P.Geo., of P&E Mining Consultants Inc., are independent Qualified Persons as defined by NI 43-101 and are responsible for the Mineral Resource Estimate, with an effective date of October 16, 2025. |

|

2. |

Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

|

3. |

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. |

|

4. |

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration. |

|

5. |

The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council. |

|

6. |

Historical mined areas were removed from the block-modelled Mineral Resources. |

|

7. |

The Lawyers Area includes the Cliff Creek (CC), Dukes Ridge (DR), Phoenix (PX), and Amethyst Gold Breccia (AGB) zones. The 2025 MRE includes updates to the CC, DR, and PX zones since the 2024 MRE. The AGB block model remains unchanged from the 2022 MRE but is restated with updated RPEEE constraints. |

|

8. |

The Ranch Area includes the Thesis II, Thesis III, Bingo, Barite Vein (BV), Bonanza-South, JK, Bonanza, and Ridge zones. The 2025 MRE updates all Ranch Area zones from the 2024 MRE. |

|

9. |

Economic assumptions include metal prices of US$2,500/oz Au, US$30/oz Ag, and US$8,800/tonne Cu; an exchange rate of 0.73 US$:CAD$; process recoveries of 93% Au for both Areas, 86% and 88% Ag for the Lawyers and Ranch areas, respectively, and 85% Cu for the Ranch Area; and processing and G&A costs of CAD$17/t and CAD$6/t, respectively. AuEq values are calculated using an Au-to-Ag ratio of 1:80. Cu is not included in the AuEq calculation. |

|

10. |

Pit-constrained Mineral Resources include blocks within an optimized pit shell derived using the economic assumptions described above, together with a mining cost of CAD$4.0/t for mineralized and waste material, and pit slopes of 52° and 48° for the Lawyers and the Ranch Areas, respectively. |

|

11. |

Out-of-pit Mineral Resource Estimates include blocks below the constraining pit shell that form continuous and potentially mineable shapes, derived using the economic assumptions described above together with a mining cost of CAD$90/t. These parameters result in an out-of-pit cut-off grade of 1.20 g/t AuEq. Mining shapes encapsulate material within domains with a minimum horizontal width of 2.0 m (perpendicular to strike) and target vertical and horizontal dimensions of approximately 10 m (H) by 20 m (L). |

Mineral Reserve

The PFS is based on the Mineral Reserve Estimate prepared by Mining Plus and reported by Thesis Gold with an effective date of October 27, 2025. The Mineral Reserve Estimate is summarized in Table 6 below:

|

Category |

Tonnes |

Au (g/t) |

Ag (g/t) |

AuEq (g/t)7 |

Au (koz) |

Ag (koz) |

AuEq |

|

Open Pit |

|||||||

|

Proven |

|||||||

|

Lawyers Area |

31,582 |

0.97 |

33.45 |

1.39 |

990 |

33,965 |

1,414 |

|

Ranch Area |

365 |

3.66 |

1.11 |

3.67 |

43 |

13 |

43 |

|

Open Pit Subtotal: Proven |

31,948 |

1.01 |

33.08 |

1.42 |

1,033 |

33,978 |

1,457 |

|

Probable |

|||||||

|

Lawyers Area |

39,661 |

0.79 |

20.16 |

1.04 |

1,007 |

25,709 |

1,329 |

|

Ranch Area |

2,134 |

1.65 |

11.69 |

1.80 |

113 |

802 |

123 |

|

Open Pit Subtotal: Probable |

41,795 |

0.83 |

19.73 |

1.08 |

1,120 |

26,511 |

1,452 |

|

Underground |

|||||||

|

Proven |

|||||||

|

Lawyers Area |

1,301 |

2.96 |

115.68 |

4.41 |

124 |

4,839 |

184 |

|

Underground Subtotal: Proven |

1,301 |

2.96 |

115.68 |

4.41 |

124 |

4,839 |

184 |

|

Probable |

|||||||

|

Lawyers Area |

1,112 |

3.08 |

95.55 |

4.28 |

110 |

3,416 |

153 |

|

Underground Subtotal: Probable |

1,112 |

3.08 |

95.55 |

4.28 |

110 |

3,416 |

153 |

|

Total |

|||||||

|

Proven |

33,249 |

1.08 |

36.31 |

1.54 |

1,156 |

38,817 |

1,642 |

|

Probable |

42,907 |

0.89 |

21.69 |

1.16 |

1,231 |

29,927 |

1,605 |

|

Proven + Probable |

76,156 |

0.97 |

28.08 |

1.33 |

2,387 |

68,743 |

3,246 |

|

Source: Mining Plus (2025) |

|

Notes: |

|

|

1. |

Classification of Mineral Reserves is in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) of NI 43-101. |

|

2. |

The independent and qualified person for the Mineral Reserve, as defined by NI 43-101, is Peter Lock, FAusIMM. |

|

3. |

The effective date is October 27, 2025. |

|

4. |

Open Pit Mineral Reserves are reported using an AuEq cut-off grade of 0.29 g/t AuEq for the Lawyers Area pits and a 0.37 g/t for the Ranch Area. |

|

5. |

Underground Mineral Reserves are reported using a cut-off grade of 2.20 g/t diluted AuEq to determine the mining extents. Lower grade gaps within the extents were infilled using stopes that met the incremental cut-off grade of 1.7 g/t diluted AuEq. A lower mill feed cut-off grade of 1.5 g/t diluted AuEq was applied to mineralized development. |

|

6. |

Processing costs used in the cut-off grade calculation were $C 15.77/t milled for Lawyers Area feed and $15.91/t milled for Ranch Area feed; the costs used for sustaining capital, G&A, and Ranch Area ore haul were $C 2.49/t milled, $C 5.23/t milled, and $C 5.80/t milled, respectively. |

|

7. |

AuEq =Au + Ag/80, where Au is the gold grade in g/t and Ag is the silver grade in g/t. |

|

8. |

Mineral Reserves are reported using long-term gold and silver prices of $US 2,000/oz and $US 24.50/oz, respectively, and a foreign exchange rate of 1CAD = 0.73USD. |

|

9. |

The gold processing recovery assumptions used were 92.9% for the Lawyers Area mill feed and 93.2% for the Ranch Area feed. The silver processing recovery assumptions used were 86.1% for Lawyers Area mill feed and 88.4% for Ranch Area mill feed. |

|

10. |

A minimum mining width of 2.5 m was used for all underground assets. |

|

11. |

Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content. |

Capital and Operating Costs

The PFS includes initial capital expenditures of $736.2 million, compared to $598.4 million in the 2024 PEA, a 23% increase. The increase reflects general cost inflation, a 9% increase in process plant throughput (from 12,600 t/d to 13,700 t/d), increased definition for facilities associated with water management, an increase in electrical design and equipment costs, and the mining of the Ranch Area accelerated to year one of operations. The total sustaining costs are estimated at $861.2 million, inclusive of contingency, estimated closure costs of $71.8 million, and estimated salvage credit of $56.3 million.

LOM operating costs for the Project are estimated to average $46.53 per tonne processed excluding pre-production operating costs and tonnes. The PFS is based on an owner-operated model for mining the Lawyers Area open pits, contractor mining for the Ranch Area open pits, and an owner-operated underground operation at the Lawyers Area. Mill feed distribution over the LOM is 3.2% of the ore processed from the Lawyers Area underground, 3.3% from the Ranch Area open pit via contractor, and the remaining 93.5% is from the Lawyers area owner-operated open pits.

The capital and operating cost estimate was developed in Canadian Dollars ($) in Q3 2025. The capital cost summary is presented in Table 7 and the operating cost summary is presented in Table 8.

|

Capital Costs |

Pre-Production |

Sustaining / Closure |

Total |

|

Open Pit Mining |

79.1 |

181.0 |

260.1 |

|

Underground Mining |

0.7 |

227.3 |

228.0 |

|

Mineral Processing |

246.1 |

0.0 |

246.1 |

|

Tailings and Waste Management |

70.7 |

293.1 |

363.8 |

|

On-site Infrastructure |

103.1 |

0.0 |

103.1 |

|

Off-site Infrastructure |

1.9 |

45.1 |

47.0 |

|

Project Indirects |

56.0 |

0.8 |

56.8 |

|

EPCM |

53.6 |

0.0 |

53.6 |

|

Owner’s Costs |

20.1 |

0.0 |

20.1 |

|

Closure |

0.0 |

71.8 |

71.8 |

|

Subtotal 1 |

631.2 |

819.2 |

1,450.3 |

|

Contingency |

98.7 |

42.0 |

140.7 |

|

Subtotal 2 |

729.8 |

861.2 |

1,591.0 |

|

Capitalized Process OPEX |

6.4 |

0.0 |

6.4 |

|

Salvage Credit |

0.0 |

(56.3) |

(56.3) |

|

Total Capital Costs |

736.2 |

804.9 |

1,541.1 |

|

*Numbers may not sum due to rounding |

|||

|

Operating Costs |

$/t Mined^ |

Average Annual |

LOM $M |

|

OP Mining – Lawyers |

4.13 |

105.2 |

1,578.1 |

|

UG Mining – Lawyers |

100.58 |

34.7 |

242.7 |

|

OP Mining – Ranch |

4.65 |

36.9 |

110.7 |

|

Operating Costs |

$/t Processed |

Average Annual $M |

LOM $M |

|

Mining – Total |

25.53 |

129.54 |

1931.4 |

|

Processing** |

15.36 |

78.07 |

1,162.5 |

|

G&A |

5.64 |

28.6 |

426.9 |

|

Total |

46.53 |

236.1 |

3,520.8 |

|

*Numbers may not sum due to rounding **Processing operating costs include waste management and infrastructure ^Open pit mining costs are presented as $/t mined, Underground mining costs are presented as $/t ore mined ^^Average annual mining costs reflect the costs allocated to an area divided by the years that area is in operation. |

|||

Mining

The PFS outlines a mining strategy that integrates conventional open pit truck-and-shovel operations with underground longhole stoping, supported by a stockpiling approach to maintain a maximum annual processing rate of 5.1 million tonnes per annum (Mtpa). Approximately 96.8% of the mill feed will be sourced from open pit mining, as most of the defined Mineral Reserves are located near-surface. In contrast, underground mining will target deeper, higher-grade zones at the Lawyers Area.

Over the LOM, the Project is expected to deliver 76.2 Mt of mill feed at an average grade of 1.33 g/t AuEq*, containing approximately 2.39 million ounces (“Moz”) of gold and 68.74 Moz of silver. These estimates are based on cut-off grades of 0.29 g/t AuEq* for the Lawyers Area open pits and 0.37 g/t AuEq* for the Ranch Area open pits. The underground Mineral Reserve diluted cut-off grade of 2.2 g/t AuEq* was used to define the mining footprint. Additionally, an incremental cut-off grade of 1.5 g/t AuEq* was applied to development, while a cut-off grade of 1.7 g/t AuEq* was used for additional infill stopes.

Figure 2 presents the annual mill feed by ore source, along with the mined AuEq* grade.

Note: AuEq = Au + Ag/80

Open Pit Mining

Open pit mine design was guided by a series of optimized shells for each deposit. This mine design consists of four pits at the Lawyers Area and eight small pits at the Ranch Area, with a combined strip ratio of 4.6:1. Where operational widths allowed, these shells were subdivided into pushbacks to improve operational flexibility and optimize the production schedule. Approximately 73.7 Mt of open pit Mineral Reserve has been defined with grades of 0.91g/t Au and 25.51 g/t Ag, containing 2.15 Moz of gold and 60.49 Moz of silver.

The mining sequence prioritizes high-grade material in the schedule, while stockpiling lower-grade material to optimize feed grade. It also includes mining out select pits to establish development access for underground operations which enables, the delivery of higher-grade underground mill feed. The open pit operation is planned for 15 years, preceded by a two-year pre-production period. Average material movement, inclusive of stockpile reclaim, is estimated at 78.2 kt/d, with peak movement reaching 89.0 kt/d. This excludes pre-production material movement.

The open pit mining activities for the Lawyers Area will be undertaken by an owner-operated truck and shovel fleet with conventional drill, blast, load and haul operations. All mining activities at the Ranch Area will be undertaken by a mining contractor. Given the overall scale of operations and equipment requirements, a diesel-powered fleet has been selected.

Underground Mining

Underground mining in the Lawyers Area will take place at the Dukes Ridge and Cliff Creek (North and South) Deposits. The underground will utilize longhole stoping to achieve a production rate of 1,640 t/d. Stopes will be extracted in a retreat sequence and backfilled with unconsolidated waste rock and/or cemented rock fill. All waste from underground development will be used as backfill.

The mine will be developed using conventional underground equipment, including development jumbos, longhole drills, bolters, LHDs, and haul trucks. Mineralized material will be hauled to the surface and to a stockpile facility near the portal, where open pit equipment will transport stockpiled material to the crusher.

Approximately 2.4 Mt of underground Mineral Reserve have been defined with grades of 3.02 g/t Au and 106.40 g/t Ag, containing 234,000 oz of gold and 8.26 Moz of silver. Underground mine production will occur during the first seven years of the Project’s 15-year mine life.

Processing

The metallurgical test program demonstrates the Project is well suited to a conventional treatment circuit that allows for flexibility to suit the blended feed characteristics of the mineralized material from the Lawyers and Ranch Areas. The PFS metallurgical test work program was completed at SGS Canada Inc.’s metallurgical lab in Burnaby, BC and the testing builds on previous test work. The test work shows that lower sulphide material responds well to cyanide leaching and that higher sulphide material has a poor leach response but can be readily recovered by flotation. The operating philosophy of Lawyers-Ranch will allow for production of a saleable flotation concentrate, while maintaining the ability to leach various process streams to produce doré at site. The flowsheet is designed to be flexible and operates to recover gold via gravity recovery, flotation, and leaching.

The proposed flowsheet has a primary grind to a product particle size 80% passing 140 microns feeding a differential flotation circuit. Gravity pretreatment is included prior to flotation. The flexible flotation circuit allows production of two types of flotation concentrates: one is a high-grade saleable concentrate, and the second is a lower grade scavenger concentrate that is reground before further processing via a more intensive concentrate leach. When processing Ranch ore as a blend, the high-grade concentrate is assumed to be saleable but when the mill feed switches to feeding ore just from the Lawyers Area deposits, the flowsheet has the option to maximize revenue by leaching the concentrate onsite to produce additional doré from the concentrate rather than selling the flotation product.

Project Infrastructure

The Project infrastructure is designed to support a mining and processing operation with a 13,700 t/d throughput, operating on a 24-hour per day, seven day per week basis. The overall site layout will include open pit mines, underground mines, a processing plant, tailings storage facility, waste rock storage facilities, and supporting infrastructure including an accommodation complex, administration office, mine dry, mine maintenance facility, assay lab, and bulk fuel storage.

Site access will be via the existing access road connecting the site to the Kemess mine. A new site access road will branch off the existing access road, providing a more direct route onto the project site. Power will be supplied by a new 69kV transmission line connecting a new 230:69kV step down substation which will tap into the existing 230kV line at Kemess. The Kemess line is subsequently connected to BC Hydro’s Kennedy Siding Substation near Mackenzie BC. A 13.8 kV distribution system will be constructed to support site infrastructure.

The TMF is designed as a conventional thickened slurry tailings storage facility with a downstream embankment construction. Each mining site has a WRSF where material characterized as non-acid generating will be stored. Results from preliminary material characterization suggest potentially acid-generating volumes and onset timing can be managed through pit backfilling for long-term storage. Water treatment is included in the design to create a robust water management plan to handle a range of climatic conditions.

A regional site map is presented in Figure 5. The overall site layout showing the proposed location of the Lawyers Area on-site infrastructure is provided in Figure 6, and the Ranch Area site layout showing infrastructure is provided in Figure 7.

Permitting and Studies

Thesis holds the required permits and approvals to continue exploring the areas comprising the Project. Historical environmental studies were conducted prior to and during the operation of the Cheni Mine, with recent monitoring overseen by the BC Ministry of Energy, Mines and Low Carbon Innovation. In the past two years, Thesis has initiated additional environmental baseline studies to support ongoing exploration and prepare for an environmental assessment application. The Project, located on Crown land in British Columbia within the traditional lands of the Tsay Keh Dene Nation, Kwadacha Nation, Takla Nation, and Tahltan Territory, will require additional permits, including an Environmental Assessment Certificate (EAC) and a federal decision statement. The project plans to follow a concurrent environmental permitting and impact assessment process, in concert with federal and provincial regulators after the submission of an Initial Project Description. The region has Indigenous communities with strong land and resource use traditions. Thesis has secured agreements with Indigenous groups, including a trilateral Exploration Cooperation and Benefit Agreement (Tsay Keh Dene Nation, Kwadacha Nation, and Takla Nation) as well as an Exploration Agreement with the Tahltan Central Government. Thesis is committed to establishing forums for the benefit of communities that will facilitate on-going engagement, sharing project information, and exploring economic opportunities throughout the project lifecycle.

Project Update and Next Steps

With the PFS now complete, Thesis is advancing to a Feasibility Study (“FS”) for the Project. FS data collection started during the 2025 field season where approximately 2,800 meters of drilling occurred with geotechnical data collected and installation of vibrating wire piezometers in three of the geotechnical holes. A portion of the FS metallurgical samples were selected from these geotechnical holes as a starting point for the FS level metallurgical program in conjunction with remaining samples from the PFS program. In 2025, the Company completed a broad geochemical sampling program, correlated with the preliminary PFS mine plan, incorporating both new and historical core, as part of the technical work supporting the FS. Thesis intends to initiate an Environmental Assessment (“EA”) process with the British Columbia Environmental Assessment Office and the Government of Canada’s Impact Assessment Agency of Canada in December 2025 through the submission of an Initial Project Description.

The main focus of the 2026 field season will be to collect the remaining FS level data gaps for geotechnical and hydrogeological data as well as collection of additional FS metallurgical samples. Drilling will be planned to accomplish these multiple objectives, and multielement assays from the same holes when going through the ore body will continue to enhance the team’s geological understanding of the project. Key aspects of the 2026 data collection include:

- Geotechnical/Hydrogeological Site Investigation (FS Level) for:

- Tailings Storage Facility (Lawyers)

- Process Plant (Lawyers)

- Camp Foundations and Mine Maintenance Facility Area (Lawyers)

- Open Pits (Lawyers-Ranch)

- Waste Rock Storage Facility (Lawyers-Ranch)

- Metallurgical Sample Generation (Lawyers-Ranch)

- Project-Scale Hydrogeology Site Investigation Program: to continue the monitoring well network to support the development of a site-wide water balance.

- Mineral Processing and Recovery Testwork to validate processing methods and for optimization of FS flowsheet. A key component will be a geometallurgical study to investigate the variability of mineralized material to identify if there is a lower capital cost alternative to the robust and flexible flowsheet developed for the PFS.

- Conduct Ore Sorting Testwork on the Ranch Area material to investigate the opportunity for the FS.

- Complete Geochemical Characterization of Lawyers-Ranch waste and mineralization, including static and kinetic test work to inform the FS and the EA process.

Once the 2026 field season data collection is complete, Thesis will assess the remainder of the FS schedule and kickoff the engineering and cost estimation portion of the study.

Qualified Persons and NI 43-101 Technical Report

The 2025 PFS for the Lawyers-Ranch Project summarized in this news release was completed by Ausenco and will be incorporated in a NI 43-101 technical report that will be available under the Company’s SEDAR+ profile at www.sedarpus.ca, and on the Company’s website, within 45 days of this news release.

The affiliation for each of the independent Qualified Persons (as defined under NI 43-101) involved in preparing the 2025 PFS, upon which the technical report will be based, are as follows:

- Kevin Murray, P.Eng., Ausenco Engineering Canada ULC

- Eugene Puritch, P.Eng., FEC, CET, P&E Mining Consultants Inc.

- Yungang Wu, M.Sc., P.Geo., P&E Mining Consultants Inc.

- William Stone, M.Sc., Ph.D., P.Geo., P&E Mining Consultants Inc.

- Jarita Barry, P.Geo., P&E Mining Consultants Inc.

- Brian Ray, M.Sc., P.Geo., P&E Mining Consultants Inc.

- Peter Lock, Beng (Mining), Mining Plus Canada Ltd.

- Rita Tsai, P.Eng., Equilibrium Mining Inc.

- Frank Wright, P.Eng., F. Wright Consulting Inc.

- Mark Alban, P.Eng., Knight Piésold Ltd.

- Stephan Theben, Dipl.-Ing., SME RM, SLR Consulting Ltd.

- Andrea Samuels, P.Geo., pHase Geochemistry Inc.

Data Verification

The Qualified Persons responsible for the 2025 PFS and its related technical report have verified the data for which they are accountable, including the sampling, analytical, and test data underlying the information disclosed in this news release. Geological, mine engineering and metallurgical reviews included, among other things, reviewing drill data and core logs, review of geotechnical and hydrological studies, environmental and community factors, the development of the life of mine plan, capital and operating costs, transportation, taxation and royalties, and review of existing metallurgical test work. In the opinion of the Qualified Persons, the data, assumptions, and parameters used in the sections of the 2025 PFS that they are responsible for preparing are sufficiently reliable for those purposes. The technical report in respect of the 2025 PFS, when filed, will contain more detailed information concerning individual Qualified Persons responsibilities, associated quality assurance and quality control, and other data verification matters, and the key assumptions, parameters and methods used by the Company.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc, P.Geol., P.Geo., a non-independent Qualified Persons as defined by NI 43-101.

On behalf of the Board of Directors

Thesis Gold Inc.

“Ewan Webster”

Ewan Webster Ph.D., P.Geo.

President, CEO, and Director

About Thesis Gold Inc.

Thesis Gold Inc. is a resource development company focused on unlocking the potential of its 100%-owned Lawyers-Ranch Project, located in British Columbia’s prolific Toodoggone Mining District. The Company recently completed a 2025 Pre-Feasibility Study, which outlines robust project economics, including a 54.4% after-tax IRR and an after-tax NPV5% of C$2.37 billion at US$2,900 and US$35.00 per ounce of gold and silver, respectively, demonstrating significant value-creation potential. Thesis Gold intends to initiate the Environmental Assessment Process in late 2025 and a Feasibility Study in 2026. Through these steps, the Company aims to further de-risk the Lawyers-Ranch Project and advance it toward becoming a leading global precious metals development opportunity.

For further information or investor relations inquiries, please contact:

Kettina Cordero

Vice President Investor Relations

Email: kettinac@thesisgold.com

Tel: +1 672-910-0026

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Non-GAAP Measures

Certain financial measures referred to in this news release are not recognized measures under IFRS and are referred to as non-GAAP financial measures or ratios. These measures have no standardized measures under IFRS and may not be comparable to similar measures presented by other issuers. The definitions established and calculations provided by the Company are based on management’s reasonable judgment and are consistently applied. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-GAAP financial measures used in this news release are:

Total Operating Costs and Total Operating Costs per Tonne Processed

Operating Costs are reflective of the cash cost of production. Operating Costs include mining costs, processing costs, water and waste management costs, and on-site general and administrative costs. Total Operating Costs per tonne processed is calculated as total Operating Costs divided by total LOM tonnes processed, excluding pre-production Operating Costs and tonnes.

All-in Sustaining Cash Cost and AISC per AuEq Ounce

AISC is reflective of all of the cash costs that are required to produce an ounce of gold from operations. AISC includes Operating Costs, treatment and refining costs, royalties, sustaining capital, expansion capital, and closure costs, less salvage credits. AISC per AuEq ounce is calculated as dividing total AISC by the LOM payable AuEq ounces.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” including FOFI (as defined below) and financial outlook within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the development of Lawyers-Ranch in the PFS, mineralized material processing, highlights of the PFS including the pre and after tax IRR, annual production rates, a range of potential gold prices, the extension of the operation of the mine life to 15 years, information respecting a Maiden Mineral Reserve statement, after-tax payback, capital expenditures at the Project, optimization of engineering design through a Feasibility Study, outlines of processing and production potential, the potential for further Project improvements including pre-concertation, crown pillar recovery, pit geotechnical optimization, construction and commissioning optimization, waste management and closure optimization, and potential mine life extension through reprocessing material characterized as waste and upgrading the classification of inferred ounces through additional drilling, projected mining operations under the PFS, information respecting a Mineral Resource Estimate and Mineral Reserve Estimate, capital and operating costs under the PFS, location of potential mining at the Project, mine design, processing, project infrastructure including new site access, permitting and studies including an environmental permitting and impact assessment process, and advancement of a Feasibility Study including collection of additional data for the Feasibility Study. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results, performance, or achievements to be materially different from those expressed or implied by forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Other factors which could materially affect such forward-looking information are risks respecting uncertainties inherent to the conclusions of economic evaluations and economic studies, changes the parameters of the Project, including budget and schedule, uncertainties with respect to actual results of current exploration activities, delays in the advancement of the Project, including with respect to drilling activities, equipment availability and/or issues, labour force shortages, fluctuations in metal and foreign exchange rates, limitation on insurance coverage, accidents, lack of available capital to the Company, failure to obtain necessary regulatory approvals as the project advances, labour disputes and other risks of the mining industry, the ability of the Company and stakeholders to realize the anticipated benefits of the Project, delays in obtaining governmental approvals or in the completion of development or construction activities, opposition by social and non-government organizations to mining projects, unanticipated title disputes, claims or litigation, cyber-attacks and other cybersecurity risks and changes to tax regimes in the jurisdictions relevant to the Company and other risks described in the Company’s filings, including in the risk factors in the Company’s most recent management’s discussion and analysis, which are available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained in this news release also includes financial outlooks and other forward-looking metrics relating to the Company and the Project, including references to financial and business prospects, future results of operations, performance and estimated NPV and IRR. Such information, which may be considered future oriented financial information (FOFI) or financial outlooks within the meaning of applicable Canadian securities laws, has been approved by management of the Company as of the date hereof. Such FOFI and financial outlooks are based on assumptions which management believes are reasonable as of the date hereof, having regard to the industry, business, financial conditions, plans and prospects of the Company, including the PFS. These projections are provided to describe the prospective performance of the Project and readers are cautioned such information may not be appropriate for other purposes. Such information is highly subjective and should not be relied on as necessarily indicative of future results and actual results may differ significantly from such projections. FOFI and financial outlook constitute forward-looking statements and are subject to the same assumptions, uncertainties, risk factors and qualifications above.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

*AuEq reported for the mined materials/mill feed in mineral resource estimate and mineral reserve estimates assumes a conversion of 80:1 for Ag to AuEq based on expected average expected recoveries of 93% Au and 86.1% Ag at US$2,000/oz Au and $24.50/oz Ag.

**AuEq production values are based on payable ounces as calculated by the financial model and have varying gold and silver recoveries by deposit at a US$2,900/oz Au and US$35/oz Ag.

AISC† costs consist of mining costs, processing costs, mine-level G&A, offsite charges, royalties, sustaining capital, expansion capital, and closure costs.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/thesis-gold-announces-positive-prefeasibility-study-for-lawyers-ranch-project-after-tax-npv5-of-2-37-billion-and-54-4-irr-302628748.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/thesis-gold-announces-positive-prefeasibility-study-for-lawyers-ranch-project-after-tax-npv5-of-2-37-billion-and-54-4-irr-302628748.html

SOURCE Thesis Gold Inc.