Signature Resources Announces Results of the 2025 Annual General & Special Meeting of Shareholders and Provides Update on Winter Drill Program

Toronto, Ontario–(Newsfile Corp. – December 5, 2025) – Signature Resources Ltd. (TSXV: SGU) (OTCQB: SGGTF) (FSE: 3S30) (“Signature” or the “Company”) “) is pleased to announce the results of voting at its annual general and special meeting of shareholders which was held today (the “Meeting”). All matters submitted to the shareholders, as set out in the Company’s Notice of Meeting and Management Information Circular, were approved with overwhelming support.

Each of the following six nominees proposed by management was elected as a director of the Company.

The results of such vote were as follows:

Election of Directors

| Nominee | Votes For | Votes Withheld | % |

| Paolo Lostritto | 38,493,814 | 23,200 | 99.94 |

| Dan Denbow | 38,493,814 | 23,200 | 99.94 |

| Stephen Timms | 38,493,814 | 23,200 | 99.94 |

| Lisa Davis | 38,493,814 | 23,200 | 99.94 |

| John Hayes | 38,493,814 | 23,200 | 99.94 |

| Matthew Goodman | 38,493,814 | 23,200 | 99.94 |

In addition, at the Meeting, shareholders approved (i) fixing the board of directors (the “Board”) at six; (ii) reappointing McGovern Hurley LLP, Chartered Professional Accountants as the Company’s auditor for the ensuing year and authorizing the board to fix their compensation; and (iii) reapproval of the Company’s Incentive Stock Option Plan as set out in the Management Information Circular.

The results of such votes were as follows:

| Resolution | Votes For | Votes Against | % |

| Fixing the board of directors at six (6). | 38,493,814 | 23,200 | 99.94 |

| Resolution | Votes For | Votes Withheld | % |

| Reappointment of McGovern Hurley LLP, Chartered Professional Accountants as the Company’s auditor. | 38,517,014 | – | 100 |

| Resolution | Votes For | Votes Against | % |

| Reapproval of Incentive Stock Option Plan | 38,493,814 | 63,200 | 99.84 |

Update on Winter Drill Program

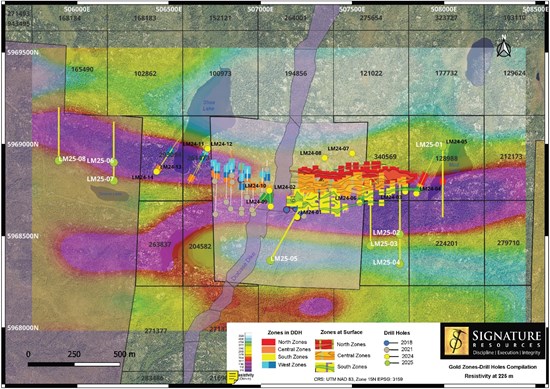

The Company had previously announced its intent to complete a 3,000 metre (“m”) diamond drillhole (“DDH”) program with the intent of extending the known mineralization at depth and to the west. With the closing of the oversubscribed equity offering announced on October 30, 2025, we have modified our program increasing it to eight planned DDH’s for a total of approximately 3,900 metres. Figure 1 shows the plan view of the winter drill program as well as the drill traces from the 2018, 2021 and 2024 program. The gold zone intercepts are highlighted on these drill traces as well as the surface view of the North, Central and South Gold Zones that have been modeled. With the updated modeling completed earlier this year, we have been able to incorporate a prior 3D Alpha IP and Mag survey that demonstrated a high correlation between mineralization and areas of high chargeability and low resistivity. The surface view of the modeled gold zones and drill traces have been overlayed onto the resistivity survey at a depth of 225 m.

Figure 1: Winter Drill Program Plan View

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/277135_9eaa4c14d404aa2b_001full.jpg

The Company commenced the winter drill program in early November and has completed approximately 1,312 m of drilling to date. We anticipate closing camp at the end of the second week of December providing a break in the activities, allowing the field crews a chance to recuperate over the holidays and the Company will recommence field activities early in the new year.

Extending at Depth

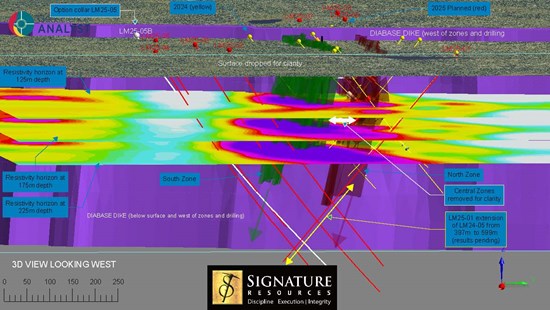

The first five DDH’s of the winter program are targeted at exploring the extension of the known mineralization at depth. Figure 2 shows a western view of the drill program with the planned drillholes shown in red. Three horizontal section planes of the IP survey are shown at depths of 125 m, 175 m and 225 m demonstrating the low resistivity anomaly that is highly correlated with mineralization. Sections from the survey show the low resistivity anomaly down through the entire IP survey with a depth of 500 m. The interpretations of the South and North Gold Zones can be seen in the graphic

Figure 2: West View of 2025 Drill Program with Horizontal Resistivity Section Planes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/277135_9eaa4c14d404aa2b_002full.jpg

LM25-01 is a re-entry and extension of DDH LM24-05 that was drilled from the north to the south and appeared to stop at the edge of the low resistivity anomaly and the Company believes it was a cost effective way to test the depth extensions in the southern edge of the anomaly. The extension to this hole was 240 m to a total drilled depth of 600 m and samples have been delivered to the lab for assaying and results will be provided when received in the coming weeks.

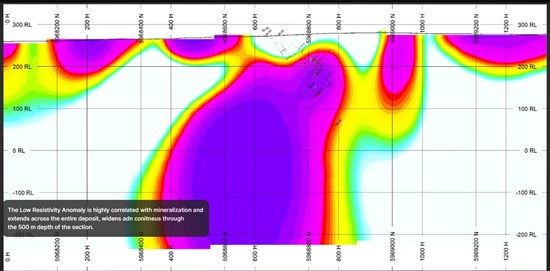

LM25-02 and LM25-04 will both be drilled on a south to north orientation and are intended to test at depth the extensions of the mineralization. Figure 3 is the section for the approximate location for these two drillholes. LM 25-02 was completed to a drilling depth of 530 m and the “leopard rock” package which forms the footwall on the North Zone was within approximately five meters of where we had modeled this intercept. Samples for assaying have been delivered to the lab and results for LM25-02 are pending. LM25-04 will be collard to the south of LM25-02 by approximately 100 m with a planned drilling depth of 675 m. As the zones are interpreted, this hole would intercept mineralization approximately 300 m below the mineralized intercepts shown on Figure 3. It is anticipated that LM25-04 will be completed following the holiday break.

Figure 3: Section 507780E Large Low Resistivity Anomaly Down Plunge from Existing Resource

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/277135_9eaa4c14d404aa2b_003full.jpg

LM25-03 has a planned drilling depth of 600 m drilling a south to north orientation. This hole is targeting the area where DDH’s 24-06[1] and 24-07[2] demonstrated that the North and Central zones were converging creating a wider area of mineralization. This hole is 90% complete and we anticipate having the samples delivered to the lab for assaying before the holiday break.

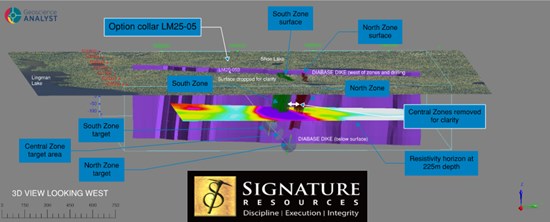

LM25-05 has a planned drilling depth of 500 m and will have a southwest to northeast orientation with a goal of avoiding the mildly easterly dipping diabase dyke. This hole is targeted because of the nearly 50 m wide occurrence of the South Zone at surface which also correlates strongly with the wide intercepts of DDH’s LM24-09[3] and LM24-10[4] which showed wide intercepts in the same zone just west of the post mineralization diabase dike. LM 25-05 will not only test the depth extension of the South Zone but will also test the extension of the North Zone as is demonstrated in Figure 4. This graphic is a good example of the intent of this drill program testing the deeper extensions of mineralization. It shows the horizon of the resistivity at 225 m and the modeled South and North Gold Zones and the approximate areas we would expect to intercept those zones at depth.

Figure 4: LM25-05 Drill Plan

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/277135_9eaa4c14d404aa2b_004full.jpg

Extending Laterally to the West

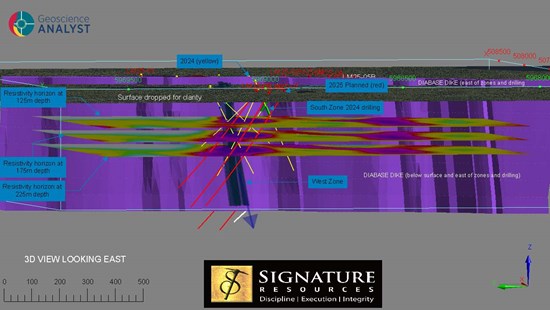

The final three holes of the winter drill program are targeted at extending the known mineralization laterally to the west. If LM25-08 is successful, it will demonstrate the continuation of the mineralization, 600 m to the west of the 1.6km conceptual pit modeled in our recently published NI 43-101. Figure 5 shows an east facing 3D view of the drill program with the three resistivity horizons. The planned DDH’s for 2025 are shown in red and the drill traces from 2024 are shown in yellow. The drillholes planned for the western portion of the program are testing three areas identified in the 3D Alpha IP and Mag survey.

Figure 5: East View of 2025 Drill Program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/277135_9eaa4c14d404aa2b_005full.jpg

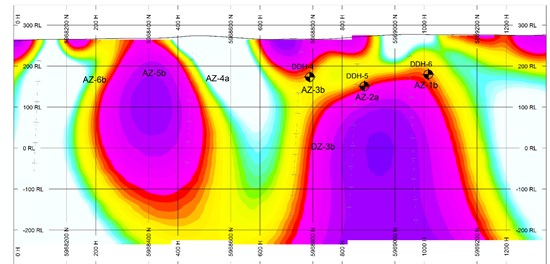

LM25-06 and LM25-07 are being drilled on the section seen in Figure 6 showing the two targets identified in the survey (DDH-5 and DDH-6). These targets are 290 m West of the final two DDH’s drilled in 2024. LM 25-06 has a planned drilling depth of 350 m and will target the northern edge of the low resistivity anomaly. LM25-07 has a planned depth of 500 m and will test the large heart of the anomaly below the identified target DDH-5.

Figure 6: Resistivity Section 506200E – Extending West

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/277135_9eaa4c14d404aa2b_006full.jpg

LM25-08 will be collared 300 m further west with a planned depth of 500m with a south to north orientation. This drillhole will also be testing the heart of the low resistivity anomaly, similar to LM25-07, and further extending the mineralization laterally to the west.

Qualified Person

The scientific and technical content of this press release have been reviewed and approved by Mr. Walter Hanych, P. Geo, consultant and Head Geologist, is a Qualified Persons under NI 43-101 regulations.

About Signature Resources Ltd.

The Company is a Canadian based advanced stage exploration company focused on expanding the 100% Lingman Lake gold deposit, located within the prolific Red Lake district in Northwestern Ontario, Canada. The Lingman Lake gold property (the “Property”) consists of 1,274 single-cell and 13 multi-cell staked claims, four freehold fully patented claims and 14 mineral rights patented claims totaling approximately 24,821 hectares. The Property includes what has historically been referred to as the Lingman Lake Gold Mine, an underground substructure consisting of a 126.5-metre shaft, and 3-levels at depths of 46-metres, 84-metres and 122-metres. There has been over 43,222 metres of drilling done on the Property and four 500-pound bulk samples that averaged 19 grams per tonne of gold. The Company’s initial mineral resource estimate was published in the report entitled “NI 43-101 Technical Report on the Lingman Lake Property” dated May 31, 2025 prepared by Gehard Kiessling, P. Geo., Farshid Ghazanfari, P. Geo., Marin Drennan, P. Eng., Cameron Finlayson and Jeff Plate,CFA, P. Geo, of Watts, Griffis and McOuat Geologic Mining Consultants. The initial mineral resource published was estimated to contained 2.145 million tonnes of material grading 1.38 g/t Au for an estimated 95,200 ounces in the indicated category and 18.398 million tonnes of material with an average grade of 1.14 g/t Au for an estimated 674,320 ounces in the inferred category at a cutoff grade of 0.30 g/t. The company is focused on rapidly expanding the known mineralized envelope with its 100% owned diamond drilling rigs. In November 2023, Wataynikaneyap Power energized a new 115kV high tension transmission line within 40 km of the historic Lingman Lake Mine (https://www.wataypower.ca/).

To find out more about Signature, visit www.signatureresources.ca or contact:

Dan Denbow

Chief Executive Officer

(800) 259-0150

info@signatureresources.ca

or contact :

Renmark Financial Communications Inc.

John Boidman: jboidman@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Cautionary Notes

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains forward-looking statements which are not statements of historical fact. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions and risks associated with infectious diseases and global geopolitical events. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to changes in general economic and financial market conditions, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

[1] As reported in a press releases dated January 10, 2025, LM 24-06 returned results in the Central Zone of 54 m with an average grade of 1.14 gram per tonne of gold (“g/t Au”) including 1 m intercepts of 9.97 g/t Au, 7.16 g/t Au and 17.69 g/t.

[2] As reported in a press release dated February 6, 2025, LM24-07 returned results for a North Zone A intercept of 47m with an average grade of 2.43 g/t and a Central Zone intercept of 19 m with an average grade of 4.71 g/t Au

[3] As reported in a press release dated February 18, 2025, LM24-09 returned results for a South Zone intercept of 51 m with an average grade of 1.81 g/t Au including a 4 m intercept with an average grade of 4.4 g/t Au and a 6 m intercept with an average grade of 5.34 g/t Au.

[4] As reported Februrary 18, 2025, LM24-10 returned results of 34 m with an average grade of 1.8 g/t Au including a 6 m segment with an average grade of 7.7 g/t Au.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277135