Scorpio Gold Announces Additional Drilling Results at the Manhattan District, Nevada

Highlights:

- Hole 25MN-016 returned 0.91 g/t Au over 36.39 m, including 2.97 g/t Au over 3.41 m and 3.33 g/t Au over 4.08 m

- Hole 25MN-017 returned 0.80 grams g/t Au over 33.13 m, including 10.07 g/t Au over 5.94 m

- Hole 25MN-013 returned 0.49 g/t Au over 30.48 m

- Hole 25MN-015 returned 5.49 g/t Au over 7.32 m

Vancouver, British Columbia–(Newsfile Corp. – October 14, 2025) – Scorpio Gold Corp. (TSXV: SGN) (OTCQB: SRCRF) (FSE: RY9) (“Scorpio Gold“, or the “Company“) is pleased to announce further results from Phase 1 of its 2025 drilling program at the Manhattan District Project (“Manhattan“), Nevada, USA.

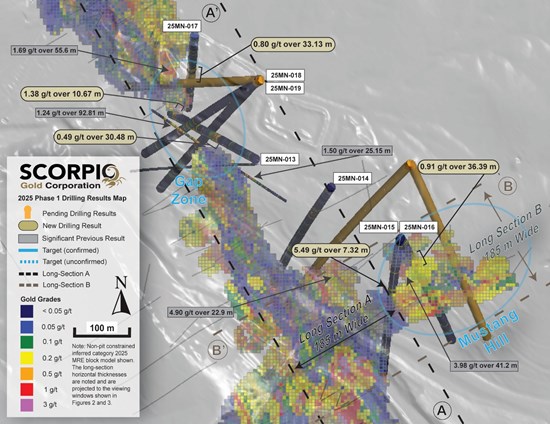

Holes 25MN-013, 25MN-014, 25MN-017, and 25MN-019 intersected gold mineralization associated with the Reliance Trend and holes 25MN-015 and 25MN-016 intersected gold mineralization at the Mustang Hill target (see Table 1). Phase 1 has since concluded with 12 diamond drill holes, totalling 4,216 m (see Figure 1). Further assay results are pending for the four remaining Phase 1 drill holes, totalling 1,465 m.

Phase 1 drilling builds upon the recently announced maiden Mineral Resource Estimate, see news release dated September 11, 2025.

Scorpio Gold’s VP Exploration, Harrison Pokrandt, commented, “As we continue to receive results from our Phase 1 drilling program, these first results at Mustang Hill and additional results within the Gap Zone add ounces to open areas that are along strike of our maiden resource. These results continue to support our objective of expanding the maiden resource at Manhattan to achieve our next goal of two-million-ounces of high-grade gold. With continued drilling, we expect to be able to evaluate potential updates to the resource estimate and ultimately achieve Manhattan’s full potential.”

Overview of Target Zones

The Company’s 2025 Phase 1 drill program was designed to test four primary mineralized zones within the Manhattan District and, critically, to evaluate and confirm gold-bearing structures between existing mines. The Gap Zone lies between the historic Goldwedge Underground and West Pit mines and represents roughly 200 metres of previously undrilled strike along the Reliance Trend; results from this area confirm that mineralization continues across this corridor and remains open both along strike and at depth. The Reliance Trend hosts broad zones of near-surface and deeper mineralization extending northwest from the West Pit, helping to close historic gaps and demonstrating continuity for potential open-pit expansion. The Mustang Hill area, located east of the West Pit, contains several historic underground workings and has now returned multiple high-grade intercepts near surface, reinforcing its importance as a key growth target. Finally, the West Pit Extension encompasses the immediate northwest wall of the existing pit and remains an area of high potential for resource expansion at shallow depths. Together, these four zones define a coherent mineralized system.

Transition to Phase 2

With Phase 1 complete, the Company is completing the planning for Phase 2 of its 2025 drill campaign and will provide a detailled update in the coming weeks. This next phase will focus on systematically drilling the core of Mineral Resource Estimate to the northwest of the West Pit, targeting both infill and step-out holes to better define and expand the main mineralized body, and continuing delineation of strong near-surface mineralization at Mustang Hill. Phase 2 drilling will be conducted on a regular fence pattern to ensure consistent coverage and improved definition of mineralized domains. The Company is also in the process of mobilizing two additional drill rigs, enabling a more aggressive pace toward its goal of completing 50,000 metres of drilling by the end of next August. This accelerated work program is designed to support Scorpio Gold’s near-term objective of defining a two-million-ounce gold resource at the Manhattan District.

Figure 1: Map of the Manhattan District with 2025 Phase 1 drill holes and significant intercepts. Note: Target zones (Gap Zone and Mustang Hill) and the widths of the vertical longitudinal sections (“long-section”) are noted (see Figure 2 and 3 for individual long-sections).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/270278_37109da414ed1aa0_002full.jpg

Phase 1 of the 2025 drilling program targeted (1) the Gap Zone, located between the historic Goldwedge and West Pit mines, along approximately 200 m of unexplored strike length, and (2) Mustang Hill’s historic underground mines, see news release dated June 19, 2025. Holes 25MN-013, 25MN-017, and 25MN-019 targeted the Gap Zone, intersecting Reliance Trend gold mineralization connecting the West Pit and Goldwedge mines, and building upon results from holes 25MN-011 and 25MN-012, see news release dated August 25, 2025. Hole 25MN-014 targeted the Reliance Trend, between the West Pit and the Gap Zone, stepping out and intersecting gold mineralization near surface and at depth. Holes 25MN-015 and 25MN-016 targeted Mustang Hill, and both intersected gold mineralization near surface along the trend (see Figure 1).

The Gap Zone

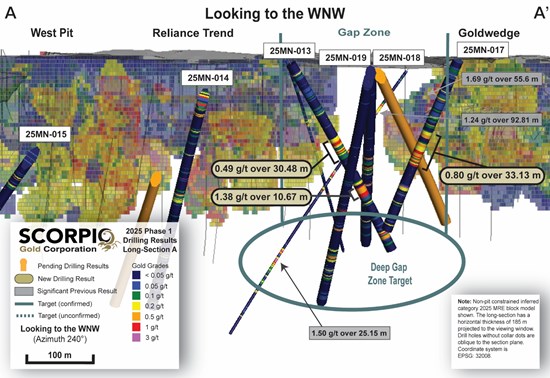

Diamond drill hole 25MN-017 tested the Gap Zone below Goldwedge, and returned:

- 0.33 per metric tonne (“g/t“) gold over 5.7 metres (“m“) from 53.58 m; 0.51 g/t gold over 10.06 m from 102.11 m;

- 0.8 g/t gold over 33.13 m from 118.38 m, including 10.07 g/t gold over 5.94 m from 180.59 m;

- 0.54 g/t gold over 9.75 m from 182.42 m, including 1.27 g/t gold over 2.74 m from 189.43 m (see Table 1).

The drill hole features low to high grade open-pit mineralization near surface from 102.11 m to 151.51 m, and at depth from 180.59 m to 192.17 m within the Gap Zone, along the larger Reliance Trend (see Figure 2).

Diamond drill hole 25MN-018 tested the Gap Zone from the northeast side of the West Pit and returned 0.27 g/t gold over 18.75 m from 181.63 m and 9.4 g/t gold over 3.35 m from 216.1 m (see Table 1).

Diamond drill hole 25MN-019 tested the Gap Zone from the northeast side of the West Pit and returned 0.51 g/t gold over 6.52 m from 234.88 m and 0.39 g/t gold over 12.53 m from 302.51 m (see Table 1).

Diamond drill hole 25MN-013 tested the Gap Zone from the northeast side of the West Pit, and returned 0.49 g/t gold over 30.48 m from 122.22 m; 1.27 g/t gold over 14.75 m from 194.95 m, including 1.81 g/t gold over 5.85 m from 203.85 m; and 1.38 g/t gold over 10.67 m from 260.60 m (see Table 1).

Drill holes 25MN-017, 25MN-018, 25MN-019 and 25MN-013 establish new mineralization within the Gap Zone, along the Reliance Trend. Holes 25MN-019 and 25MN-013 help solidify a new deeper mineralized target in the zone previously discovered by hole 25MN-011, see news release dated August 25, 2025 (see Figure 2).

Figure 2: Long-section A showing connection from West Pit to Goldwedge. The long-section has a 185 m thickness projected to the viewing window (as noted in Figure 1).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/270278_37109da414ed1aa0_003full.jpg

Reliance Trend

Diamond drill hole 25MN-014 tested the Reliance Trend from the northeast side of the West Pit, and returned 0.7 g/t gold over 7.32 m from 64.92 m; 0.55 g/t gold over 10.82 m from 77.30 m; 0.63 g/t gold over 4.08 m from 92.66 m; 0.29 g/t gold over 7.44 m from 203.3 m; and 0.21 g/t gold over 7.28 m from 289.86 m (see Table 1). The drill hole features lower grade open-pit mineralization near surface, infilling mineralization gaps along the Reliance Trend from 64.92 m to 88.12 m (see Figure 2).

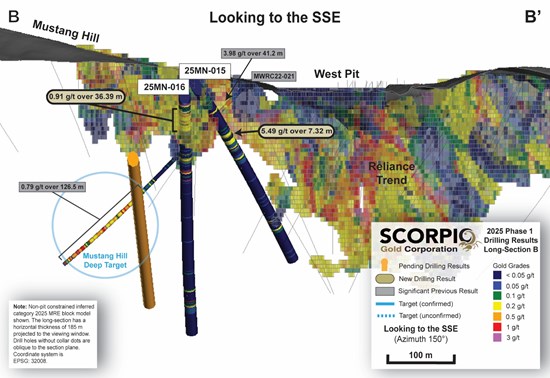

Mustang Hill

Diamond drill hole 25MN-015 tested the Mustang Hill Trend on the northeast side of the West Pit, and returned 0.28 g/t gold over 6.46 m from 104.55 m; 0.35 g/t gold over 6.74 m from 114.57 m; and 5.49 g/t gold over 7.32 m from 124.36 (see Table 1 and Figure 2 and 3).

Diamond drill hole 25MN-016 tested the Mustang Hill Trend on the northeast side of the West Pit, and returned 0.91 g/t gold over 36.39 m from 45.96 m, including 2.97 g/t gold over 3.41 m from 45.96 m and 3.33 g/t gold over 4.08 m from 58.67 m; 0.4 g/t gold over 12.22 m from 113.36 m; and 0.27 g/t gold over 8.41 m from 308.73 m (see Table 1 and Figure 3).

Both drill holes 25MN-015 and 25MN-016 followed up on, and add to, previously drilled near surface mineralization at Mustang Hill, including 3.98 g/t over 41.2 m from 24.4 m in drill hole MWRC22-021, see news release dated October 6, 2022 (see Figure 3).

Figure 3: Long-section B showing the Reliance Trend and Mustang Hill. The long-section has a 185 m thickness projected to the viewing window (as noted in Figure 1).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/270278_37109da414ed1aa0_004full.jpg

| Drill Hole ID | Target Azimuth / Dip |

From (m) |

To (m) |

Intercept¹ (m) |

Gold (g/t) |

ETW² (m) |

| 25MN-013 | Gap Zone | 122.22 | 152.70 | 30.48 | 0.49 | 7.27 |

| 300° / -55° | 194.95 | 209.70 | 14.75 | 1.27 | 3.52 | |

| including | 203.85 | 209.70 | 5.85 | 1.81 | 1.40 | |

| 260.60 | 271.27 | 10.67 | 1.38 | 2.54 | ||

| 25MN-014 | Reliance Trend | 64.92 | 72.24 | 7.32 | 0.70 | 1.81 |

| 217° / -55° | 77.30 | 88.12 | 10.82 | 0.55 | 2.32 | |

| 92.66 | 96.74 | 4.08 | 0.63 | 1.03 | ||

| 203.30 | 210.74 | 7.44 | 0.29 | 1.84 | ||

| 289.86 | 297.15 | 7.28 | 0.21 | 1.80 | ||

| 25MN-015 | Mustang Hill | 104.55 | 111.01 | 6.46 | 0.28 | 5.05 |

| 190° / -45° | 114.57 | 121.31 | 6.74 | 0.35 | 5.27 | |

| 124.36 | 131.67 | 7.32 | 5.49 | 5.72 | ||

| 25MN-016 | Mustang Hill | 45.96 | 82.36 | 36.39 | 0.91 | 31.88 |

| including | 150° / -60° | 45.96 | 49.38 | 3.41 | 2.97 | 2.99 |

| including | 58.67 | 62.75 | 4.08 | 3.33 | 3.57 | |

| 113.36 | 125.58 | 12.22 | 0.40 | 10.71 | ||

| 308.73 | 317.14 | 8.41 | 0.27 | 7.37 | ||

| 25MN-017 | Reliance Trend | 53.58 | 59.28 | 5.70 | 0.33 | 3.62 |

| 190° / -63° | 102.11 | 112.17 | 10.06 | 0.51 | 6.39 | |

| 118.38 | 151.52 | 33.13 | 0.80 | 21.04 | ||

| including | 180.59 | 186.54 | 5.94 | 10.07 | 3.77 | |

| 182.42 | 192.18 | 9.75 | 0.54 | 6.19 | ||

| including | 189.43 | 192.18 | 2.74 | 1.27 | 1.74 | |

| 25MN-018 | Reliance Trend | 181.63 | 200.38 | 18.75 | 0.27 | 2.63 |

| 240° / -45° | 216.10 | 219.46 | 3.35 | 9.40 | 0.47 | |

| 25MN-019 | Reliance Trend | 234.88 | 241.40 | 6.52 | 0.51 | 2.51 |

| 225° / -55° | 302.51 | 315.04 | 12.53 | 0.39 | 1.30 |

Table 1: Manhattan District gold assay highlights from 2025 drilling campaign.

Marketing Update

Management will be participating in The Hidden Gems Conference in New York city on October 20-21, 2025, to meet with new investors over one-to-one meetings. Investors can look forward to getting updated on the ongoing drill program, recently announced Maiden Resource Estimate and drill results. CEO & Director, Zayn Kalyan will also be participating in the upcoming Kinvestor Day Virtual Investor Conference 2025 on October 23, 2025, to provide a corporate update and will be presenting at 11:40am PT. Investors are encouraged to review the updated corporate presentation, here.

QA/QC

HQ sized diamond drill core samples were cut in halves, then bagged and secured with security tags to ensure integrity during transportation to the Reno, NV, Paragon Geochemical facility for preparation. For quality assurance (“QA“), unmarked coarse blanks, unmarked certified reference materials, and requested laboratory duplicates were inserted into the sampling sequence. QA samples were systematically inserted into each batch of samples, amounting to approximately 8% of the run of samples. Samples were analyzed for gold using method PA-AU02 (~500 g), a two-cycle PhotonAssayTM analysis of crushed material (70% passing 2 mm). All Paragon Geochemical facilities comply with ISO 17025:2017.

About the Manhattan District

Manhattan, located in the Walker Lane Trend of Nevada, USA, is road accessible and lies approximately 20 kilometers south of the operating Round Mountain Gold Mine, which has produced more than 15 million ounces of gold. For the first time, the Company has consolidated the district’s past-producing mines under a single entity that holds valuable permitting and water rights. Historically, Manhattan has produced approximately 700,000 ounces of gold from high-grade placer and lode operations dating from the late 1890s through to the mid-2000s (Goldwedge Project Technical Report, 2005). The June 4, 2025 Maiden MRE for the Goldwedge & Manhattan Pit areas of the Project is comprised of 18,343,000 tonnes grading 1.26 g/t gold for a total of 740,000 oz contained gold in the inferred category. Concurrently, a historical mineral resource estimate (the “Historical Estimate”) covers the Black Mammoth, April Fool, Hooligan, Keystone, and Jumbo areas of the Project and comprises 1,652,325 tonnes grading 5.89 g/t gold for a total of 303,949 oz contained gold, see news release dated September 11, 2025. The deposit is interpreted as a low-sulfidation, epithermal, gold-rich system situated adjacent to the Tertiary-aged Manhattan caldera in the Southern Toquima Range of Nevada.

The Historical Estimate is not considered current under NI 43-101, the Company is not treating the Historical Estimate as current mineral resources, and a Qualified Person has not done sufficient work to classify the estimate as current. The Historical Estimate should not be relied upon.

Qualified Person

The scientific and technical information in this news release has been reviewed, verified and approved by Thomas Poitras, P. Geo., Chief Geologist of Scorpio Gold, a “Qualified Person”, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Verification included review of laboratory certificates, review of field logs and chain-of-custody records, inspection of blank/standard/duplicate performance, and review of collar and down-hole survey data. No limitations or failures to verify were identified.

About Scorpio Gold Corp.

Scorpio Gold holds a 100% interest in the Manhattan District located in the Walker Lane Trend of Nevada, USA. Scorpio Gold’s Manhattan District is ~4,780-hectares and comprises the advanced exploration-stage Goldwedge Mine, with a 400 ton per day maximum capacity gravity mill, and four past-producing pits that were acquired from Kinross in 2021 (see March 25, 2021 news release). The consolidated Manhattan District presents an exciting late-stage exploration opportunity, with over 140,000 metres of historical drilling, significant resource potential, and valuable permitting and water rights.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

ON BEHALF OF THE BOARD OF SCORPIO GOLD CORPORATION

Zayn Kalyan, Chief Executive Officer and Director

Tel: (604)-252-2672

Email: zayn@scorpiogold.com

Investor Relations Contact:

Kin Communications Inc.

Tel: (604) 684-6730

Email: SGN@kincommunications.com

Connect with Scorpio Gold:

Email | Website | Facebook | LinkedIn | X | YouTube

To register for investor updates please visit: scorpiogold.com

(TSXV: SGN) (OTCQB: SRCRF) (FSE: RY9)

Forward-Looking Statements

Certain statements contained in this news release constitute “forward-looking statements” within the meaning of applicable Canadian securities legislation. These statements relate to future events or the Company’s future performance, business prospects, plans and objectives, and are based on current expectations, assumptions and estimates of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “anticipates”, “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “believes”, “projects”, “potential”, “targets”, “aims” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements in this release include, but are not limited to: the potential significance of drill results from the Manhattan District; the Company’s ability to define, expand or upgrade mineral resources at the Property; the timing, scope and success of future exploration programs; plans to evaluate and advance a mineral resource estimate; expectations regarding permitting, environmental and community matters; and the potential for the Manhattan District to host multi-million-ounce gold resources.

These forward-looking statements are based on a number of assumptions believed by management to be reasonable at the time they were made, including assumptions regarding: future gold and silver prices; the accuracy of exploration results; the availability of financing; the ability to obtain necessary permits and approvals; labour, materials and equipment availability and costs; the performance of contractors and suppliers; and general business and economic conditions.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: risks inherent in mineral exploration and development; uncertainty in the interpretation of drill results, geology, grade and continuity of mineral deposits; variations in mineral content, grade or recovery rates; delays or failures in obtaining permits, approvals or financing; changes in project parameters as plans continue to be refined; fluctuations in commodity prices, exchange rates and costs of inputs; labour disputes or shortages; political, social or regulatory developments in the jurisdictions where the Company operates; unanticipated environmental impacts or liabilities; and general market and economic conditions. Additional risk factors are described in the Company’s most recent Management’s Discussion and Analysis, each of which is available under the Company’s profile on SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statement, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270278