Royal Road Minerals Reports First Pass Scout Drilling, Trench and Channel Sample Results from It's Jabal Sahabiyah Project: Kingdom of Saudi Arabia

Toronto, Ontario–(Newsfile Corp. – October 6, 2025) – Royal Road Minerals Limited (TSXV: RYR) (OTCQB: RRDMF) (“Royal Road” or the “Company“) is pleased to announce initial scout drilling results and exploratory trench, channel and surface geochemical results from seven separate prospect areas at its Jabal Sahabiyah exploration project in the Kingdom of Saudi Arabia.

Drilling, trench and channel sampling, tested four separate occurrences of polymetallic skarn-style and three gold and silver sheeted-vein-style occurrences. Notable results are as follows (see also Table 1):

SKARN-STYLE DRILLING INTERSECTIONS

| JMRC001 – From 0 to 11 meters- | 11 meters at 12.3% zinc equiv, or 3.3 g/t gold equiv1

FROM: 11 meters at 1.0 g/t gold, 51.3 g/t silver, 0.4% copper, 0.4% lead & 4.9% zinc |

| JMRC006 – From 2 to 17 meters- | 15 meters at 1.4 g/t gold equiv, or 1.5% copper equiv

FROM: 15 meters at 0.7 g/t gold, 3.2 g/t silver, 0.3% copper, 0.5% lead & 1.0% zinc |

| HNRC003 – From 20 to 32 meters- | 12 meters at 3.5% zinc equiv, or 90.0 g/t silver equiv

FROM: 12 meters at 10.0 g/t silver, 0.1% copper & 2.8% zinc |

SHEETED-VEIN GOLD DRILLING INTERSECTIONS

| WRRC002 – From 2 to 13 meters- | 11 meters at 1.0 g/t gold & 4.6 g/t silver |

SHEETED-VEIN GOLD TRENCH & CHANNEL INTERSECTIONS

| WRTR01 – From 57 to 69 meters- | 12 meters at 0.9 g/t gold |

| WRTR06 – From 366 to 378 meters- | 12 meters at 0.5 g/t gold & 3.2 g/t silver (open across strike) |

| ALTR02 – From 24 to 35.5 meters- | 11.5 meters at 0.6 g/t gold |

| ASCH01 – From 0 to 11 meters- | 11 meters at 0.9 g/t gold (open across strike) |

| ASCH04 – From 5 to 14 meters- | 9 meters at 1.3 g/t gold |

| ASCH06 – From 4 to 14 meters- | 10 meters at 2.2 g/t gold (open across strike) |

| ASCH07 – From 0 to 11 meters- | 11 meters at 0.5 g/t gold (open across strike) |

(Not true width and the company does not have sufficient information to determine the true widths of the drill hole intersections)

| TABLE 1: NOTABLE DRILL RESULTS JABAL SAHABIYAH | DENOTES TRANSITION TO SULPHIDE INTERSECTIONS | |||||||||||||||||

| GOLD | SILVER | COPPER | LEAD | ZINC | ZINC EQ | GOLD EQ | SILVER EQ | COPPER EQ | ||||||||||

| HOLE ID | E | N | Z(m) | DIP | AZIM | DEPTH | FROM | TO | LENGTH (m)* | (g/t) | (g/t) | % | % | % | % | g/t | g/t | % |

| JABAL MUWAYQIRAH | ||||||||||||||||||

| JMRC001 | 357564 | 2142315 | 1209 | -90 | 0 | 76 | 0.0 | 11.0 | 11 | 1.0 | 51.3 | 0.4 | 0.4 | 4.9 | 12.3 | 3.3 | 312.7 | 3.6 |

| JMRC002 | 357601 | 2142191 | 1207 | -55 | 330 | 120 | 14.0 | 17.0 | 3 | 0.4 | 2.9 | 0.4 | 40.6 | |||||

| 36.0 | 37.0 | 1 | 0.7 | 71.1 | 0.1 | 1.6 | 146.0 | 1.7 | ||||||||||

| 110.0 | 112.0 | 2 | 0.3 | 0.3 | ||||||||||||||

| JMRC003 | 357566 | 2142112 | 1202 | -55 | 330 | 60 | NO SIGNIFICANT INTERSECTIONS | |||||||||||

| JMRC004 | 357621 | 2142274 | 1207 | -55 | 330 | 90 | 22.0 | 23.0 | 1 | 1.1 | 1.3 | 1.1 | 105.0 | |||||

| 32.0 | 33.0 | 1 | 2.3 | 33.8 | 2.7 | 250.7 | ||||||||||||

| JMRC005 | 357598 | 2142360 | 1217 | -55 | 310 | 80 | 4.0 | 8.0 | 4 | 0.5 | 5.9 | 0.8 | 0.6 | 1.1 | 6.4 | 1.7 | 162.1 | 1.8 |

| 35.0 | 39.0 | 4 | 0.9 | 45.2 | 0.1 | 3.3 | 8.8 | 2.4 | 223.0 | 2.5 | ||||||||

| JMRC006 | 357588 | 2142243 | 1206 | -55 | 330 | 80 | 2.0 | 17.0 | 15 | 0.7 | 3.2 | 0.3 | 0.5 | 1.0 | 5.1 | 1.4 | 130.0 | 1.5 |

| 36.0 | 39.0 | 3 | 0.2 | 43.0 | 0.7 | 61.9 | ||||||||||||

| JMRC007 | 357573 | 2142229 | 1205 | -55 | 330 | 70 | 1.0 | 9.0 | 8 | 0.3 | 1.5 | 0.2 | 0.7 | 2.6 | 0.7 | 65.3 | 0.7 | |

| 27.0 | 28.0 | 1 | 1.9 | 7.1 | 2.0 | 186.2 | ||||||||||||

| JMRC008 | 357522 | 2142413 | 1206 | -50 | 170 | 100 | NO SIGNIFICANT INTERSECTIONS | |||||||||||

| JMRC009 | 357346 | 2142005 | 1200 | -55 | 330 | 70 | NO SIGNIFICANT INTERSECTIONS | |||||||||||

| JMRC010 | 357630 | 2140209 | 1208 | -55 | 310 | 108 | NO SIGNIFICANT INTERSECTIONS | |||||||||||

| JMRC011 | 357596 | 2140267 | 1208 | -55 | 310 | 80 | NO SIGNIFICANT INTERSECTIONS | |||||||||||

| JMRC012 | 357634 | 2142213 | 1207 | -55 | 330 | 80 | 27.0 | 30.0 | 3 | 0.7 | 13.6 | 0.1 | 0.3 | 0.4 | 4.1 | 1.1 | 1.4.0 | 1.2 |

| 35.0 | 36.0 | 1 | 1.0 | 7.8 | 1.1 | 102.1 | ||||||||||||

| 50.0 | 51.0 | 1 | 0.7 | 29.6 | 1 | 95.6 | ||||||||||||

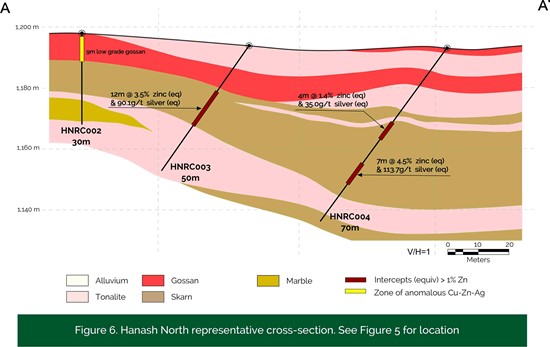

| HANASH NORTH | ||||||||||||||||||

| HNRC001 | 351663 | 2140702 | 1172 | -55 | 225 | 70 | 37.0 | 42.0 | 5 | 11.0 | 0.2 | 3.0 | 4.1 | 110.0 | 1.2 | |||

| HNRC002 | 351801 | 2140506 | 1178 | -90 | 0 | 30 | NO SIGNIFICANT INTERSECTIONS | |||||||||||

| HNRC003 | 351840 | 2140544 | 1174 | -55 | 225 | 50 | 20.0 | 32.0 | 12 | 10.0 | 0.1 | 2.8 | 3.5 | 90.1 | 1.0 | |||

| HNRC004 | 351859 | 2140619 | 1193 | -55 | 225 | 70 | 33.0 | 37.0 | 4 | 10.4 | 0.1 | 0.6 | 1.4 | 35.0 | 0.4 | |||

| 48.0 | 55.0 | 7 | 0.1 | 29.4 | 0.3 | 1.9 | 4.5 | 113.7 | 1.3 | |||||||||

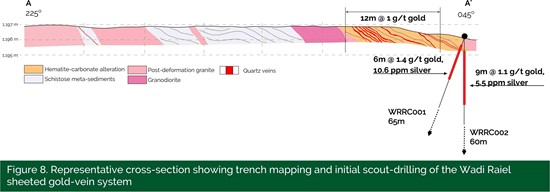

| WADI RAIEL | ||||||||||||||||||

| WRRC001 | 353468 | 2135469 | 1196 | -70 | 230 | 65 | 1.0 | 7.0 | 6 | 1.5 | 11.0 | 1.5 | 143.0 | |||||

| WRRC002 | 353468 | 2135469 | 1196 | -90 | 0 | 60 | 2.0 | 13.0 | 11 | 1.0 | 4.6 | 1.1 | 98.9 | |||||

The Company conducts its exploration activities in Saudi Arabia through its local subsidiary, Royal Road Arabia Limited (“RRA“). RRA is a Saudi Arabian joint-venture company owned on a 50-50% basis by Royal Road and MIDU Company Limited (“MIDU”). MIDU is a Saudi Arabian investment holding company, headquartered in Jeddah, with interests across various sectors including mining, industrial, real estate development and utilities.

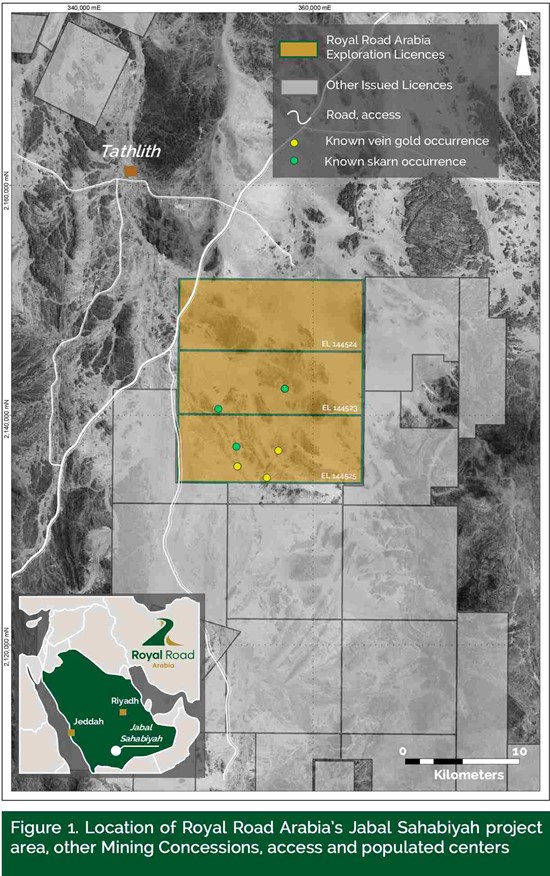

The Jabal Sahabiyah exploration project, located in Saudi Arabia’s Asir Province, comprises three contiguous Exploration Licenses covering a total area of 284 square kilometers (see Figure 1). The project’s mineral potential was first evaluated in the late 1970’s by Riofinex (a subsidiary of Rio Tinto Zinc), which focused primarily on zinc, conducting limited drilling of exposed gossans and concealed geophysical anomalies. More recently, RRA has carried out geological mapping, drone-borne and ground geophysics, soil and auger geochemical sampling, trenching, and rock-chip sampling (see Press Releases; May 29, 2024, November 5, 2024). Mineralization at Jabal Sahabiyah is primarily intrusion-related and includes zinc-gold-silver-copper skarn-style, as well as gold and silver-bearing quartz veins. Gold and base metal mineralization is interpreted to have formed along deep-crustal, shallow-dipping discontinuities during regional extension, and was subsequently folded by two regional deformation events.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_1.jpg

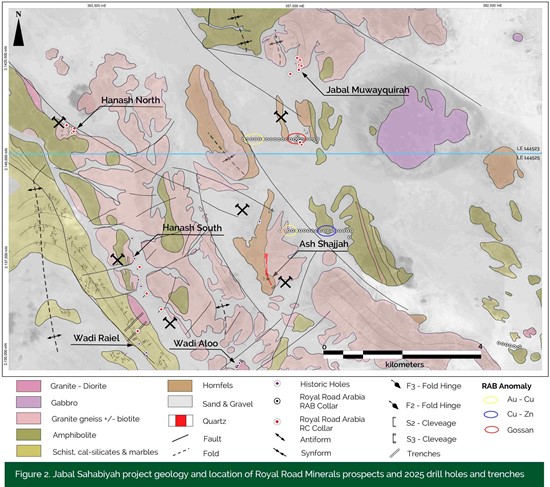

Royal Road has completed 2,486 meters of reverse circulation drilling at Jabal Sahabiyah as a combination of targeted scout-style drill holes, testing geophysical anomalies and extensions of surface occurrences beneath cover rocks (21 drill holes for a total of 1868 meters); and RAB-style shallow-drilling beneath recent soil and alluvial cover (52 drill holes for a total of 618 meters). The Company has also completed trench and rock-chip channel sampling across outcropping and shallow-concealed sheeted vein-gold style mineralization (see Figure 2).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_2.jpg

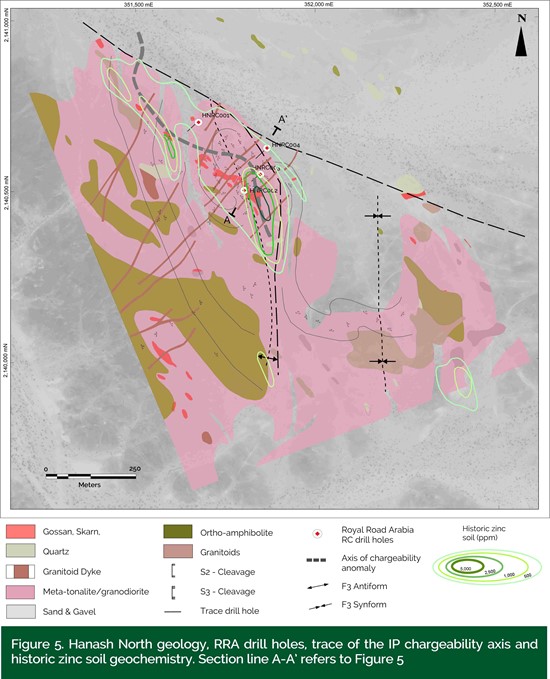

Skarn-style targets

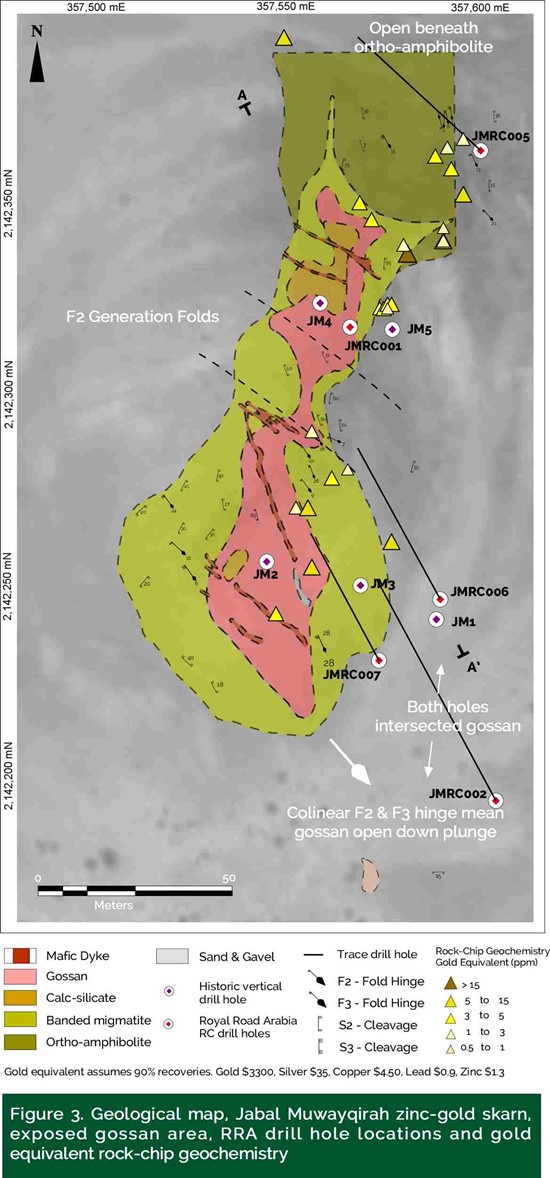

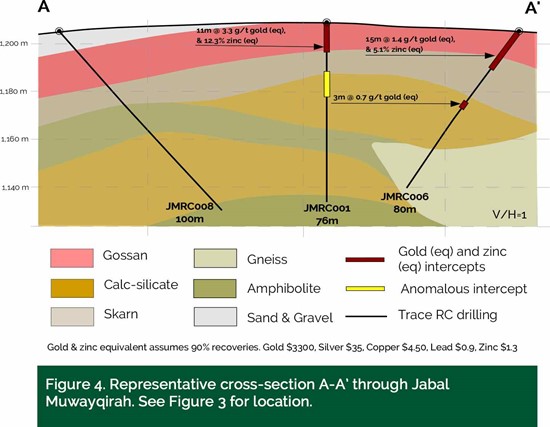

Polymetallic gossans (oxidized sulphide mineralization) are evident on surface at the Jabal Muwayqirah and Hanash North prospect areas. In both cases, mineralization is related to layered, garnet-bearing, calc-silicate rocks, located proximal to a contact with granitoid intrusions. Scout drilling has revealed that the Jabal Muwayqirah prospect (see Figure 2) is characterized predominantly by zinc-gold-silver ± copper mineralization at shallow oxidized levels, transitioning to gold and silver dominated calc-silicate skarn-style mineralization at deeper sulphide-dominated levels (see Table 1 and Figures 3 and 4). Hanash North is a zinc-silver-copper dominated mineralized skarn system, which scout drilling reveals is oriented parallel to a 600 meter long Induced Polarization (IP) chargeability axis, identified by Riofinex in the late 1970’s. Mineralization intercepted by scout drilling, is entirely transition or sulphide in nature, extends across downhole thicknesses of up to 12 meters and can be traced horizontally along the axis of the chargeability anomaly for at-least 250 meters, remaining open towards the northwest and southeast (see Table 1 and Figures 5 and 6).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_3.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_4.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_5.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_6.jpg

Early scout drilling in both areas has successfully confirmed the presence of sulphide mineralization of potentially economic grades, with room for additional volume down-plunge and along-strike. At Hanash North, encouraging signs suggest continuity and new drill targets along and beyond the IP chargeability trend. At Jabal Muwayqirah, additional geophysical surveys and structural studies will help pinpoint larger and thicker sulphide zones at depth.

The Hanash South prospect (see Figure 2) was first drilled by Riofinex in the late 1970s, targeting a 2.3-kilometer long IP chargeability anomaly linked to sulphide mineralization with anomalous zinc, copper and silver over downhole intervals exceeding 50 meters. RRA twinned three of these historical holes to test for gold within the sulphide zones (not systematically assayed by Riofinex). While the drilling only returned localized anomalies in zinc and copper (e.g., HSRC001: 1 meter at 1.6% zinc and 0.1% copper from 83-84 meters, and 1 meter at 0.4% copper and 8.1 ppm silver from 88-89 meters), the broader intersections confirmed sulphide mineralization extending across 20-50-meter downhole intervals. Importantly, RRA interprets Hanash South as representing a distal but significant alteration zone that may indicate proximity to a larger skarn-style mineralized system. Follow-up geological mapping is now underway to better define the structural setting and refine follow up drill targets.

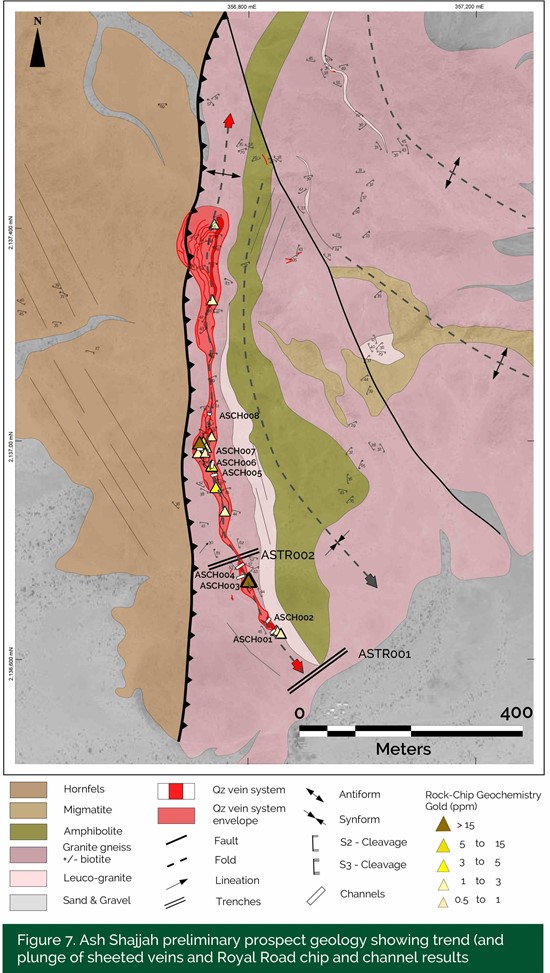

Sheeted-vein gold targets

Exploration at Jabal Sahabiyah has confirmed potential for sheeted-vein gold and silver mineralization at the Ash Shajjah, Wadi Raiel and Aloo prospect areas (see Figures 2 and 7). Recent work by RRA, including channel and trench sampling, ground magnetic and radiometric surveys, and two scout drill holes at Wadi Raiel, has mapped out extensions to known surface occurrences and returned broad low-grade mineralized intersections exceeding 10 meters in width (see Table 2 and Figure 8). Rock-chip sampling of quartz vein material has delivered grades of up to 36.8 grams per tonne gold (minimum 0.002, mean 0.54 grams per tonne gold), underlining the potential for localized (plunging) higher grade sections of the gold mineralized system. The Ash Shajjah mineralized gold vein system has been traced for a strike-length of one kilometer before it plunges below sequence towards the north and is concealed under cover to the south.

Sheeted veins are folded by regional deformation events, meaning that surface exposures do not fully represent their true scale or continuity. Importantly, this structural setting suggests that higher-grade shoots may persist down-dip within the plane of the veins. Early indications also point to the possibility that the various sheeted vein occurrences formed at a similar sub-horizontal level, implying significant potential for broader continuity once geometry is resolved.

| TABLE 2: TRENCH AND CHANNEL RESULTS JABAL SAHABIYAH | ||||||||||

| START | GOLD | SILVER | ||||||||

| TRENCH ID | E | N | Z(m) | AZIM | LENGTH | FROM | TO | LENGTH (m)* | (g/t) | (g/t) |

| ALTR01 | 356074 | 2134747 | 1208 | 132 | 92.0 | NOT SAMPLED | ||||

| ALTR02 | 356000 | 2134540 | 1207 | 317 | 74.0 | 24.0 | 35.5 | 11.5 | 0.6 | |

| ASTR01 | 356978 | 2136617 | 1215 | 235 | 125.0 | NO SIGNIFICANT INTERSECTIONS | ||||

| ASTR02 | 356825 | 2136800 | 1214 | 253 | 93.0 | |||||

| WRTR01 | 353431 | 2135409 | 1205 | 45 | 73.0 | 57.0 | 69.0 | 12.0 | 0.9 | 2.7 |

| WRTR02 | 353345 | 2135238 | 1208 | 68 | 104.0 | NO SIGNIFICANT INTERSECTIONS | ||||

| WRTR03 | 353485 | 2135110 | 1220 | 55 | 39.0 | |||||

| WRTR04 | 353608 | 2135158 | 1212 | 41 | 85.0 | |||||

| WRTR05 | 353276 | 2135746 | 1204 | 65 | 88.0 | |||||

| WRTR06 | 353210 | 2135186 | 1198 | 46 | 717.0 | 366.0 | 378.0 | 12.0 | 0.5 | 3.2 |

| WRTR07 | 353605 | 2135925 | 1186 | 223 | 670.0 | NO SIGNIFICANT INTERSECTIONS | ||||

| ASCH01 | 356842 | 2136649 | 1268 | 47 | 11.0 | 0.0 | 11.0 | 11 | 0.9 | |

| ASCH02 | 356832 | 2136666 | 1254 | 38 | 15.0 | 0.0 | 2.0 | 2 | 0.4 | |

| 11.0 | 15.0 | 4 | 0.4 | |||||||

| ASCH03 | 356780 | 2136750 | 1222 | 68 | 18.0 | 15.0 | 18.0 | 3 | 3.5 | |

| ASCH04 | 356779 | 2136768 | 1226 | 56 | 17.0 | 5.0 | 14.0 | 9 | 1.3 | |

| ASCH05 | 356733 | 2136938 | 1230 | 76 | 12.0 | 0.0 | 8.0 | 8 | 0.4 | |

| ASCH06 | 356734 | 2136952 | 1238 | 12 | 14.0 | 4.0 | 14.0 | 10 | 2.2 | |

| ASCH07 | 356707 | 2136987 | 1232 | 91 | 11 | 0.0 | 11.0 | 11 | 0.5 | |

| ASCH08 | 356726 | 2137052 | 1225 | 104 | 13 | 0.0 | 8.0 | 8 | 0.6 | |

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_7.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/269163_figure_8.jpg

RAB-style drilling

RRA also completed 52 shallow, RAB-style, RC drill holes (totalling 628 meters) across three lines testing covered areas at Jabal Sahabiyah (see Figure 2). Holes ranged from 3-8 meters in depth, with samples collected immediately above the bedrock interface. The program successfully outlined anomalous gold and base metal zones and identified a weakly anomalous gossan extending over a 30-meter downhole interval.

Although early-stage, these results point to the potential northerly continuation of the Ash Shajjah sheeted-vein gold system and the southerly continuation of the Jabal Muwayqirah skarn-style target. These concealed targets will be assessed in the context of further geological mapping aimed principally at resolving the broad structural framework at Jabal Sahabiyah.

“This program is typical of a successful first-pass, exploratory drilling and sampling campaign” said Tim Coughlin, Royal Road’s President and CEO. “Our work has for the first time confirmed the presence of zinc-precious-metal skarn mineralization at Jabal Sahabiyah and, importantly, has highlighted the potential for significant gold in previously untested sheeted vein systems. We are particularly excited by the obvious potential at Ash Shajjah which is exposed over a one-kilometer strike length but remains open down plunge, along and across strike. We now have some dots to join, and so the next stage of our program will focus on systematic drill-targeting, supported by detailed mapping and geophysics in order to unravel the true size and continuity of both the skarn and vein-style systems.”

About Royal Road Minerals:

Royal Road Minerals is a mineral exploration and development company with its head office and technical-operations center located in Jersey, Channel Islands. The Company is listed on the TSX Venture Exchange under the ticker RYR, on the OTCQB under the ticker RRDMF and on the Frankfurt Stock Exchange under the ticker RLU. The Company’s mission is to apply expert skills and innovative technologies to the process of discovering and developing copper and gold deposits of a scale large enough to benefit future generations and modern enough to ensure minimum impact on the environment and no net loss of biodiversity. The Company currently explores in the Kingdoms of Saudi Arabia and Morocco and in Colombia. More information can be found on the Company’s website www.royalroadminerals.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The scientific and technical information contained in this news release has been prepared, reviewed and approved by Dr. Tim Coughlin, BSc (Geology), MSc (Exploration and Mining Geology), PhD, FAusIMM, President and Chief Executive Officer of Royal Road Minerals Limited and a Qualified Person as defined under National Instrument 43-101.

Cautionary statement:

This news release contains certain statements that constitute forward-looking information and forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”) describing the Company’s future plans and the expectations of its management that a stated result or condition will occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in the mineral resources industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Forward-looking statements include all disclosure regarding possible events, conditions or results of operations that is based on assumptions about, among other things, the Alliance, the intention to form a joint venture, enter into a related agreement and establish Newco and, more generally, future economic conditions and courses of action, and assumptions related to government approvals, and anticipated costs and expenditures. The words “plans”, “prospective”, “expect”, “intend”, “intends to” and similar expressions identify forward looking statements, which may also include, without limitation, any statement relating to future events, conditions or circumstances. Forward-looking statements of the Company contained in this news release, which may prove to be incorrect, include, but are not limited to the Company’s exploration plans.

Quality Assurance and Quality Control

Sample preparation and analyses are conducted according to standard industry procedures at certified laboratories.

RC and RAB Sampling and Analysis

Percussion-chip and RAB drillholes were sampled on 1 meter downhole intervals and passed through a 75-25% drill-rig mounted splitter. The 75% sample was placed in rows and analyzed for guidance on-site using a Vanta pXRF tool. The 25% sample was split 50-50% to produce analytical and retention samples of between 1 to 3kg. Samples for analysis were bagged in the field and sent to ALS Jeddah for analysis of gold by fire assay with an ICP-AES finish (method Gold-ICP22) and multi-elements by four acid digest ICP-MS (method ME-MS61QAQC). QAQC materials including CRMs, blanks and duplicates were inserted into the sample batch on a ratio of 1:14.

Trench Sampling and Analysis

Trenches were completed using a tracked excavator down to an average depth of 1.5 meters and a nominal width of 1.5 meters. Trenches were geologically logged and an assessment was made on which sections to sample. Sampling was on a meter-by-meter basis across zones of interest and extended 8-10m into the host rock either side. Distances along trenches were measured using a tape measure and samples were collected along 1 to 2 meter long, 5-10cm wide and 5cm deep horizontal channels. Samples of between 1 to 3kg were bagged in the field and sent to ALS Jeddah for analysis of gold by fire assay with an ICP-AES finish (method Gold-ICP22) and multi-elements by four acid digest ICP-MS (method ME-MS61). Select samples were also analyzed using a screen analysis technique to account for coarse gold (method Gold-SCR24). QAQC materials including CRMs, blanks and duplicates were inserted into the sample batch on a ratio of 1:12.

Chip-Channel Sampling and Analysis

Chip-Channel samples were collected on continuous 1 meter intervals across exposed sheeted veins and surrounding host rock. Samples of between 1 to 2kg were collected along the sampling interval using a hammer and chisel. Samples were bagged in the field and sent to ALS Jeddah for gold and multi-elements analysis (Gold-ICP22 and ME-MS61. Select samples were also analyzed using a screen analysis technique to account for coarse gold (method Gold-SCR24). QAQC materials including CRMs, Blanks, and Duplicates were inserted into the sample batch on a ratio of 1:28.

The Company cautions you not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. There is no guarantee that the anticipated benefits of the Company’s business plans or operations will be achieved. The risks and uncertainties that may affect forward-looking statements include, among others: economic market conditions, anticipated costs and expenditures, government approvals, and other risks detailed from time to time in the Company’s filings with Canadian provincial securities regulators or other applicable regulatory authorities. Forward-looking statements included herein are based on the current plans, estimates, projections, beliefs and opinions of the Company management and the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change.

Contact

Royal Road Minerals Limited

info@royalroadminerals.com

+44 1534 887166

1 Metal equivalent calculations assume 90% recoveries. Gold $3300/ounce, Silver $35/ounce, Copper $4.50/lb, Lead $0.9/lb, Zinc $1.3/lb

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269163