Prospera Energy Reports Production Growth, Increases Asset Ownership, and Provides Corporate Update

Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF) (“Prospera“, “PEI” or the “Corporation“)

CALGARY, AB, Sept. 30, 2025 /CNW/ –

Industry Outlook – Heavy Oil on the Rise:

The Canadian oil and gas sector is benefiting from a favorable shift in market dynamics, particularly for heavy oil producers. Western Canadian Select (WCS), historically discounted relative to West Texas Intermediate (WTI) due to transportation constraints and limited refining capacity, has seen differentials narrow significantly in 2024 and 2025. Improvements in pipeline capacity with the Enbridge Line 3 project completion, start-up of the TMX pipeline project, excess availability of rail capacity and enhanced logistics, and growing U.S. Gulf Coast refinery demand for heavy barrels have all contributed to this positive trend. For Prospera Energy, a producer with a concentrated heavy oil portfolio, the narrowing WCS differential offsets the impact of currently lower WTI benchmark prices, in turn enhancing realized prices, strengthening netbacks, and improving capital project economics.

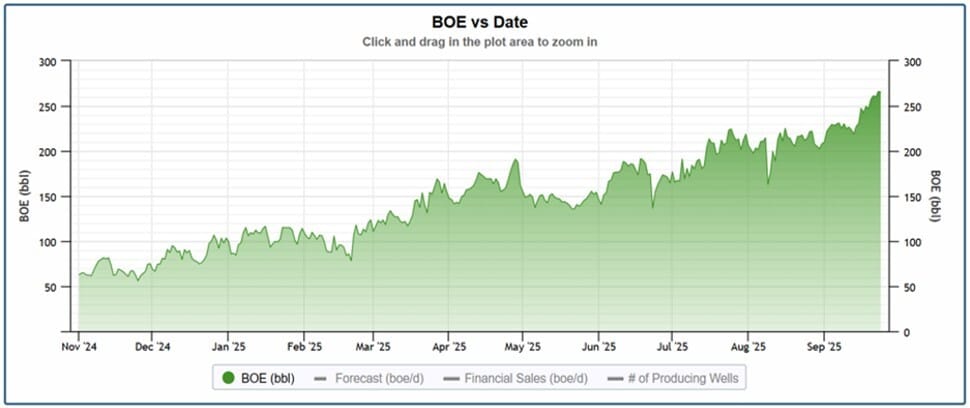

This favorable environment allows the Corporation to reinvest in its asset base, accelerate enhanced oil recovery programs, and advance development with improved capital efficiency. By executing its development strategy in this market context, Prospera is well-positioned to expand margins, enhance operational resilience, and deliver sustainable value to shareholders. An example of this is at Prospera’s heavy oil Luseland property, where eighteen completed reactivations have resulted in an increase from approximately 62 bbl/d in November 2024 to current 266+ bbl/d over the course of the last eleven months. With Saskatchewan conventional heavy oil production at a fraction of its previous highs, Prospera maintains significant optionality in proving out its reactivation strategy and replicating these results at scale across its Cuthbert and Hearts Hill properties, in addition to extensive additional wells still in inventory at Luseland, and numerous adjacent acquisition opportunities. This consistent growth at Luseland underscores that Prospera’s approach is both effective and repeatable with excellent project economics.

Operations Update

Prospera continues to build on its strong operational momentum, averaging gross production of 823 boe/d (93% oil) from September 1st to September 23rd. Multiple projects are complete, including reactivation of the 9-18 and 14-18 wells in Luseland and installation of three recycle pumps and sand suspension chemical systems. Additional projects are underway such as well optimizations and speed-ups especially in Luseland’s Section 33 and Section 18, ongoing engine maintenance and tune-ups, mineral rights acquisitions, waterflood enhancements, and the launch of a comprehensive well load and flush soak program in Luseland. Daily well-by-well analysis remains a core focus, with production enhancement measures implemented in close coordination with field operations. Results from the Luseland reactivations have validated several development strategies and proof-of-concept wells, as outlined in the Key Wells Report available on Prospera’s website.

The Corporation’s strong netbacks are driving efficient capital deployment into high-impact, low risk projects. Over sixty-five projects have already been executed in 2025, with a Q4 program targeting an incremental nine Luseland reactivations. Additionally, the success of the first heel perf in Cuthbert has unlocked eighteen more candidates including six Tier 1 projects, further strengthening the company’s workover inventory. Prospera is proactively addressing legacy environmental issues, advancing remediation of historical spill piles, vegetation management, and site reclamation. The Company is also resolving regulatory non-compliance through in-field work, enhanced monitoring and proactive modernization of active legacy wellsites. Prospera targets substantial progress toward full remediation compliance within the next six months, underscoring its commitment to environmental stewardship and sustainable development.

Cuthbert

Production at the Cuthbert pool averaged 278 boe/d (100% oil) from September 1st to September 23rd. Enhanced winterization efforts are underway, supported by critical infrastructure and field upgrades completed earlier this summer. Production is continuing to recover from temporary shut-ins associated with horizontal well re-entry operations as well as recent major power outages and related electrical upgrades. Prospera is actively engaged with SaskPower and local government officials to improve grid reliability and implement upgrades aligned with growing regional demand. This includes a comprehensive power quality investigation completed in collaboration with SaskPower.

Meanwhile, Prospera’s horizontal well remediation program continues to demonstrate positive results, reinforcing the viability of this development strategy. Additionally, pipeline replacement work is scheduled to commence following harvest activity on farmland where Prospera currently operates.

Hearts Hill

Production at Hearts Hill averaged 182 boe/d (88% oil) from September 1st to September 23rd. The Corporation is advancing waterflood pattern optimization and fluid level drawdown initiatives aimed at enhancing reservoir performance. A comprehensive line-by-line review of all area pipelines has been completed to confirm injection volumes, validate integrity, and support the development of a final field-wide reactivation and workover plan. Earlier Sparky zone recompletions continue to deliver steady oil production, with additional Sparky waterflood development remaining in the project inventory.

Injection pattern adjustments implemented in August are continuing to influence the reservoir, providing early positive results and contributing to a deeper understanding of reservoir behavior. These insights are enabling further refinement of reactivation strategies and prioritization of development efforts.

In September, several wells experienced rod breaks. A service rig is scheduled to mobilize next week for four jobs to repair the rod breaks and replace worn downhole pumps. The Corporation plans to upgrade to larger pumps, enabling the production of comparable fluid volumes at lower RPMs, thereby reducing the frequency of rod failures and improving operational reliability.

Luseland

Production at Luseland averaged 235 boe/d (98% oil) from September 1st to September 23rd. This performance has been supported by two additional well reactivations and ongoing field optimizations driven by daily monitoring of fluid levels and wellhead cuts. Several wells continue to experience notable sand slugging, with sand production reaching up to 20%. This behavior is encouraging as it supports wormhole development, which has the potential to significantly increase production at the well level. In addition, wellhead oil cuts are trending toward lighter, foamier, and less-viscous oil, a positive indicator that fresh reservoir fluid is being accessed from previously undrained portions of the pool and matrix. To further advance this trend, the Corporation is evaluating a range of production engineering techniques designed to promote additional wormhole development and controlled sand influx.

More than fifteen wells are currently under active daily optimization, supported by the installation of nine recycle pumps and sand suspension chemical treatments, with six additional installations scheduled for October. Prospera continues to execute its strategy of increasing pump speeds to accelerate fluid drawdown, conducting proactive flushby operations to mitigate sanding issues, and conducting well loads to effectively bring sand slugs to the wellbore. Based on consultation with the downhole pump supplier and a review of pump failures to date, field operations are now adhering to a maximum pump speed increase of 8 RPM per adjustment. In late September, a new flush soak strategy was deployed on four wells, involving the injection of a hot oil–water mixture down the tubing and coating the pump, followed by a 24-hour shut-in period to allow sand suspension chemicals to disperse clumps and entrain sand. Initial results have been encouraging, with daily monitoring in place to track performance. These optimization initiatives are further supported by cost-efficiency measures, including the optimization of emulsion trucking routes, collaboration with landowners to reduce service travel time, and agreements with service providers to store equipment at Prospera’s secured boneyard, thereby minimizing travel time and reducing operating costs.

Prospera’s engineering and field teams remain focused on well-by-well monitoring of all new reactivations to maximize production, improve reservoir understanding, and minimize failures and decline rates. In Luseland, a total of thirty-six wells are currently online, with nine additional wells finalized for the next stage of the reactivation rig program. Beyond these, a further thirty-two wells have been identified as Tier 1 reactivation candidates, which are being prioritized and scheduled based on results and continuous data collected from the first eighteen completed reactivations.

Several high-performing Luseland wells are featured in the accompanying Key Wells Report, illustrating the success of Prospera’s strategic focus on revitalizing legacy wells with substantial original oil in place (OOIP). Through targeted reactivations, the Corporation is converting wells previously classified as No Reserves Associated (NRA) and burdened solely with Asset Retirement Obligations (ARO) into actively producing assets with meaningful Proved Developed Producing (PDP) reserves, generating sustainable revenue and positive cash flow. Prospera has also grouped wells with comparable production histories, applying tailored optimization strategies to each. Once validated, these approaches will be replicated across other wells with similar geologic characteristics, supporting more predictable reactivations and efficient field development.

Production, Workover Tracker, and Key Wells Report

Prospera has now published its updated production, workover tracker, and key wells report. Production volumes in each field will continue to be reported on a monthly basis, along with corporate revenue information. A detailed workover tracker will share production rates from all workovers and reactivations completed, with information on capital spend and cumulative production since start-up to be added to the September iteration of this report. Additionally, numerous key wells and their production graphs are explained in detail as the Corporation demonstrates its highly capital-efficient workover and reactivation business model.

Joint Venture Partnership

Prospera is pleased to announce that it has received nominations on three wells as per the joint venture partnership to advance the development of its Mannville stack Formation assets. Operations are expected to commence by October 31st, 2025, with completions targeted for January 31st, 2026. This partnership structure allows Prospera to accelerate the development of its Mannville assets while optimizing capital efficiency and maintaining operational control. By leveraging the expertise and resources of its joint venture partner, Prospera can execute these high-impact projects with precision, reducing risk while unlocking additional production potential. This partnership positions the Corporation for long-term, sustainable growth while focusing on its base Bakken heavy oil pools. The initiative positions the Corporation for long-term, sustainable growth while focusing on its base Bakken heavy oil pools.

Working Interest Acquisition

Prospera Energy is pleased to announce it has acquired an additional 14% working interest in the Cuthbert property from an arm’s length joint venture partner. The total purchase price for this transaction was $1,226,744, consisting of $199,634 in equity through the issuance of 6,654,450 PEI common shares at a price of $0.03 per share, subject to a twelve-month hold period, 3,334,550 warrants allowing the holder to acquire one PEI common share at a price of $0.05 for three years from issuance, and forgiveness all outstanding debts totaling $1,027,111 owed by the joint venture partner. Prospera Energy now has 100% working interest across all of its core Saskatchewan heavy oil properties.

Shares for Debt Settlements

Prospera has entered into agreements with two vendors to settle outstanding trade payables through the issuance of common shares. The first vendor has agreed to settle a total of $50,000 through the issuance of 1,428,571 common shares at a deemed price of $0.035 per share. The second vendor has agreed to settle $100,000 through the issuance of 2,500,000 common shares at a deemed price of $0.040 per share. The shares will be subject to a trading restriction of four months and a day from the date of issuance and are subject to TSXV acceptance.

Convertible Debt Offering

The Corporation provides an update regarding its previously announced convertible debt offering on May 12th, 2025. Due to strong investor commitments of $1,750,000, Prospera has increased the size of its non-brokered private placement of convertible debentures from $2,000,000 to $3,000,000. Additionally, the convertible debt will now carry a three-year term and will include warrants exercisable at $0.05 per share for a period of three years from the date of issuance. The offering is subject to acceptance from the TSXV.

|

|

Prospera Energy Inc. (“Prospera” or the “Corporation”). |

|

|

Convertible Debenture with a three-year term. |

|

|

$3,000,000 CAD (the “Offering”). |

|

|

$0.05 if converted within the first year and $0.10 if converted in years two or three; convertible into units consisting of one common share and one warrant exercisable into another common share at $0.05 for a period of three years from initial closing. The Company reserves the right to force conversion in the event that the shares of the Company trade at $0.125 for a period of ten days or more. |

|

|

Common shares of the Company listed on the TSX Venture Exchange under the symbol PEI (the “Common Shares”). |

|

|

Prospera intends to use the net proceeds of the offering for well reactivation, production optimization, strategic acquisitions and working capital. |

|

|

12% interest calculated quarterly and paid at maturity, or conversion date, whichever comes first. Interest may be paid in cash or in shares at the then market price, at the Company’s discretion. |

|

|

The conversion price and warrants will also be subject to standard anti-dilution adjustments upon, inter alia, share consolidations, share splits, spin-off events, rights issues, and reorganizations. |

|

|

Non-brokered private placement offering. |

|

|

On or before October 30, 2025. |

|

|

The convertible debenture will be unsecured. |

|

|

The Company may pay qualified finders a fee of 7% cash and 7% warrants. |

The convertible debt will be used for well reactivations, production optimization, strategic acquisitions, and working capital. The securities will be offered to qualified purchasers in reliance upon exemptions from prospectus and registration requirements of applicable securities legislation. A finder’s fee in cash and/or warrants may be paid to eligible finders in relation to this financing. These private placements are offered in jurisdictions where the Corporation is legally allowed to do so.

About Prospera

Prospera Energy Inc. is a publicly traded Canadian energy company specializing in the exploration, development, and production of crude oil and natural gas. Headquartered in Calgary, Alberta, Prospera is dedicated to optimizing recovery from legacy fields using environmentally safe and efficient reservoir development methods and production practices. The company’s core properties are strategically located in Saskatchewan and Alberta, including Cuthbert, Luseland, Hearts Hill, and Brooks. Prospera Energy Inc. is listed on the TSX Venture Exchange under the symbol PEI and the U.S. OTC Market under GXRFF.

Prospera reports gross production at the first point of sale, excluding gas used in operations and volumes from partners in arrears, even if cash proceeds are received. Gross production represents Prospera’s working interest before royalties, while net production reflects its working interest after royalty deductions. These definitions align with ASC 51-324 to ensure consistency and transparency in reporting.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the future operations of the Corporation and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will,” “may,” “should,” “anticipate,” “expects” and similar expressions. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding future plans and objectives of the Corporation, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Although Prospera believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Prospera can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Prospera. As a result, Prospera cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward- looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and Prospera does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Prospera Energy Inc.