Fuerte Announces a Positive Preliminary Economic Assessment for the Coffee Gold Project; Positioning the Company as one of Canada's Next Gold Producers

After-Tax NPV(5%) of US$2.3 Billion and IRR of 47.8% at Consensus Gold Prices

After-Tax NPV(5%) of US$4.0 Billion and IRR of 67.2% at Spot Gold Price

Vancouver, British Columbia–(Newsfile Corp. – February 22, 2026) – Fuerte Metals Corporation (TSXV: FMT) (OTCQB: FUEMF) (“Fuerte” or the “Company”) is pleased to announce the results of its Preliminary Economic Assessment (“PEA”) for the 100% owned Coffee Gold Project (“Coffee”) in Yukon, Canada.

Highlights:

- Very robust economics: After-Tax NPV(5%) of US$2.3 Billion, IRR of 47.8%, and payback achieved in 1.7 years at analyst consensus gold prices(1). After-Tax NPV(5%) of US$4.0 Billion, IRR of 69.7%, and payback achieved in 1.2 years at spot gold prices(2).

- High-quality open-pit heap-leach mine with significant production: 249,000 oz per year on average in the first full five years of production and 217,000 oz on average over the 13-year Life of Mine.

- Attractive cost profile: Cash operating costs of US$1,136/oz and All-In Sustaining Costs (“AISC”) of US$1,274/oz position the project in 2nd quartile of global producers.

- Stable, supportive jurisdiction: Strong support from the Yukon Government and agreements in place with key First Nations provide momentum in a politically secure, established mining jurisdiction.

- Clear pathway to production: PEA is the catalyst for significant early works in 2026, expected receipt of mine permits by end of year, and a construction decision in early 2027.

1 Analyst consensus prices as at February 18, 2026: US$4,100/oz in 2029 and US$3,620 in 2030 and beyond.

2 Spot price scenario is based on US$5,000/oz, which is the LBMA gold price as of the close of business on February 18, 2026, of US$5,003/oz rounded to the nearest $100/oz.

Fuerte’s CEO, Tim Warman, commented: “The positive results of the PEA strongly validate our decision to acquire the Coffee project in 2025. We will be moving ahead with an aggressive timeline and early works program in 2026, including construction of the remaining portions of the access road from Dawson to the Coffee Project, which we anticipate beginning on receipt of road-related permits later this spring. We expect to obtain the key remaining mine licenses by year-end, which would pave the way for a construction decision for the project in early 2027. We are excited to drive forward with Coffee and to deliver significant economic benefits to our shareholders, residents of the Yukon, and our First Nations partners.”

We respectfully acknowledge that protection of the water and lands around the Coffee Creek and mine project area is of high importance to First Nations. Through cooperation, transparency, and respect, we pledge to continue to build on relationships with Tr’ondëk Hwëch’in, White River First Nation, Selkirk First Nation, and the First Nation of Na-Cho Nyäk Dun, whose Traditional Territories overlap or partially overlap with the project access road, and areas where exploration and mining activities may occur.

PEA Summary

The PEA contemplates a high-grade open-pit heap-leach mine with an initial planned mine life of approximately 13 years. Coffee is expected to produce 249,000 saleable gold ounces per year on average for the first full five years of production and an average of 217,000 saleable gold ounces per year over the life of mine (“LOM”) at an attractive AISC of US$1,274/oz.

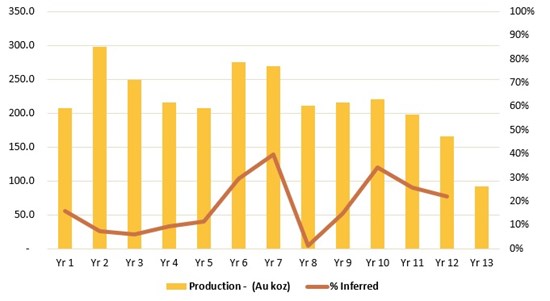

Consistent with PEA studies, the production profile includes Inferred resources and is provided in the chart below. Approximately 16% of the ounces mined in the PEA profile are in the Inferred category, which cannot be included in the Feasibility Study scheduled for Q4/26. In order to upgrade a portion of these Inferred ounces to the Indicated category, the Company will commence an infill drilling program in Q1/26. The mineralization at Coffee is such that it hosts a number of high grade near surface zones that enable the mining of good grade material early in the mine plan allowing for higher average production in the initial five years.

LOM annual gold production with Inferred contribution

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7505/284732_fuerte1.jpg

The PEA mine plan estimates a robust internal rate of return (IRR) of 47.8% and after-tax net present value (NPV5%) of US$2.3 billion at analyst consensus gold prices (US$3,620/oz long-term) and a foreign exchange rate of 1.39 CAD per 1.00 USD. The mineral resources included in the mine design are from pit shells developed using a gold price of US$2,500/oz.

PEA Study Highlights

| PEA Study Highlights | |||

| LOM Production | |||

| Material Mined | Mt | 90.5 | |

| Gold Grade | (g/t) | 1.25 | |

| Contained Gold | kozs | 3,644 | |

| Processed Material Stacking Rate | Mtpa | 7.4 | |

| Average Recovery Rec |

% | 77.5% | |

| Recovered Gold | kozs | 2,824 | |

| Strip Ratio | waste: material processed | 7.6 | |

| Mine Life | years | 13 | |

| Annual Production (Saleable Gold) | |||

| Annual Production – First Full 5 Years | oz/yr | 249,000 | |

| Annual Production – Life of Mine | oz/yr | 217,000 | |

| Operating Costs | |||

| Avg. LOM Operating Costs | C$/t processed | 44.24 | |

| Total Cash Costs1 | US$/oz | 1,136 | |

| All-in Sustaining Cost – First Full 5 Years1 | US$/oz | 1,166 | |

| All-in Sustaining Cost1 | US$/oz | 1,274 | |

| Capital Costs | |||

| Total Direct Capital Costs | C$M | 638.5 | |

| Indirect Costs | C$M | 165.3 | |

| Contingency | C$M | 179.4 | |

| Total Initial Capital | C$M | 983.1 | |

| Sustaining Capital | C$M | 558.8 | |

| Economic Attributes | |||

| Gold Price | US$/oz | Consensus2 | Spot3 |

| After Tax NPV(5%) | US$B | 2.3 | 4.0 |

| After Tax IRR | % | 47.8 | 67.2 |

| Payback Period | years | 1.7 | 1.2 |

1 Total Cash Costs are a non-GAAP financial measure and include mining, processing, refining & transport, G&A and royalty costs. All-in Sustaining Costs (AISC) is a non-GAAP financial measure and is comprised of total cash costs, sustaining capital expenditures to support the on-going operations, and closure costs.

2 Analyst consensus prices as at February 18, 2026: US$4,100/oz in 2029 and US$3,620 in 2030 and beyond.

3 Spot price scenario is based on US$5,000/oz, which is the LBMA gold price as of the close of business on February 18, 2026, of US$5,003/oz rounded to the nearest $100/oz.

Economic Sensitivities

The following table provides a sensitivity analysis of key project economic parameters at various gold prices.

| Project Economics – Gold Price Sensitivity | |||||

| Gold Price (US$/oz) | $2,500 | Consensus1 | $4,500 | Spot2 | $5,500 |

| Pre-tax NPV(5%) (US$M) | 1,678 | 3,770 | 5,414 | 6,234 | 7,282 |

| After-tax NPV(5%) (US$M) | 983 | 2,326 | 3,380 | 3,963 | 4,578 |

| Pre-tax NPV(5%) (C$M) | 2,332 | 5,241 | 7,526 | 8,665 | 10,122 |

| After-tax NPV(5%) (C$M) | 1,366 | 3,233 | 4,698 | 5,508 | 6,363 |

| After-tax IRR (%) | 26.4 | 47.8 | 62.1 | 67.2 | 76.9 |

| Payback (years) | 2.9 | 1.7 | 1.4 | 1.2 | 1.1 |

1 Analyst consensus prices as at February 18, 2026: US$4,100/oz in 2029 and US$3,620 in 2030 and beyond.

2 Spot price scenario is based on US$5,000/oz, which is the LBMA gold price as of the close of business on February 18, 2026, of US$5,003/oz rounded to the nearest $100/oz.

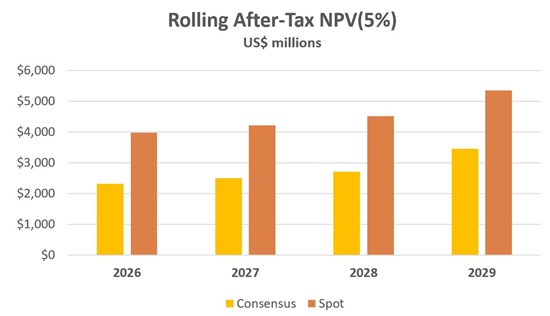

The following chart provides the rolling after-tax NPV(5%) at both analyst consensus and spot prices. The chart demonstrates the go-forward value of the project once the capital for the project has been incurred.

Rolling After-Tax NPV(5%)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7505/284732_fuertegraph2.jpg

Resource Estimate

The Mineral Resource Estimate (“MRE”) used in the PEA is unchanged from that presented in the technical report prepared for Fuerte Metals Corporation and entitled “NI 43-101 Technical Report for the 2025 Mineral Resource Estimate Update on the Coffee Gold Project, Yukon, Canada” prepared by Micon International Ltd. (“Micon”). The MRE has an effective date of August 21, 2025.

| Resource Category | Tonnage (kt) |

Gold Grade (g/t) |

Contained Gold (gold koz) |

| Measured | 1,200 | 1.80 | 69 |

| Indicated | 78,846 | 1.14 | 2,888 |

| Measured + Indicated | 80,046 | 1.15 | 2,957 |

| Inferred | 21,200 | 1.17 | 800 |

Notes to Table

- Economic parameters used in the resource are a gold price of US$2,500/oz; heap leach average recoveries for the individual metallurgical domains of 86.3% for Oxide, 76.0% for Upper Transition, 54.5% for Middle Transition and 31.4% for Lower Transition; a mining cost of C$3.27-$3.50/t, processing costs of C$6.64/t, and general and administrative costs of C$6.0/t. A CAD:USD exchange rate of 1.35 was also assumed.

- The calculated cut-off grades vary between 0.13 g/t Au and 0.48 g/t Au, depending on the metallurgical domain. The global weighted average cut-off grade is 0.18 g/t Au, with domain tonnage contributions comprising 64% Oxide, 18% Upper Transition, 5% Middle Transition, and 13% Lower Transition.

- Design inter-ramp angles vary between 46.3 and 48.3 degrees in pit walls governed by bedding and foliation stability. Pit walls not expected to be impacted by southerly dipping bedding and foliation are designed at inter-ramp angles between 51.7 and 55.3 degrees.

- Pit optimization was done on 12x12x10 m re-block model with a minimum of 4x4x5 m regularized SMU.

- Numbers have been rounded to the nearest for thousand tonnes and ounces. Differences may occur in totals due to rounding.

- The mineral resources described above have been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Standards and Practices.

- Messrs. Alan J. San Martin, P.Eng. and Charley Murahwi, P.Geo. from Micon International Limited are the Qualified Person (QP) for this Mineral Resource Estimate.

- Mineral resources are not mineral reserves as they have not demonstrated economic viability. The quantity and grade of reported Measured, Indicated and Inferred mineral resources in this news release are uncertain in nature; however, it is reasonably expected that a significant portion of Inferred Mineral Resources could be upgraded into Measured and Indicated Mineral Resources with further exploration.

- Micon’s QPs have not identified any legal, political, environmental, or other factors that could materially affect the potential development of the mineral resource estimate.

Mining

The Coffee Gold Project will be mined by conventional truck / loader open pit operations with an average annual production rate of 7.4 Mt of material processed, and a LOM strip ratio of 7.6:1. Material to be leached will be mined principally from four pits, with minor production from smaller pits, over an expected 13-year mine life. Mining will take place year-round, with material to be leached delivered by truck from the pits to the crusher except in the coldest period of the year (approximately three months) when this material will be stockpiled.

Processing

Run-of-mine (“ROM”) process material will be delivered from the pits via trucks and dumped into the primary gyratory crusher at an average daily rate of about 26,900 t. A ROM stockpile area with a capacity of ~1.5 Mt will allow the stockpiling of material to be processed when the crusher is not running, particularly during the winter months. There will be two-stage crushing with a final target product size of P80 of 50 mm. Material to be processed will be stacked on the Heap Leach Facility (“HLF”) by conveyors.

The HLF will consist of a conventional, multi-lift, free-draining ridge-top leach pad, ponds, access roads, and leachate solution distribution and collection piping. Barren solution will be irrigated onto the heap using drip irrigation. Pregnant (gold-bearing) solution will be collected at the base of the heap leach pad by impermeable membranes and piping. The pregnant solution will flow to the process plant by gravity for gold recovery.

The leach pad will be constructed in stages, with each stage large enough to provide capacity for one and a half to three years of operation. The pad will be lined with two liners: a geosynthetic clay liner at the base directly overlain by an impermeable collection geomembrane. A network of drainage pipes within a layer of permeable gravel at the base of the pad will collect and direct the pregnant solution into trunk lines on each flank of the pad and transport it by gravity to the process plant. A series of horizontal trenches or wick drains will be installed beneath the liner system to detect leakage.

Process solution (barren, pregnant and heap rinse water) will be stored in tanks located at the plant. The barren solution will be heated when necessary to ensure that the thermal integrity of the system and the leach pad is maintained. Ponds adjacent to the heap leach pad will be used to store contact and clean water generated from seasonal and storm events, heap upset conditions (e.g., power loss), and normal precipitation runoff.

Leached gold will be recovered from solution using an activated carbon adsorption circuit. The gold will then be stripped from carbon using a desorption process followed by electrowinning to produce a precipitate sludge, which is refined on site in a furnace to produce doré bars as final products.

Heap Leach Facility Engineering and Safety

The safety of the HLF is of paramount importance to our team, who have taken a proactive approach to carry out a robust technical review of the HLF design and operating procedures, including:

- A third-party expert review of all existing HLF documentation, including but not limited to; foundation investigations, design plans, stability assessments, HLF water balance, and operating and closure plans. That work was completed and recommendations from that review were made to HLF design and operating procedures planning and documentation.

- A failure modes and effects analysis was completed in 2025 for the HLF which included the third-party technical experts, as well as the project team and HLF engineers and informed by findings from the Independent Review Board investigation into the Eagle Gold Mine Heap Leach Failure. Recommendations from that investigation have been evaluated and integrated into the Project HLF design, operation, maintenance and closure plans where appropriate. The design and operation of the Coffee HLF will be monitored by an Independent Technical Review Board, one of the key recommendations arising from the Eagle Mine investigation.

The HLF design has had 10 years of progressively detailed design and substantial engineering review, and the design incorporates conventional stacking of well-drained material and a conservative water/solution management design that allows for unplanned events and contingencies.

Capital Costs

The direct construction capital for Coffee is estimated at C$638.5 million, including off-site costs of C$71.3 million for the Northern Access Route, which will provide road access to site from Dawson City. Mobile mining equipment costs are included in the direct construction capital at C$89.2 million for the primary equipment and $39.2 million for the auxiliary equipment, reflecting the purchase of an owner-operated mining fleet. Indirect costs are estimated at C$165.3 million and contingency is C$179.4 million. Sustaining capital over the life of mine (including contingency) is estimated at C$558.8 million and closure costs are estimated at C$182.6 million.

| Capital Cost Summary | C$ millions |

| Direct Construction Capital | 567.2 |

| Northern Access Route | 71.3 |

| Total Direct Capital Costs | 638.5 |

| Indirect Costs | 165.3 |

| Contingency | 179.4 |

| Total Initial Capital | 983.1 |

| Sustaining Capital – LOM | 558.8 |

| Reclamation Costs | 182.6 |

| Total LOM Capital Incl. Sustaining & Reclamation | 1,724.5 |

Operating Costs

Operating costs average C$44.24/tonne stacked and are based on estimates provided by WSP for labour and consumables. Total cash costs are forecast to average US$1,136/oz of gold produced over the life of mine and All-in Sustaining Costs (AISC) are expected to average US$1,274/oz. Costs in the first full five years of the mine plan will benefit from the processing of higher-grade material and AISC will average US$1,166/oz over the period.

| Operating Cost Summary | (C$) | (US$) |

| Mining Costs ($/t material stacked) | 30.32 | 21.81 |

| Site Services Costs ($/t material stacked) | 1.84 | 1.32 |

| Processing Costs ($/t material stacked) | 6.48 | 4.67 |

| G&A Costs ($/t material stacked) | 5.60 | 4.03 |

| Total Operating Costs ($/t material stacked) | 44.24 | 31.83 |

| Total Operating Costs ($/oz gold sold) | 1,412 | 1,016 |

| Royalties ($/oz)1 | 140 | 101 |

| Refining & Transport ($/oz) | 28 | 20 |

| Total Cash Cost ($/oz gold sold) | 1,579 | 1,136 |

| Sustaining Capital & Other ($/oz) | 192 | 138 |

| All-in Sustaining Cost ($/oz sold) | 1,771 | 1,274 |

1 Royalty costs include payments to third party royalty holders and assume that a buyback of half of a 2% NSR is exercised prior to commercial production and that the 3% NSR to Newmont is re-purchased at the end of the first year of commercial production.

Environmental, Social, and Permitting

The Coffee Gold Mine Project is nearing the completion of mine permitting; the environmental and socioeconomic assessment process was completed in 2022, and major mine license applications were filed in 2023. The Quartz Mining Licence (QML) and Water Use Licence (WUL) are required to advance major mine construction and operations activities, and the company anticipates receipt of these permits by year-end 2026.

The Coffee Gold Mine Project licensing documents do not fully reflect the scope of the project outlined in the PEA and amended permits will be required to fully realize the value of the Coffee Project. The first several years of mine construction and operation will not require material divergence from the mine permit approvals, and the Company intends to pursue additional permitting, as required, in parallel with mine development and production.

Next Steps

The Company is planning a 40,000-metre drill program in 2026, for the purposes of both upgrading the confidence level of existing mineral resources and testing new targets.

The infill drill program will focus on upgrading the mineral resource confidence in the Supremo Extension deposit and parts of Latte deposit to the Measured and Indicated category to improve confidence and bring additional resources into the Feasibility Study. The Feasibility Study will also evaluate potential opportunities to improve productivity and overall project performance.

While the majority of drilling will focus on infill, a portion of the 2026 drill program will be allocated to test new targets at the project. The Coffee project is situated on a 70,000 hectare claim package with the potential for resource expansion as well as new discoveries.

With the positive results of the PEA, the Company is planning an Early Works program to complete several strategic initiatives that will help accelerate the construction timeline once a construction decision is made. The initiatives permissible under our existing permits include:

- New airstrip that allows larger aircraft and night flights

- Installation of a construction camp

- Development of laydown areas

- Other minor projects (Ex., aggregate stockpiling, powder magazine, etc.)

Upon receipt of the remaining permits for the Northern Access Route (“NAR”), the company is also planning to begin work on the site access road from Dawson City to the project. The NAR is a ~214 km road, much of which currently exists in the form of public roads to access nearby placer gold operations. Approximately 40 km of new road will be built with the remainder requiring upgrades for more permanent use.

The Company is also advancing the previously announced Feasibility Study with G Mining Services, who will also manage construction of the project. Once the permits are received, our ambition is to be in a position to make a construction decision in early 2027.

About Fuerte Metals Corporation

Fuerte is a Canadian exploration and development company focused on advancing high-potential precious metals and base metals projects across the Americas. Our flagship asset is the 100%-owned Coffee Project in the Yukon, Canada – a high-quality gold project advancing through the final stages of permitting, engineering, and resource expansion drilling in preparation for a construction decision. Coffee hosts 3.0 million ounces of open-pit heap-leach Measured and Indicated Resource and an Inferred Resource of 0.8 million ounces. We respectfully acknowledge that protection of the water and lands around the Coffee Creek and mine project area is of high importance to First Nations. Through cooperation, transparency, and respect, we pledge to continue to build on relationships with Tr’ondëk Hwëch’in, White River First Nation, Selkirk First Nation, and the First Nation of Na-Cho Nyäk Dun, whose Traditional Territories overlap or partially overlap with the project access road, and areas where exploration and mining activities may occur. In addition to Coffee, Fuerte holds a portfolio of copper and gold assets, including the Placeton-Caballo Muerto Project in Chile and the Cristina and Yecora Projects in Mexico, offering additional growth and exploration upside. At Fuerte, we are committed to building value through disciplined project development, responsible stewardship of the land, a safety-focused culture, and creating long-term returns for shareholders.

Qualified Persons

The Preliminary Economic Assessment was prepared by independent Qualified Persons in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. A technical report on the Coffee Gold Project will be prepared in accordance with National Instrument 43-101 and filed under the Company’s profile on SEDAR+ and on the Company website within 45 days.

The report will cover all key aspects of the Project, including property description and location, geology, mineral resource estimates, mining methods, metallurgical testing and recovery processes, project infrastructure, permitting, capital and operating cost estimates, and economic analysis.

The Qualified Persons (“QPs”) responsible for the Study include:

-

Charley Murahwi., (Micon) – Mineral Resource Estimates

-

William Richard McBride and David Jin., (WSP) – Process Plant Design, Process Infrastructure, Metallurgy, Recovery Methods, and Operating (plant and G&A) Cost Estimates, Financial Analysis

-

Lasha Young and Kim Ferguson., (WSP) – Environmental Studies, Permitting and Social or Community Impacts

-

Marc Rougier., (WSP) – Waste Rock Storage Design, Project Infrastructure

-

John Kurylo., (SRK) – Mine Waste and Water Management Infrastructure (geotechnical)

-

Samantha Barnes., (SRK) – Mine Waste and Water Management Infrastructure (hydrotechnical)

-

Hannah Chiew., (Ensero) – Water Treatment

-

Russ Downer., (Open Contour) – Responsible for Mine Optimization, Mine Design, and Mine Schedule

-

Barry Calson., (Forte Dynamics) – Heap Leach

Full detail of areas of responsibility of the QPs can be found in the Technical Report.

The content of this news release from the Study has been reviewed and approved by the QPs who authored the Study. In addition, Mr. Denis Flood, P.Eng., Chief Operating Officer of Fuerte Metals and a QP as defined in NI 43-101, has reviewed the PEA on behalf of the Company and has approved the technical disclosure contained in this news release.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Additional Information

For more information, please contact:

Tim Warman, Chief Executive Officer and Director

Fuerte Metals Corporation

Email: info@fuertemetals.com

Forward-Looking Information

Certain of the statements made and information provided by Fuerte in this press release are forward-looking statements or information within the meaning of applicable Canadian securities laws. Often, these forward-looking statements and forward-looking information can be identified by the use of words such as “anticipates”, “believes”, “budget”, “continue”, “estimates”, “expects”, “forecasts”, “guidance”, “intends”, “plans”, “projected” or “scheduled” or the negatives thereof or variations of such words and phrases or statements. Forward-looking statements or information contained in this press release include, but are not limited to, statements or information with respect to: resource estimates in respect of the Company’s mineral projects; exploration and development activities; the preliminary economic assessment for the Coffee Project including anticipated production, planned mine life, operating costs, cash costs, AISC, capital costs, cash flow and closure costs; anticipated royalties and the expectation that royalties will be repurchased; the sensitivity of project economics to gold prices; the 2026 drilling program and early works program for the Coffee Project; expectations relating to production from the Coffee Project and the timing of the commencement of commercial production; the timing of a construction decision; the timing of permitting and engineering milestones; planned infrastructure upgrades; and, generally, the Company’s strategy, plans, goals and priorities.

Forward-looking statements and forward-looking information are by their nature based on a number of assumptions that management considers reasonable. However, such assumptions involve both known and unknown risks, uncertainties, and other factors which, if proven to be inaccurate, may cause actual results, activities, performance or achievements to be materially different from those described in the forward-looking statements or information. These include assumptions concerning: timing, cost and results of exploration and development activities; the future price of gold and other base and precious metals; exchange rates; anticipated operating and capital costs, expenses and working capital requirements; royalty costs and the repurchase of royalties; the cost of, and extent to which the Company uses, essential consumables; the sustaining capital required for the Company’s projects; and the geopolitical, economic, permitting and legal climate. Even though management believes that the assumptions underlying such statements or information are reasonable, there can be no assurance that the forward-looking statement or information will prove to be accurate. Many assumptions are difficult to predict and are beyond the Company’s control.

Forward-looking statements and forward-looking information are subject to known and unknown risks, uncertainties and other important factors that may cause actual results, activities, performance or achievements to be materially different from those described in the forward-looking statements or information. These risks, uncertainties and other factors include, among others: inaccurate estimation of mineral resource; the results of exploration and development activities not being as anticipated; integration risks associated with acquisitions; liquidity and financing risks; changes in prices of gold, other base and precious metals and consumables; currency risk; tax matters; changes in general economic or market conditions; market volatility; competition for, among other things, capital and skilled personnel; legal and regulatory risks including failure to obtain necessary permits or changes in applicable mining laws; mineral tenure; failure to protect proprietary information; risks relating to operating in remote or foreign jurisdictions; risks of political instability, terrorism, sabotage, natural disasters or public health concerns; community relations and social license; geotechnical conditions or failures; reclamation and long-term obligations; risks relating to environmental, sustainability, and governance practices and performance; corruption, bribery, and sanctions; employee misconduct; litigation; conflicts of interest; tariffs and other trade barriers; and those risk factors discussed in our most recent Annual Information Form.

To the extent that any forward-looking information presented herein constitutes future-oriented financial information or financial outlook, as defined by applicable securities legislation, such information has been approved by management of the Company and has been presented to provide management’s expectations used for budgeting and planning purposes and for providing clarity with respect to the Company’s strategic direction based on the assumptions presented herein and readers are cautioned that this information may not be appropriate for any other purpose.

There can be no assurance that forward-looking statements or information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, you should not place undue reliance on the forward-looking statements or information contained herein. Except as required by law, the Company does not expect to update forward-looking statements and information continually as conditions change and you are referred to the full discussion of the Company’s business contained in the Company’s reports filed with securities regulatory authorities.

Non-GAAP Measures

The Company has included herein certain performance measures (“non-GAAP measures”) which are not specified, defined, or determined under generally accepted accounting principles (“GAAP”). These non-GAAP measures are common performance measures in the gold mining industry, but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented by other issuers. Accordingly, we use such measures to provide additional information, and readers should not consider these non-GAAP measures in isolation or as a substitute for measures of performance prepared in accordance with GAAP. As the Coffee Project is not in production, it does not have historical non-GAAP financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-GAAP financial measures or ratios may not be reconciled to the nearest comparable measures under IFRS.

Cash Costs – The Company calculated total cash costs as the sum of mining, processing, refining & transport, G&A and royalty costs. Cash costs per ounce is calculated by taking total cash costs and dividing such amount by payable gold ounces. While there is no standardized meaning of the measure across the industry, the Company believes that this measure is useful to external users in assessing operating performance.

All-In Sustaining Cost – All-in sustaining costs are comprised of total cash costs, sustaining capital expenditures to support ongoing operations and closure costs. All-in sustaining costs per ounce is calculated as all-in sustaining costs divided by payable gold ounces. All-in sustaining costs capture the important components of Coffee’s production and related costs and are used by the Company and investors to understand projected cost performance at the Coffee Project.

Sustaining Capital – Sustaining capital is a supplementary financial measure which reflects cash-basis expenditures which are expected to maintain operations and sustain production levels at the Coffee Project.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the Policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284732