Andean Precious Metals Provides Update on 2025 Exploration Results at Golden Queen and San Bartolome

Golden Queen Exploration Program Expanded by 3,800 metres Following Positive Results

Toronto, Ontario–(Newsfile Corp. – October 16, 2025) – Andean Precious Metals Corp. (TSX: APM) (OTCQX: ANPMF) (“Andean” or the “Company“) is pleased to provide an update on its 2025 exploration activities at its Golden Queen mine located in Kern County, California, and San Bartolome operation located in Potosi, Bolivia.

2025 Exploration Program Highlights:

Golden Queen

-

Phase 3 program advancing with 4,300 metres of core drilling.

-

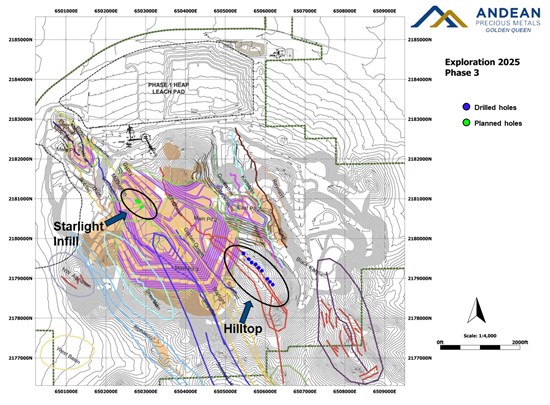

3,903 metres drilled at Hilltop (“HT” holes) (Please refer to Figure 1 below showing the location of each exploration site) to date; all holes intersected projected veins.

-

Assays confirm mineralized intervals, including:

-

HT25-01: 0.79 grams per tonne (g/t) Au and 3 g/t Ag over 8.0m (drill metres)

-

HT25-03: 1.94 g/t Au and 27 g/t Ag over 4.4m

-

HT25-06 : 1.26 g/t Au and 15 g/t Ag over 5.8m and 5.11 g/t Au and 11 g/t Ag over 1.5m

-

-

Infill drilling at Starlight Vein planned to support mine-life extension at Main Pit 2.

-

Following the positive results extending mineralization along strike during the Phase 3 exploration program, the Company has approved an additional 3,800 metres of drilling, bringing the total planned drilling to 8,100 metres for 2025.

-

Updated mineral resource and reserve statement, with supporting technical report prepared in accordance with National Instrument 43-101 – Disclosure for Mineral Projects (“NI 43-101”), anticipated in the first half of 2026.

San Bartolome

-

Secured environmental exploration permits and social licenses in partnership with COMIBOL.

-

Long-term COMIBOL agreement in place for the purchase of up to 7.0 million tonnes of oxide ore.

-

Exploration underway at Turqui, Tacobamba, Ánimas, Santa Isabel, and Trapiche. (Please refer to Figure 5 – Bolivia Exploration Project Locations)

-

5,500 metres of shallow core drilling to begin in Q4 2025, targeting ~800,000 tonnes grading 150-250 g/t Ag.

-

Program designed to extend mine life and fully utilize the 5,000 tonnes per working day (tpd) mill nameplate capacity without major capital investment.

Yohann Bouchard, President, commented, “Our exploration teams have made strong progress this year at both Golden Queen and San Bartolome. At Golden Queen, Phase 3 drilling has intersected encouraging mineralized intervals that confirm continuity and support potential mine-life extensions, while upcoming infill work at the Starlight Vein is designed to further expand Main Pit 2. In Bolivia, our partnership with COMIBOL is advancing multiple targets under a long-term ore supply agreement that secures access to up to 7 million tonnes of oxide ore. This program is designed to extend San Bartolome’s mine life and maximize throughput of the existing 5,000 tpd mill without major capital spend. Collectively, these initiatives highlight the quality of our asset base, reinforce the growth potential across our portfolio, and position Andean as a growing Americas-focused precious metals producer. We look forward to providing an updated resource and reserve statement, along with a supporting NI 43-101 technical report, in the first half of 2026.”

Golden Queen Overview

After acquiring Golden Queen in late 2023, the Company adopted a multiphase strategy to expand mineral resources and mineral reserves within the existing mining zones and to evaluate nearby targets for potential to add to the current mineral resources and mineral reserves (“GQ Exploration Program”).

In 2024, the Company completed Phase 1 and Phase 2 of the GQ Exploration Program, consisting of 29 shallow infill reverse circulation (“RC”) drill holes and 23 diamond drill holes, respectively. The RC drilling confirmed mineral continuity at the Silver Queen Vein, Main Pit 2 and Main Pit 3. The 23 diamond drill holes in Silver Queen Southwest Extension, Alphason, and the new Hilltop target also returned favourable analytical results and are expected to contribute to development of new mineral resources and mineral reserves.

The main highlights of Phase 1 and Phase 2 are the following:

-

Phase 1 consisted of 29 shallow infill RC drill holes that were completed in July 2024 totaling 4,617 metres of drilling,12 RC holes (1,360 metres) in Silver Queen Vein, in Main Pit 2 and Main Pit 3, confirming the geological model and;

-

17 RC holes (3,257 metres) in Alphason Target, tested the continuity of historic gold mineralization identified prior to the Company’s acquisition.

-

Silver Queen Southeast extension, 12 core holes (2,553 metres) were drilled, extending mineralization 100 metres longitudinally, intercepting mineralization up to 1.67 g/t gold and 8 g/t silver across 5.49 metres (DDH SQ24-06);

-

Alphason, 7 core holes (1,196 metres) intercepted gold and silver mineralization, including hole AL24-02 with 0.88 g/t Au and 10 g/t Ag across 92.96 metres; and

-

Hilltop, 4 core holes (581 metres) were drilled in this new target, all of which intercepted gold and silver mineralization, including hole SQ24-12 which intersected mineralization starting at 18.14 metres downhole, grading 1.67 g/t Au and 20 g/t Ag across 5.89 metres.

The Company released the results of the Phase 2 exploration campaign in a press release dated May 1, 2025.

Phase 3 – 2025 Golden Queen Exploration Program

The 2025 Exploration Program at Golden Queen initiated Phase 3. This phase consists of 4,300 metres of core drilling and is focused on extending the mine life by exploring the Hilltop area, which represents the southeast extension of the Silver Queen vein, as well as expanding current mining zones into areas of limited exploration data, primarily the Starlight Vein in the southeast trend of Main Pit 2.

The Company is pleased to provide an update on Phase 3 of the 2025 Exploration Program:

-

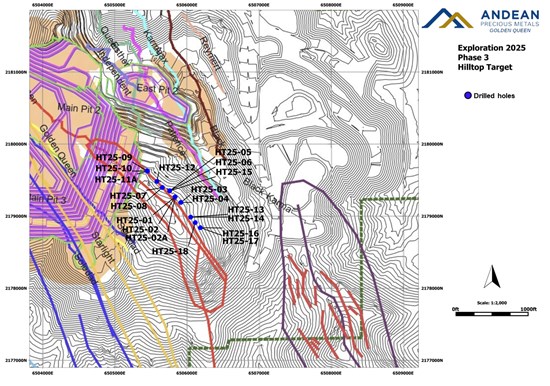

20 core holes (3,903 metres) have been drilled at Hilltop, all intersecting projected veins, which consist of low sulfidation- cryptocrystalline quartz veins and veinlets which are outcropping in the area.

-

Assay results for 6 core holes have been received. All 6 core holes report mineralized intervals, and the main highlights are the following:

-

Core hole HT25-01 intersected 0.85 g/t Au and 9 g/t Ag across 5.2 metres, as well as 0.79 g/t Au and 3 g/t Ag across 8.0 metres.

-

Core hole HT25-02: intersected 1.14 g/t Au and 14 g/t Ag across 0.7 metres.

-

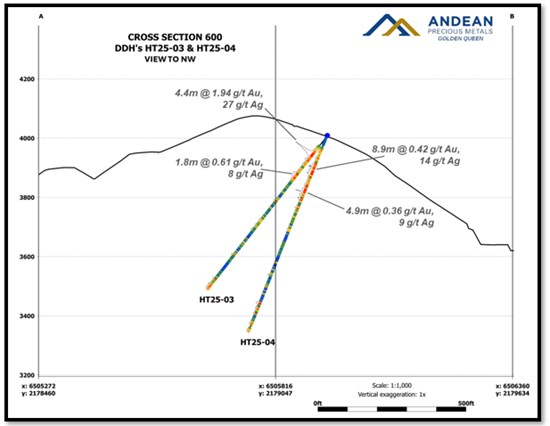

Core hole HT25-03 intersected 1.94 g/t Au and 27 g/t Ag across 4.4 metres.

-

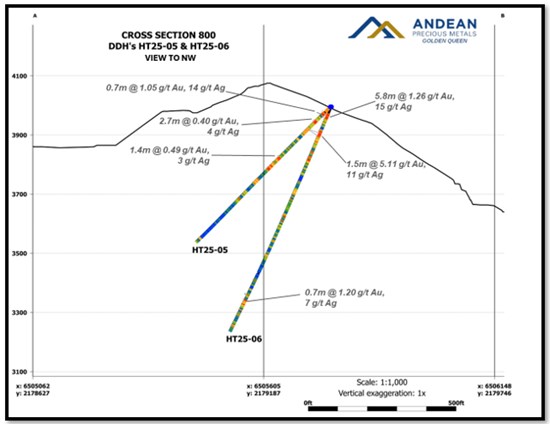

Core hole HT25-06 intersected 1.26 g/t Au and 15 g/t Ag across 5.8 metres.

-

Core hole HT25-06 intersected 5.11 g/t Au and 11 g/t Ag across 1.5 metres.

-

-

Longitudinal continuity of veins is being proved up to 280 metres on strike.

-

Mineralization continuity is open to the southwest and at depth in the Silver Queen Vein and Main Pit 1 and Main Pit 3.

The Company also plans to conduct infill drilling at the Starlight Vein, located in the southeast trend of Main Pit 2, which is currently in production. This work is expected to provide additional geological information to support the development of mineral resources and ultimately expand Main Pit 2 in this direction.

Based on the positive outcomes achieved in the Phase 3 exploration program to date, the Company has approved an additional 3,800 metres of core drilling to further expand and infilled the current mining zone along strike. This brings the total Phase 3 drilling to 8,100 metres, which is expected to be completed by the end of 2025.

The Company consistently updates its Golden Queen block model, integrating new geological data as it becomes available. Mineral resources and mineral reserves are currently under development, with an updated statement and accompanying technical report anticipated in the first half of 2026.

Figure 1 – 2025 Core Drill Holes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_001full.jpg

Figure 2 – 2025 Core Drill Holes at Hilltop

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_002full.jpg

Figure 3 – Cross Section 600 (DDH’s HT25-03 and HT25-04)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_003full.jpg

Figure 4 – Cross Section 800 (DDH’s HT25-05 and HT25-06)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_004full.jpg

Table 1 – Composited Analytical Results – Hilltop Target

| Hole ID |

Total Depth (m) |

Azimuth (degrees) |

Inclination (degrees) |

Analytical Results | ||||

| From (m) | To (m) | Width (m) | Au (g/t) | Ag (g/t) | ||||

| HT25-01 | 213 | 223 | -57 | 16.4 | 21.6 | 5.2 | 0.85 | 9 |

| 40.7 | 41.5 | 0.8 | 0.44 | 3 | ||||

| 47.7 | 55.6 | 8.0 | 0.79 | 3 | ||||

| 58.3 | 60.9 | 2.7 | 0.46 | 3 | ||||

| 77.1 | 77.9 | 0.8 | 0.69 | 3 | ||||

| 80.2 | 81.1 | 0.9 | 0.59 | 5 | ||||

| HT25-02A | 218 | 222 | -74 | 26.9 | 28.3 | 1.5 | 0.80 | 10 |

| 26.9 | 27.6 | 0.7 | 1.14 | 14 | ||||

| 31.8 | 33.1 | 1.3 | 0.43 | 9 | ||||

| 40.4 | 42.8 | 2.4 | 0.57 | 4 | ||||

| 40.4 | 41.3 | 0.9 | 0.99 | 4 | ||||

| HT25-03 | 201 | 225 | -52 | 23.5 | 27.9 | 4.4 | 1.94 | 27 |

| 32.5 | 33.3 | 0.9 | 0.43 | 8 | ||||

| 50.0 | 51.8 | 1.8 | 0.61 | 8 | ||||

| HT25-04 | 219 | 212 | -68 | 34.9 | 43.8 | 8.9 | 0.42 | 14 |

| 59.0 | 63.9 | 4.9 | 0.36 | 9 | ||||

| 66.6 | 67.2 | 0.6 | 0.50 | 10 | ||||

| 70.0 | 70.7 | 0.8 | 0.57 | 14 | ||||

| 80.6 | 81.7 | 1.1 | 0.33 | 21 | ||||

| 185.6 | 187.9 | 2.3 | 0.39 | 1 | ||||

| HT25-05 | 197 | 225 | -45 | 7.9 | 8.7 | 0.7 | 1.05 | 14 |

| 20.4 | 23.0 | 2.7 | 0.40 | 4 | ||||

| 73.5 | 74.9 | 1.4 | 0.49 | 3 | ||||

| HT25-06 | 254 | 222 | -66 | 7.9 | 13.7 | 5.8 | 1.26 | 15 |

| 30.2 | 31.7 | 1.5 | 5.11 | 11 | ||||

| 212.2 | 212.9 | 0.7 | 1.20 | 7 | ||||

Table Notes:

- All drill and assay data originally reported in imperial units converted to metric.

- 1302 HQ-sized core (63.5 mm diameter) were sampled with variable sample lengths. Mineralization widths are down-hole lengths, true widths are not yet known.

- A total of 1275 core samples plus 117 samples for QAQC purposes were submitted for analyses performed by Paragon Geochemical; an ISO 17025 accredited analytical services provider with sample preparation and analytical facilities in Sparks, NV, USA.

- Paragon’s analytical methods used for gold were Au-FA 30 for gold and 48MA-MS for silver.

- A 0.27 gold g/t cutoff grade used in compositing. No more than 2 consecutive values less than the cutoff were use. Grades were not capped.

- An additional 9% blanks, standards and duplicates were submitted for QAQC purposes. This consisted of 41 blanks, 38 certified reference materials (CRM) and 38 duplicates. 14 QAQC results failed and are being checked by GQ Exploration Staff and Paragon Lab.

San Bartolome Overview

San Bartolome fully transitioned from mining to a mineral purchase business model in 2023. Over the past 2 years, the Company has expanded the number of mineral purchase agreements with private and artisanal miners and strengthened its collaboration with COMIBOL. Our strategy is to sustainably increase the processing rate to its full nameplate capacity of 5,000 tpd.

As previously disclosed, the Company entered into an exclusive long-term agreement with COMIBOL to purchase up to 7 million tonnes of oxide ore located within a 250 kilometre radius of the San Bartolome processing facility. The Agreement is effective for 10 years and includes an option to extend for an additional 10-years to fulfill the oxide ore purchase volumes.

Working jointly with COMIBOL, the Company is securing the required environmental exploration permits and social licenses, while preparing the respective mines for operations. Ongoing negotiations with local communities and mining cooperatives have resulted in the timely authorization for site access and fieldwork.

Figure 5 – Bolivia Exploration Project Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_005full.jpg

In accordance with our COMIBOL agreements, geological and exploration activities have started. Exploration activities began in June at the Ánimas and Turqui projects, followed in August by the Santa Isabel (Khellu Orkho Bonete and Kellu Orkho Mulatos areas) and Tacobamba projects. The initial objective consisted of the refinement of the geological models leading to validation with core drilling.

The shallow core drilling campaign is schedule to commence in the fourth quarter. A total of 5,500 metres is planned consisting of 2,500 m at Ánimas , 1,500 m at Turqui, and 1,500 m at Trapiche. The objective is to delineate 800,000 tonnes of new oxide material.

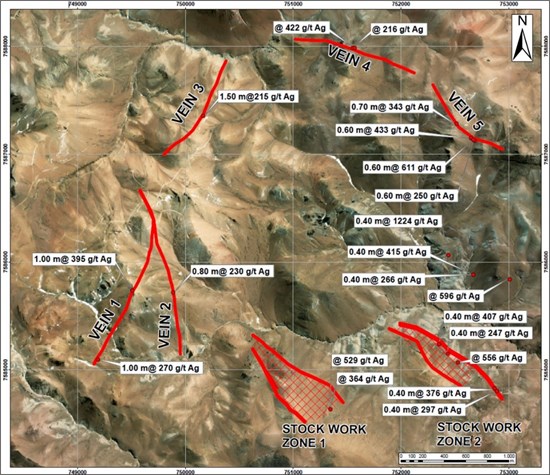

Turqui Project

The Turqui project is located in the municipality of Yocalla, Tomás Frías province, department of Potosí. The geological structure is on the eastern flank of an anticline characterized by Ordovician rocks composed of slaty mudstone interbedded with quartzite. The vein and veinlet-type mineralized structures, as well as oxidized breccias, are hosted by mudstones and quartzites with an average strike length of 500 metres, striking predominantly NE-SW and dipping to the SW.

Our initial geochemical surface sampling reports the following results: Vein 1: 221 g/t Ag; Vein 2: 402 g/t Ag, Vein 3: 244 g/t Ag; Vein 4: 358 g/t Ag. The mineralized structure has an average width of 1.0 metre grading 311 g/t Ag.

Figure 6 – Turqui Project, Target Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_006full.jpg

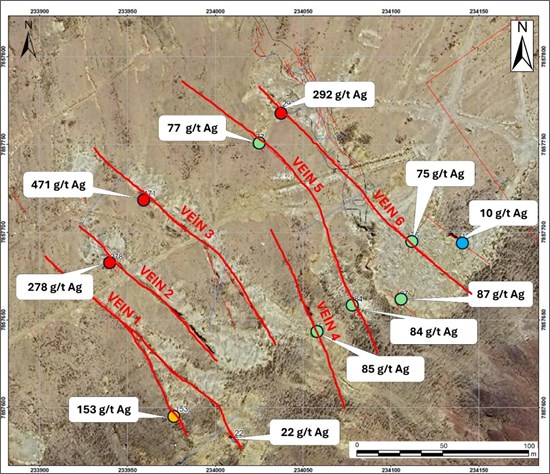

Tacobamba Project

The Tacobamba project is located in the Canutillos sector in the Tacobamba Municipality, Cornelio Saavedra Province, Potosí Department.

The mineralization is hosted in sedimentary rocks interbedded with shales and sandstones. Mineralogically, the presence of mineralized structures in NW-SE strike and dipping SW, with a length of approximately 150 metres, consisting of stockwork, breccias, veins, vein-faults, veinlets between joints, and dissemination in the host rock, is notable.

Geochemical results on surface show an average grade of 194 g/t Ag, and the underground geochemical results are averaging 246 g/t Ag.

Figure 7 – Tacobamba Project, Ore Bodies Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_007full.jpg

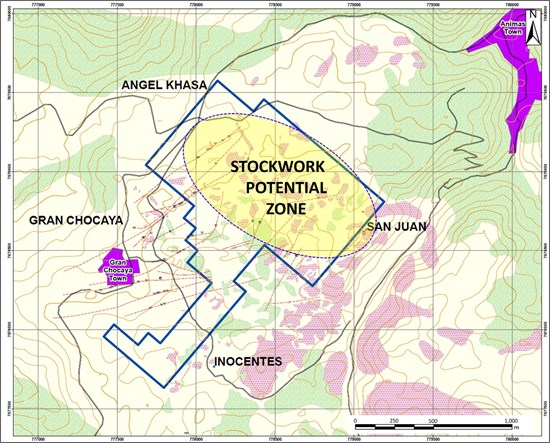

Ánimas Project

The Ánimas project is in southwestern Bolivia, department of Potosí, Sud Chichas province, within the Ánimas-Chocaya-Siete Suyos mining district.

The host rocks are composed of rhyolite domes, volcanic breccias, and sedimentary sequences of sandstones and shales. The area exhibits intense hydrothermal activity associated with regional faults that control mineralization.

The exploration work includes collection of old data, recognition of old underground workings, trenching, mapping and sampling in the area. Preliminary exploration focused to define the silver potential. To the northeast of the mining concession, the presence of a stockwork zone called the “San Juan Massive” has been identified. Old data from underground developments reveal values between 150 and 800 g/t Ag.

Figure 8 – Ánimas Project Stockwork and “Masivo San Juan” Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_008full.jpg

Santa Isabel Project

The Santa Isabel project is located in southeastern Bolivia in the Guadalupe Canton, Sud Lipez province, Potosí department. Exploration work is being carried out in mining areas. The Santa Isabel project includes two main areas of interest: Khellu Orkho Bonete and Khellu Orkho Mulatos.

The mineralized zones are hosted in volcanic rocks, composed of dacitic-andesitic lavas and pyroclastic deposits. The main structural features are domes, and other volcanic bodies.

The exploration activities involve litho-geochemical sampling and geological mapping of mineralized structures and altered rock. In Khellu Orkho Mulatos the main structures are silicified, ocherous veins with significant longitudinal extension, a stockwork zone was identified (preliminary dimensions: length 500m x width 50m), initial geochemical results from 87 to 350 g/t Ag, three veins were identified with a trending NE-SW, N-S, and NW-SE and lengths 1,200 metres, 850 metres and 650 metres respectively. These veins exhibit values ranging from 150 to 230 g/t Ag.

Figure 9 – Santa Isabel Project Ore Bodies Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_009full.jpg

Trapiche Project

The Trapiche Project is located between the municipalities of Tupiza and San Pablo de Lipez, in the Sud Lipez Sud Chichas provinces of Potosi Department. The 18 mining claims totaling 425 hectares are owned by Trapiche Mining Company S.R.L.

The Trapiche deposit is characterized by tectonic activity and intensely deformed hydrothermal breccias associated to the San Vicente Regional fault, which has experienced significant structural activity. These are overlain by Quaternary sediments, including gravel and sand.

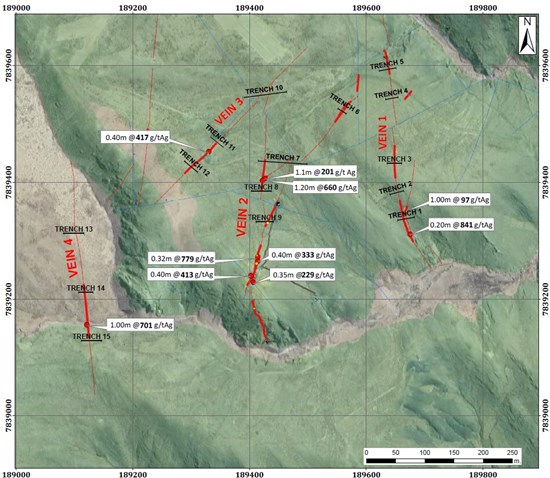

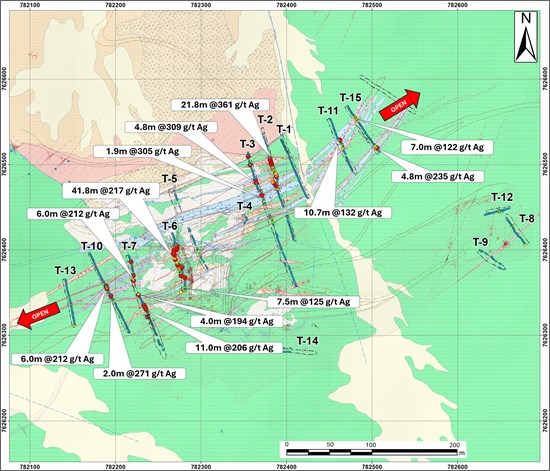

Exploration efforts are primarily focused on extending the mineralization along strike. To date, 15 trenches has been excavated, confirming a mineralized continuity over approximately 400 metres. The zone averages 10 metres in width, with an oxide layer approximately 40 metres in thickness, grading 180 g/t Ag. The Company has planned 25 drill holes totalling 1,500 metres with the objective of delineating and expanding mineral resources within the 400-metre mineralized extension.

Figure 10 – Trapiche Project, Sampling Map and Trenches Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6409/270605_2ff77ffda479f987_010full.jpg

Qualified Person Statement

The scientific and technical content disclosed in this news release was reviewed and approved by Donald J. Birak, Independent Consulting Geologist to the Company, a Qualified Person as defined by NI 43-101, Registered Member, Society for Mining, Metallurgy and Exploration (SME), Fellow, Australasian Institute of Mining and Metallurgy (AusIMM). Mr. Birak’s most recent visits to Golden Queen and Manquiri were in May, 2025 at Golden Queen and November 2024 at Manquiri.

For more information, please contact:

Amanda Mallough

Director, Investor Relations

amallough@andeanpm.com

T: +1 647 463 7808

Caution Regarding Forward-Looking Statements

Certain statements and information in this release constitute “forward-looking statements” within the meaning of applicable U.S. securities laws and “forward-looking information” within the meaning of applicable Canadian securities laws, which we refer to collectively as “forward-looking statements”. Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future economic conditions and courses of action. All statements and information other than statements of historical fact may be forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “seek”, “expect”, “anticipate”, “budget”, “plan”, “estimate”, “continue”, “forecast”, “intend”, “believe”, “predict”, “potential”, “target”, “may”, “could”, “would”, “might”, “will” and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook.

Forward-looking statements in this release include, but are not limited to, statements and information regarding the anticipated exploration activities and drilling programs at Golden Queen and San Bartolome; expected timing and results of infill drilling and mineral resource and mineral reserve updates; plans to extend mine life and expand Main Pit 2; objectives to maximize throughput without major capital investment; the anticipated benefits of the long-term COMIBOL agreement; and plans to secure permits and social licenses while preparing for mining operations under the COMIBOL agreement. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: the Company’s ability to carry on exploration and development activities; the Company’s ability to secure and to meet obligations under property and option agreements and other material agreements; the timely receipt of required approvals and permits; that there is no material adverse change affecting the Company or its properties; that contracted parties provide goods or services in a timely manner; that no unusual geological or technical problems occur; that plant and equipment function as anticipated and that there is no material adverse change in the price of silver, costs associated with production or recovery. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct, and you are cautioned not to place undue reliance on forward-looking statements contained herein.

Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this release include, but are not limited to: risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits and conclusions of economic evaluations; results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks relating to possible variations in reserves, resources, grade, planned mining dilution and ore loss, or recovery rates and changes in project parameters as plans continue to be refined; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages and strikes) or other unanticipated difficulties with or interruptions in exploration and development; the potential for delays in exploration or development activities or the completion of feasibility studies; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; risks related to commodity price and foreign exchange rate fluctuations; the uncertainty of profitability based upon the cyclical nature of the industry in which the Company operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental or local community approvals or in the completion of development or construction activities; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment; and other factors contained in the section entitled “Risk Factors” in the Company’s MD&A for the three and twelve months ended December 31, 2024.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in this release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270605