Should you sell your Lightspeed stock?

In a Nov. 6 report, ATB Capital Markets analyst Martin Toner raised his target price on Lightspeed Commerce (Lightspeed Commerce Stock Quote, Chart, News, Analysts, Financials TSX:LSPD) to $19.00 from $18.00 and maintained a “Sector Perform” rating, following better-than-expected second-quarter fiscal 2026 results and a guidance raise that suggests its transformation plan is starting to deliver.

Lightspeed reported Q2 2026 revenue of US$319.0-million, up 15.1% year over year and ahead of both consensus at US$308.3-million and the company’s own guidance of US$305–310-million. Adjusted EBITDA of US$21.3-million also beat expectations of US$18.0-million. Merchants processed US$25.3-billion in gross transaction volume (GTV), a 7.2% increase year over year.

Management raised its full-year guidance, now calling for at least 12% revenue growth (previously 10–12%), 15% gross profit growth (from 14%), and Adjusted EBITDA of at least US$70-million (previously US$68–72-million). For Q3, Lightspeed guided to revenue of US$305–310-million and Adjusted EBITDA of US$18–20-million, roughly in line with expectations.

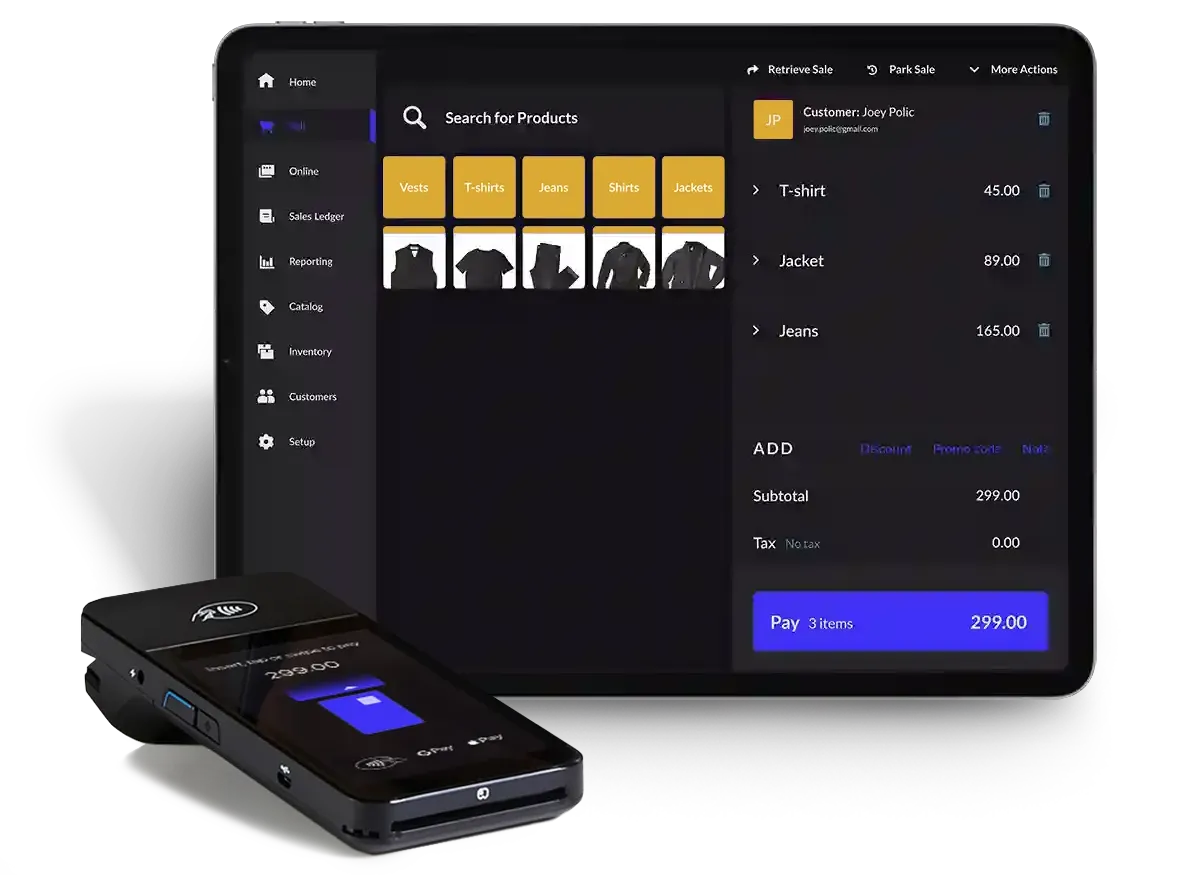

Toner said Lightspeed’s renewed focus on North American retail and EMEA hospitality is showing early results, with customer locations in its target verticals up 7% year over year to 92,000, software revenue up 20%, and payment penetration rising to 46% from 41% a year ago. “The Q2 beat and guidance raise are indications that the company’s strategic shift is working,” Toner wrote.

He also highlighted improving operating leverage, as SG&A fell to 31.2% of sales from 33.6%, while software margins rose to a record 81.7%. Lightspeed ended the quarter with US$462.5-million in cash, generated US$18.0-million in adjusted free cash flow, and has repurchased US$179-million in shares over the past year, with roughly US$200-million still authorized under its buyback program.

ATB’s updated model assumes modestly higher gross margin and EBITDA growth through fiscal 2027, with Lightspeed now expected to generate US$1.23-billion in revenue and US$74.1-million in Adjusted EBITDA in fiscal 2026, rising to US$1.36-billion and US$111.7-million in fiscal 2027.

Toner’s $19.00 price target is based on a discounted cash flow valuation with a 16% discount rate and 2.5% terminal growth rate, implying 8.8x EV/EBITDA and 1.1x EV/Revenue.

-30-

Tara Whittet

Writer

Tara Whittet is Senior Sales Manager at Cantech Letter.