No, Adobe won’t be killed by AI, this investor says

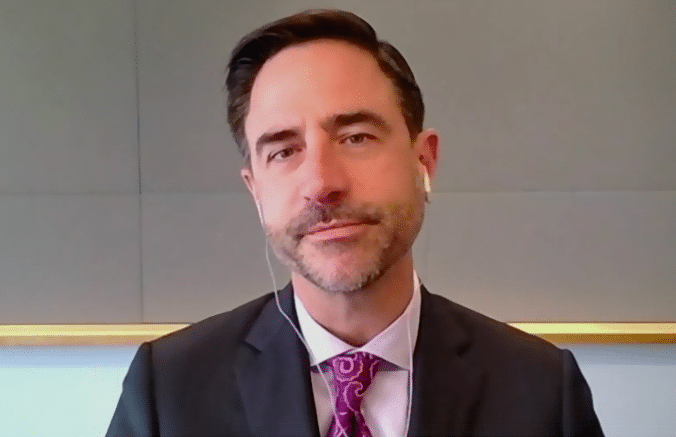

Harris Douglas Asset Management partner and portfolio manager Paul Harris told BNN Bloomberg’s Market Watch on Nov. 24 that Adobe’s (Adobe Stock Quote, Chart, News, Analysts, Financials NASDAQ:ADBE) selloff has pushed the stock to one of the cheapest valuations he has seen for the company, despite what he described as steady underlying growth and meaningful share buybacks.

Harris said the market has been overly focused on the idea that “Adobe is going to be killed by AI,” but argued that the company’s financial trajectory does not support that narrative.

“When you look at the numbers, revenue has gone from about US$3.4-billion in 2020 to about US$6.0-billion this year,” he said.

At the same time, Adobe has been “buying back roughly 10% of its shares every quarter,” a pace he believes creates a strong compounding effect for shareholders.

“When you have fewer shares and solid revenue growth, you have a very good compounding machine,” he said.

Harris added that part of Adobe’s recent weakness may stem from overly optimistic messaging around its AI strategy.

“Whether it was management’s fault or analysts’ fault, they over-emphasized how AI was going to help them,” he said. “You don’t see the fruition of that yet, but I think it will happen.”

He said he views the current level as “one of the lowest valuations you’ve ever seen on the company,” and therefore considers it attractive.

Looking more broadly, Harris said AI is likely to reshape industries, including his own.

“Why do you have so many analysts when you can have a machine do a lot of this stuff for you?” he said. “It’s going to be a very different world. They’re not going to buy the stocks for you, hopefully, but they can do a lot of the work analysts do today very easily.”

Adobe shares have fallen 37.15% over the past 12 months and 32.52% over five years. Street coverage includes 29 “Buy,” 15 “Hold,” and 2 “Sell” ratings, with a consensus price target of US$455.19.

Adobe closed Nov. 24 at US $318.73.

-30-

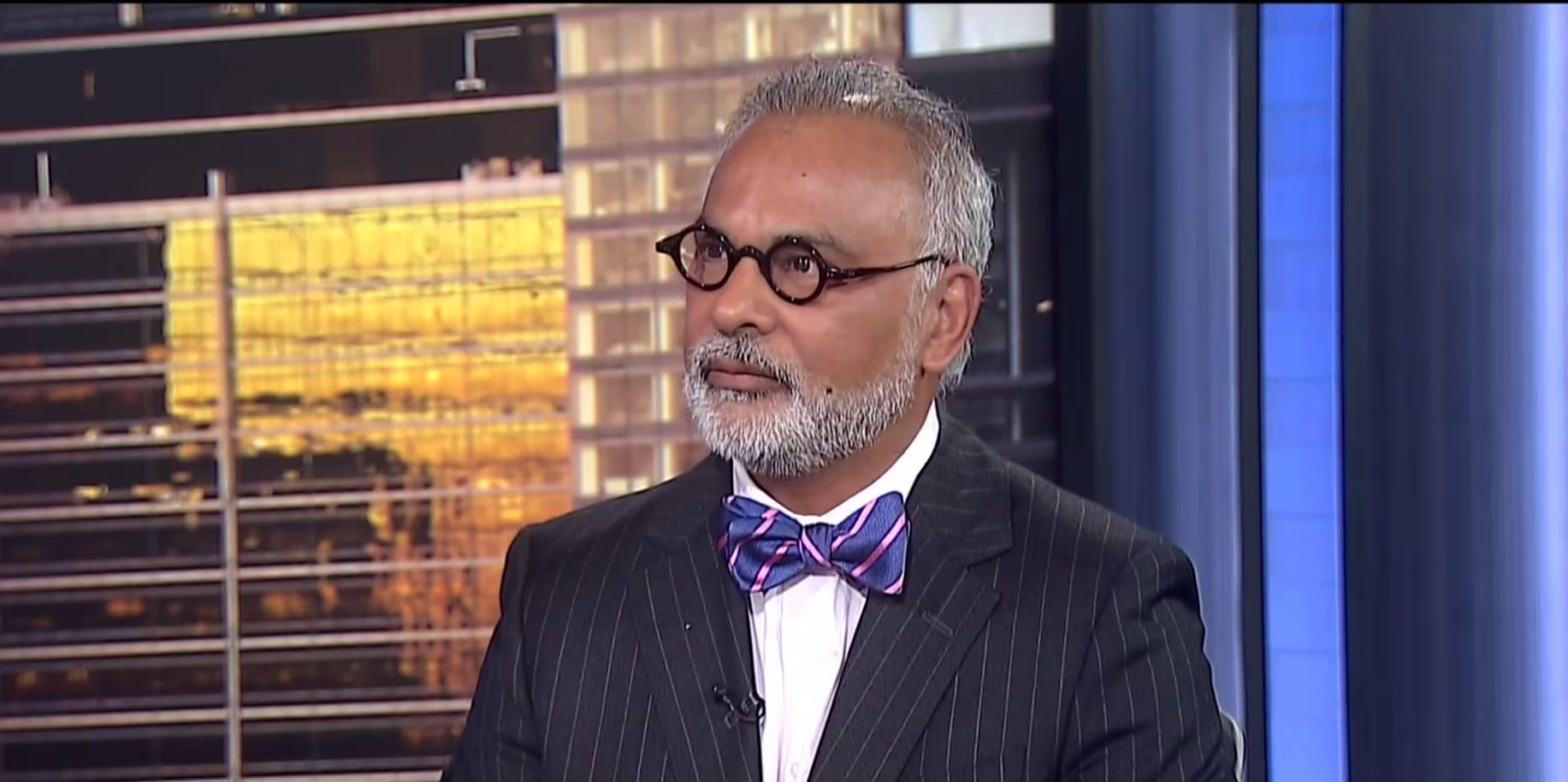

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.