Leede trims price target on Medexus Pharmaceuticals

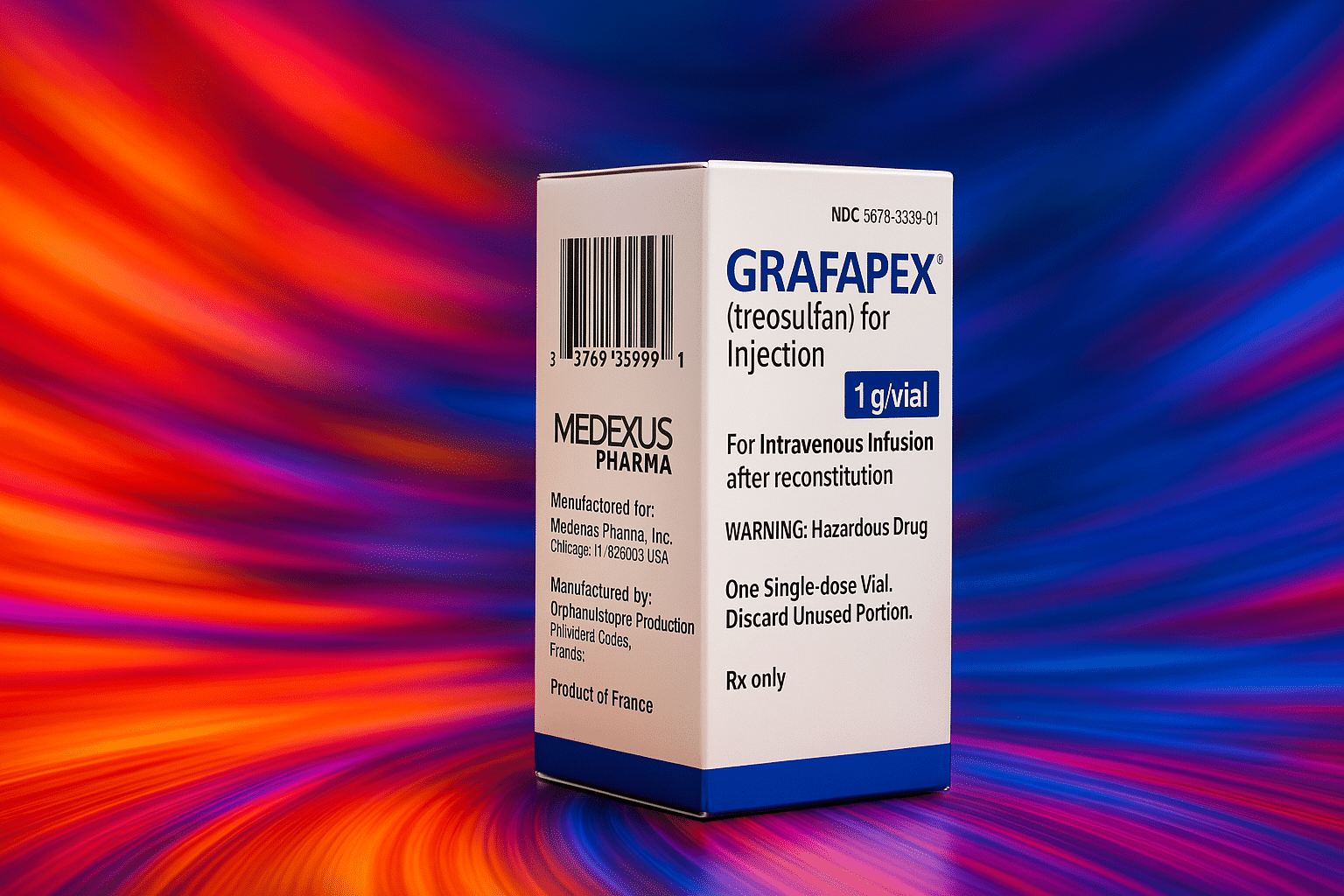

Leede Financial analyst Douglas Loe said Aug. 13 that Medexus Pharmaceuticals’ (Medexus Pharmaceuticals Stock Quote, Chart, News, Analysts, Financials TSX:MDP) fiscal Q1 2026 results were sequentially strong on early U.S. sales of its newly approved bone marrow conditioning drug Treosulfan/Grafapex, but softer than most periods between fiscal 2023 and fiscal 2025 due to limited growth in other key products.

Loe maintained a “Buy” rating but lowered his target price to C$8.00 from C$10.00.

“Most of the revenue softness arose from soggy Canadian Rx sales that were US$6.4M in the quarter, down from US$7.6M in FQ425 & more dramatically down from US$11.6M in FQ125,” Loe said.

Q1 revenue, EBITDA and margin were US$24.6-million, US$3.4-million and 14.0%, compared with US$24.8-million, US$2.0-million and 8.0% in Q4 2025, and US$27.3-million, US$6.1-million and 22.4% in Q1 2025. Gross margin improved to 65.5% from 59.8% in Q4 2025 and 59.3% a year earlier, helped by Treosulfan’s contribution.

“Medexus indicated that U.S. Grafapex-based sales activities should be sustainably cash flow-positive by FQ326 & so we are optimistic that quarterly cash flow can approach level achieved during the FQ323-to-FQ325 period for which average cash flow level was US$4.7M,” Loe said.

Operating cash flow in Q1 was US$3.4-million (US$0.09 per share), up from US$1.7-million (US$0.05) in Q4 2025 but below US$5.8-million (US$0.22) in Q1 2025.

Loe said Treosulfan is meeting early sales expectations, generating US$3.0-million in Q1 versus his forecast of US$2.5-million, and that peak sales potential of more than US$100-million “is well within reach in our view.” He added, “We stand by our view that Treosulfan’s documented superiority to previous bone marrow-conditioning standard-of-care busulfan (now widely-genericized) & the absence of plausible alternatives to Treosulfan either in the U.S. pharmacopeia or in ongoing clinical trials makes that sales threshold highly conservative.”

He believes peak sales could be achieved earlier than five years post-launch, providing upside to his fiscal 2027–2028 forecasts.

Loe forecasts Medexus will generate US$13.5-million in Adjusted EBITDA on US$102.6-million in revenue in fiscal 2026, rising to US$25.9-million on US$123.1-million in 2027, and to US$33.1-million on US$144.4-million in 2028.

-30-

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.