Is Renoworks Software a buy?

Editor’s note: This piece is the first in a series of insights from SmallCap Discoveries. As we have moved into our decade-and-a-half journey with Cantech Letter, we have found that analysis of small and microcap stocks has become increasingly rare in Canada. Filling this void admirably has been SmallCap Discoveries, which is the name for the collective efforts of Paul Andreola and Trevor Treweeke. The site has a clear mandate; introduce its readers to “10 Baggers” -stocks that return ten times on your investment- and SmallCap Discoveries has done so on multiple occasions. You may have noticed we have added a SmallCap section to our front page recently. You will find small and microcap stock ideas from SmallCap Discoveries and research from our investment bank partners here.

Renoworks Software is name that Paul and Trevor discovered years ago and has recently taken flight. I subscribe to the Premium Membership at SmallCap Discoveries and I find the nominal annual fee I pay is an afterthought when compared to the actionable investment ideas that are delivered to me throughout the year. What follows is an abridged version of an extremely comprehensive report on RW stock. The full report is available to Premium members, here

-Nick Waddell

Renoworks Software, Opportunity/Background

We first discovered Renoworks Software Inc. (Renoworks Software Stock Quote, Chart, News, Analysts, Financials TSXV:RW; OTC:ROWKF) nearly a decade ago. Since then, we’ve maintained an active dialogue with CEO Doug Vickerson and followed the business through multiple product iterations and strategic cycles. While the Company has consistently demonstrated strong product vision and deep manufacturer partnerships, its historical revenue growth and profitability have not met the thresholds we typically require before building a meaningful position.

That said, the past 24–36 months have marked a distinct strategic shift. RW has followed a clear multi-year roadmap: 2022 was a heavy investment year focused on eliminating technical debt and embedding a data science and analytics into the platform, further investment into their AI offering and revamping its Pro offering; 2023 was a stabilization year, with internal processes refined and the initial product development of new solutions largely complete. In 2024, RW entered its first true growth phase, and management has laid out a path for profitable growth in 2025 followed by ecosystem monetization and scalable expansion in 2026 and beyond.

RW now supports 3.5M homeowner sessions annually across its visualization tools, with integrations into the websites of over 200 building product manufacturers and access to 350+

branded product libraries. More than 295 contractors are now paying for Renoworks Pro licenses—a fraction of the estimated 450,000 addressable contractor market in North America.

RW is also beginning to segment contractor vs. enterprise revenue streams, setting the stage for clearer reporting and tailored growth strategies.

Management believes that going forward, growth will require less direct effort and more leverage—with manufacturer partners helping onboard contractors at scale, data enabling

lead monetization, and RW potentially taking a fee on platform-facilitated transactions. With the platform in place, the right team assembled, and aligned strategic partnerships, we believe RW is now positioned for structurally stronger execution and long-term value creation.

From a valuation perspective, we believe the business is attractively priced at ~3.1x EV/Q1-2025 ARR (see chart below), given (i) historical and expected growth of the high-margin recurring licensing revenue stream, and (ii) expected sustainable profitability going forward. At 30% ARR growth, the business is currently trading at EV/NTM ARR of ~2.4x. RW is profitable, debt free, with insider ownership of ~45% with insiders adding to their position as recently as this month. At ~$7.3M in TTM total revenue and ~$12M market cap, RW is a low-profile name with little institutional participation and strong discovery potential.

Company Overview

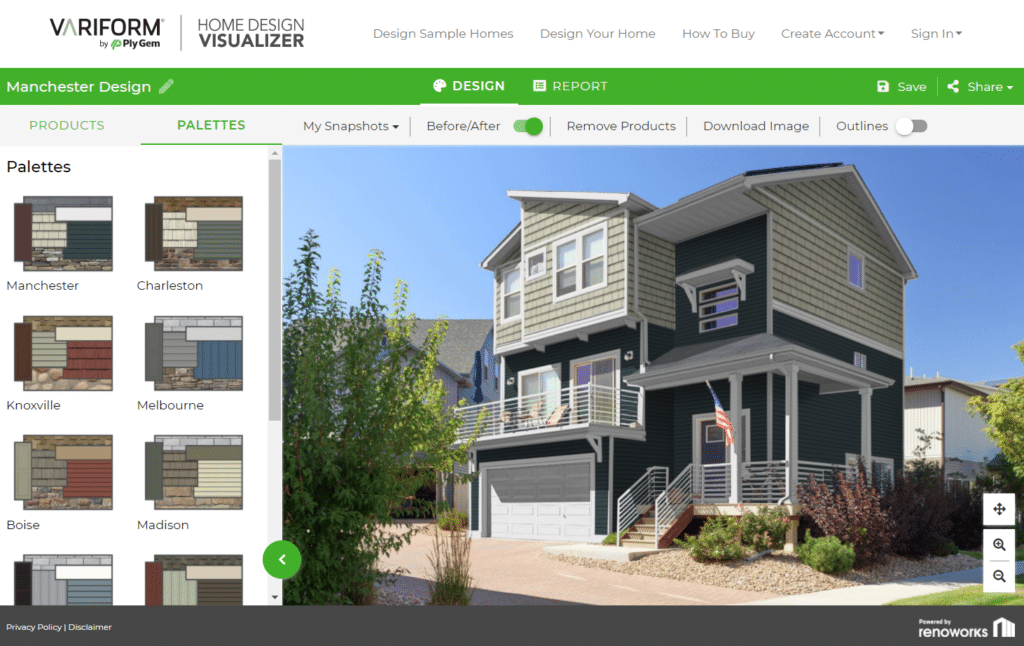

RW is a Canadian software Company founded in 2000 by Greg Martineau, a veteran in home construction and remodeling. Headquartered in Calgary, Alberta, Renoworks specializes in digital visualization solutions for the home renovation (primary focus) and new construction industries. The Company’s platform enables homeowners, contractors, and building product manufacturers to visualize exterior and interior (newly added functionality) design changes in a realistic, virtual environment before making purchase decisions.

Over the years, Renoworks has evolved its offerings to include AI-powered tools that automatically detect and segment various home features—such as roofing, siding, windows, and doors—from uploaded photos. This technology allows users to experiment with different design options quickly and intuitively. By integrating these capabilities into manufacturers’ websites, Renoworks has significantly increased user engagement, with average session times rising from 2 minutes to 15 minutes. The platform also captures extensive user interaction data, enabling predictive analytics that help manufacturers and contractors identify high-intent customers and improve lead conversion rates.

Renoworks generates revenue through multiple business lines, including Renoworks Enterprise, Renoworks PRO, and Design Services. The Company serves a broad client base across North America, encompassing over 350 building product brands and engaging more than 3.5 million homeowners annually. With a strategic focus on integrating AI and machine learning into its platform, Renoworks aims to enhance its value proposition for stakeholders in the home improvement value chain.

Conclusion

Based on our conversations with management, we believe our revenue growth assumptions in this scenario are modest. This is primarily because majority of the upside is based on conservative organic growth with existing manufacturer clients. On the GPM and opex side, we also believe our forecast is not aggressive, given that the GPM is based on the historical experience (and typical SaaS GPM for the licensing revenue) and the opex is modelled to increase by ~50% from the current levels (excl. R&D) with majority of the incremental spend

being allocated to S&M efforts. It’s worth noting that RW stands to benefit from the platform’s scalability and potential step-function change in revenues through larger upgrades or new client wins. R&D is modeled to continue at historical rates, which is likely adequate to remain innovative and be able to provide cutting edge solutions to clients.

In terms of valuation, we can see how 8.80x EV/Current ARR multiple at exit may seem aggressive. However, we believe that if RW can deliver on the value drivers embedded in this scenario, the investors looking at RW at exit will see a SaaS business with ~55% AEBITDA margin, 85% FCF conversion rate, 55% 4-year revenue CAGR, highly sticky customer base and an opportunity to continue to grow at similar rates going forward. And if this is the case, we believe 8.80x looks justified and they’d likely value the business on a forward basis using ARR and AEBITDA multiple in tandem. 6.9x NTM ARR may still seem high – however, ~11x NTM EBITDA for this type of business is viewed as more than acceptable.

We assigned 30% probability to this scenario (40% is also acceptable, with the delta allocated to the Base scenario).

Analyst Disclosure Statement

The views and opinions expressed in this research report are those of Inference Point and Dan Milic, CFA, and are based on independent analysis of publicly available information. These views do not represent the opinions, positions, or endorsements of the company being analyzed, its management, or any of its insiders. The information provided is for informational purposes only and should not be considered investment advice. Inference Point and Dan Milic, CFA, have made every effort to ensure the accuracy of the information contained herein; however, no warranty or representation is made as to its completeness or reliability. Investors are encouraged to perform their own due diligence and consider their unique investment objectives and risk tolerance before making any investment decisions. Inference Point and Dan Milic, CFA, assume no liability for any losses that may result from the use of this research report.

SmallCap Discoveries

Writer

Smallcap Discoveries is Canada’s leading small-cap investment community, dedicated to uncovering high-quality, under-followed companies with strong growth potential. Founded and led by veteran investors, the platform provides in-depth research, exclusive insights, and direct access to emerging opportunities in the micro- and small-cap space. Through its premium membership, conferences, and educational resources, Smallcap Discoveries connects growth-focused investors with exceptional companies—helping members identify tomorrow’s leaders today.