The clinical pipeline is progressing for Aptevo Therapeutics (Aptevo Therapeutics Stock Quote, Charts, News, Analysts, Financials NASDAQ:APVO), according to Roth Capital Partners analyst Jonathan Aschoff, who provided an update to clients on the company and stock on Monday. Aschoff reiterated a “Buy” rating while reducing his price target from $23 to $18.

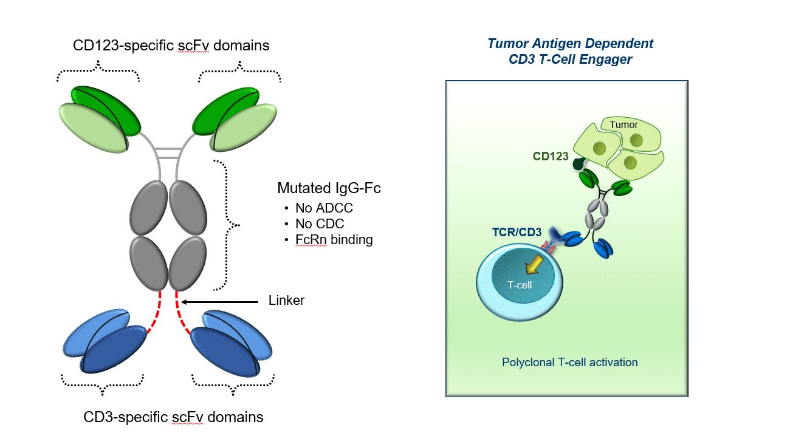

Aptevo is a Seattle-based clinical-stage biotech company focused on immunotherapy treatments for cancer. The company has candidate APVO436 in clinical trials for Acute Myeloid Leukemia (AML), where it announced this past December a favourable safety and tolerability profile in combination with venetoclax and azacitidine in a Phase 1b study. Aptevo said it plans a Phase 2 trial over the second half of 2023.

Earlier this year, Aptevo also began a first-in-human study for ALG.APV-527 to evaluate for treating 5T4-expressing tumours in multiple solid tumour types, with the first patient dosed in February.

The company announced on March 30 that it had raised $9.6 million in non-dilutive funding in a transaction for the complete sale of all future IXINITY deferred payments and a portion of IXINITY milestones to XOMA Corp. The deal left Aptevo with $26 million in cash after using about $3.5 million of the funds to fully repay its debt. (All figures in US dollars.)

Commenting on these recent developments, Aschoff wrote, “We look forward to APVO436 triple combination Phase 2 trial initiation in 2H23 in venetoclax-naive AML patients, and to initial Phase 1 ALG.APV-527 data later in 2023. Share count increase from 4Q22 At The Market use is the primary driver of our price target reduction to $18 from $23.”

As for Aptevo’s financials, Aschoff is expecting total revenue in 2023 and 2024 to now be nil, rising to $27.9 million in 2025 and $48.1 million in 2026. Net income is forecasted to go from negative $33.5 million in 2023 to negative $26.9 million in 2024.

Aptevo’s share price has fallen a long way over the past two years, going from above $25 to now below $2. Aschoff’s new $18 target represented at press time a projected one-year return of 873 per cent.

Share

Share Tweet

Tweet Share

Share

Comment