Digital health and wellness platform Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Charts, News, Analysts, Financials TSX:CARE) is set to deliver third quarter earnings next week, with Laurentian Bank Securities analyst Nick Agostino providing a review of the company and stock in a report to clients on Monday. Agostino reiterated a “Buy” rating on CARE along with an $8.00 target price, which at the time of publication represented a projected one-year return of 119.8 per cent.

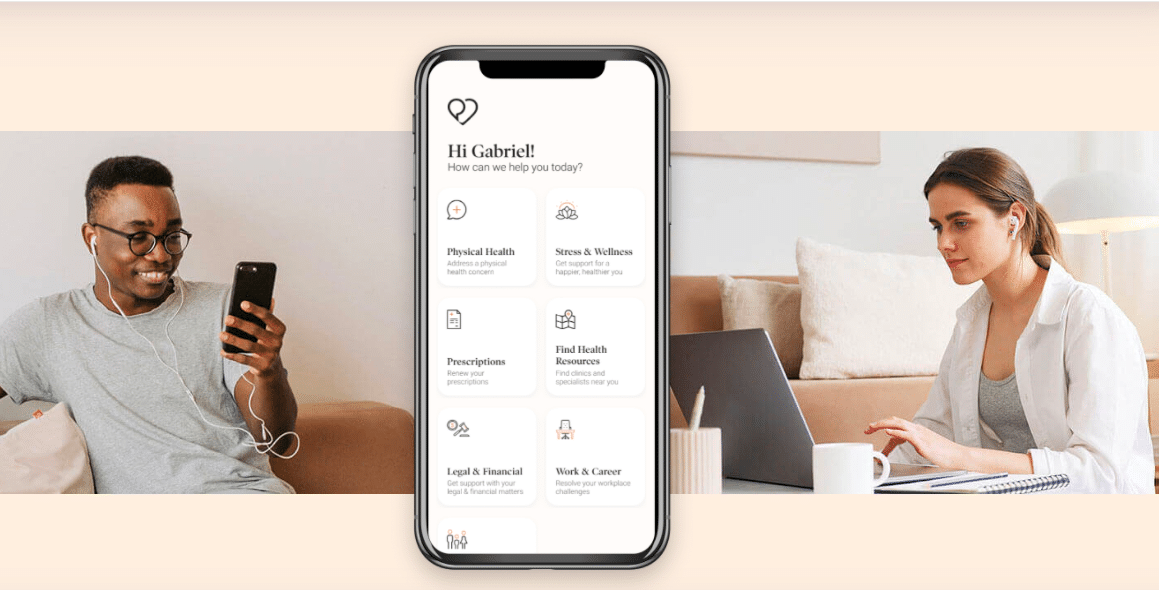

Founded in 2016 and headquartered in Montreal, Dialogue Health is an employee benefits platform providing on-demand access to medical care, serving employers and organizations and having over 2,000 customers in Canada and Germany. On its operations, the company recently announced a partnership with myHSA, a Canadian insurtech company delivering employee benefits, with myHSA now offering Dialogue’s Integrated Health Platform to myHSA’s advisor partners across Canada.

On the upcoming Q3, Agostino is calling for sales and EBITDA to be in-line with consensus estimates, with total revenue expected at $23.5 million, representing a year-over-year increase of 36.2 per cent, and EBITDA at a loss of $4.6 million. Breaking down the topline, Agostino is expecting $15.5 million from Dialogue’s Primary Care and Mental Health segment, representing a 34.7 per cent year-over-year improvement, $3.7 million from its EAP business, representing a 22.0 per cent year-over-year decline, and $1.2 million from its OHS business, up 30 per cent year-over-year. Its Wellness business is expected to come in at $3 million.

“We estimate gross margins of 49.4 per cent on a more favourable sales mix and relief from ongoing pricing increases,” Agostino wrote. “We model flat opex QoQ at 69 per cent of sales (versus 71 per cent QoQ/YoY) to reflect operating leverage and cost discipline despite inflationary pressures. That said, we look for an EBITDA loss of -$4.6 million, in-line with consensus. We estimate CARE’s customer acquisition cost (CAC) ratio at 2.1x for Q3/22, remaining in favourable territory and exemplifying sales efficiency/demand.”

Agostino said Dialogue’s balance sheet remains strong at net cash at the quarter’s end of $46.7 million.

Looking ahead, Agostino is forecasting full 2022 sales and EBITDA of $93.0 million and negative $19.2 million, respectively, and 2023 sales and EBITDA of $129.1 million and negative $6.5 million, respectively.

“With an estimated $58.3 million in cash on hand, $10-20 million annual cash burn, limited capex needs and expectations of positive EBITDA by year-end 2023, we calculate CARE to have $55-60 million in funds for M&A and/or share buybacks,” Agostino wrote.

Share

Share Tweet

Tweet Share

Share

Comment