Desjardins Capital Markets analyst Jerome Dubreuil reported on Canadian digital health tech stock Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Chart, News, Analysts, Financials TSX:CARE) in a recent client update, saying moves by the Quebec provincial government could have an impact on CARE, whose online platform could be in direct competition with a new government initiative.

The Coalition Avenir Québec (CAQ), the province’s sitting government, announced on Saturday new proposals as part of its re-election campaign, saying it will be constructing a new health portal for Quebecers to access provincial medical care. Called Votre Santé, the platform would identify a patient’s specific needs and refer them to an appropriate medical professional, including nurses, pharmacists as well as physicians.

CAQ and Premier François Legault had previously promised “a doctor for every Quebecer,” but the new approach is being offered as a more effective way to address Quebec’s health needs.

“There was a lot of discussion with the doctors for everyone to realize … that it is not possible to have a doctor for each patient — impossible,” said Health Minister Christian Dubé in a report from the Montreal Gazette. “Our commitment now is really with a health professional. And by the way, all the doctors welcome this change.”

The government said Votre Santé would not replace existing health booking sites in the province but would supplement with a “one-stop shopping” option for Quebecers.

“We have been saying for a long time that the key (to improving the health system) is the front line,” Legault said. “Until we have a strong front line, it will be difficult to solve problems.”

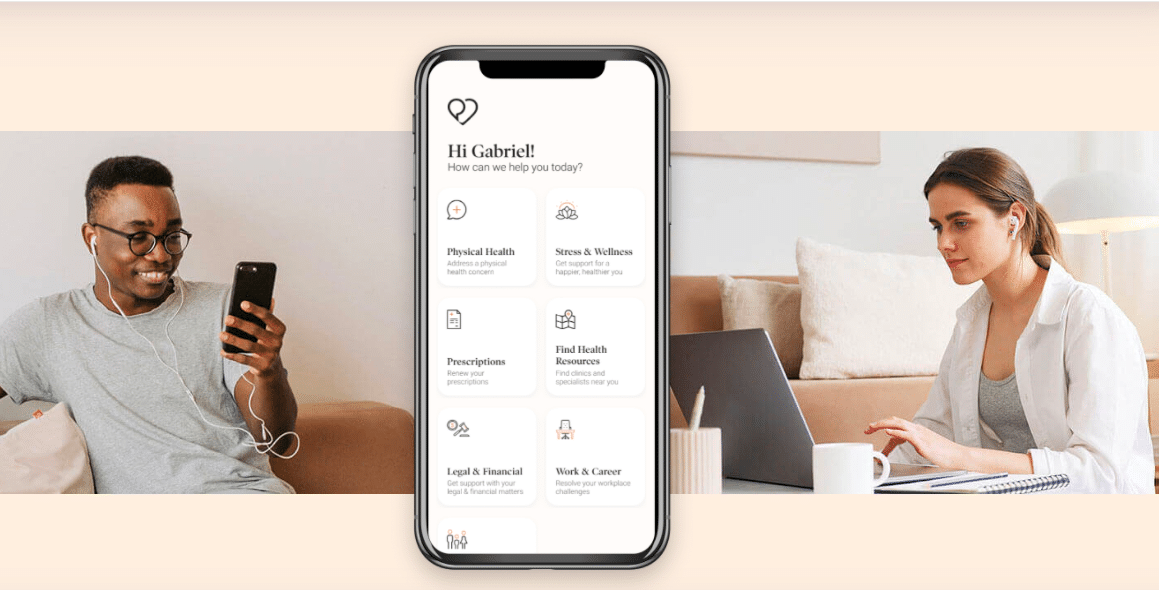

But the move could prove damaging to Montreal-based Dialogue Health, whose own health and wellness platform is currently in service to over 2,000 customers in Canada and Germany, with on-demand access to medical professionals through its Integrated Health Platform hub. Dubreuil said Votre Santé is currently only an election promise (with an expected start date of 2026) but stands as a clear threat to Dialogue, even with the head start that Dialogue has over CAQ on the technology.

“We consider the government to be a competitor of CARE—the more difficult it is to access the government’s system, the more attractive CARE’s platform is to employers, and vice versa,” Dubreuil said in his September 6 report.

“Given CARE’s expertise in the field, it should be well-positioned to continue adding value for its customers and their employers when/if the Québec government succeeds in launching Votre Santé as intended. However, there could be more pressure on CARE to innovate to stay ahead of publicly available services,” he said.

At the same time, Dubreuil noted that the Quebec government has a weak track record in tech development in health care but that more recently they have been improving, citing the deployment of the Clic Santé platform which saw strong usage over the pandemic.

Overall, Dubreuil called the government’s new announcement slightly negative for Dialogue.

“With (1) Votre Santé not launching until 2026, (2) its functionality still a big question mark, and (3) CARE progressively reducing its exposure to primary care, we do not view the CAQ’s initiative as an immediate threat to CARE. However, the announcement suggests that competition could increase for CARE in the medium to long term,” he wrote.

With the update, Dubreuil reiterated a “Buy” rating and above-average risk rating on CARE while also maintaining a $7.50 target price on the stock. At press time, the target represented a projected one-year return of 159.5 per cent. Dialogue Health Technologies, which IPO’d in March of 2021, has seen its share price drop from a high of $19.49 in early April, 2021, to the $2.00-$3.00 range where it has been trading over the past few months.

Commenting on the wider healthcare tech sector, which has been pummelled in recent years, Dubreuil said a recent bright spot is that M&A action in the space continues to accelerate. The analyst pointed to a recent announcement by CVS Health that it would be acquiring Signify Health for US$30.50 per share, implying a valuation of about 7.5x 2023 sales.

“While CARE is not a direct peer, it trades at a cheaper valuation of 0.8x despite its faster growth—consensus expects growth of 40 per cent for CARE in 2023 versus 12 per cent for Signify,” Dubreuil said.

Dialogue last reported its financials in mid-August where the company’s second quarter 2022 featured revenue of $23.0 million compared to $16.7 million a year earlier and an EBITDA loss of $7.7 million compared to a loss of $6.2 million a year earlier. The loss per share was $0.13 compared to a loss of $0.10 per share for the Q2 2021.

Share

Share Tweet

Tweet Share

Share

Comment