Desjardins analyst Jerome Dubreuil remains dialled in on Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Chart, News, Analysts, Financials TSX:CARE) as he maintained a “Buy” rating though he reduced his target price from $10.50/share to $10/share on account of the higher interest rate environment, with the revision leading to a projected return of 108.8 per cent in an update to clients on Wednesday.

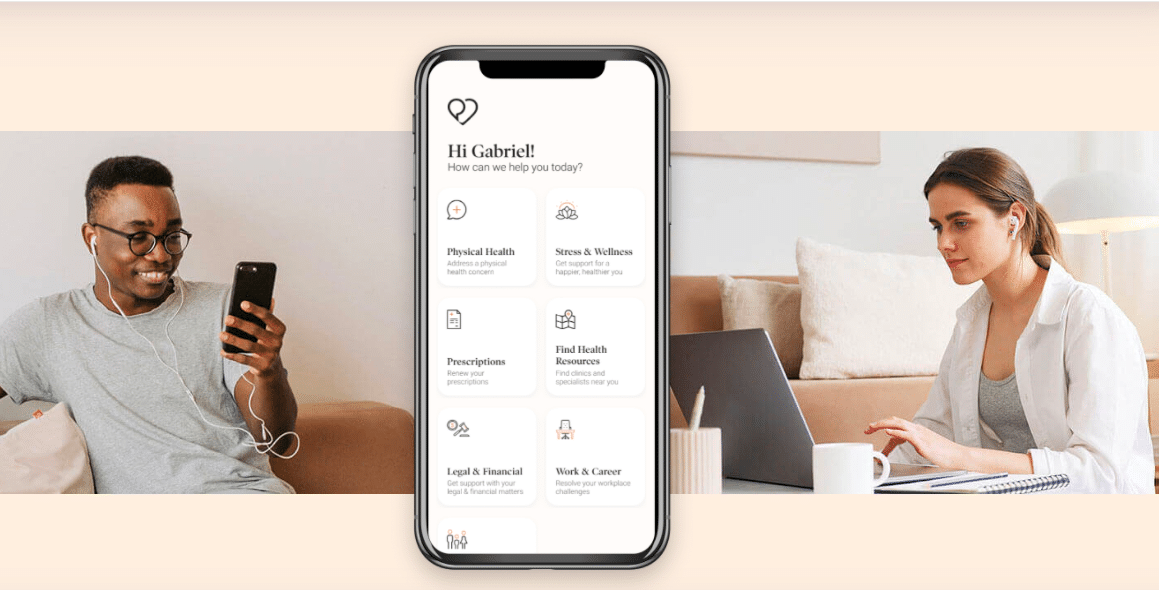

Founded in 2016 and headquartered in Montreal, Dialogue Health offers a digital healthcare and wellness platform to over 2,000 customers in Canada and Germany, including on-demand access to medical care through its Integrated Health Platform hub focused on physical, mental and wellness, as well as EAP and OHS services.

Dubreuil’s analysis arrives after Dialogue Health released its financial results for the first quarter of its 2022 fiscal year.

“CARE’s results were in line with our estimates, but slightly missed consensus, mainly due to non-recurring margin pressures,” Dubreuil said. “Revenue was in line with expectations and management indicated its pipeline is at record levels despite recently signing the large Scotiabank contract.”

Dialogue’s financial quarter was headlined by a loss of $5.7 million in adjusted EBITDA, which was in line with the Desjardins estimate of a $5.6 million loss but slightly off from the consensus estimate of a $4.9 million loss.

According to Dubreuil, the slight miss from the consensus stems from increased spending related to the Scotiabank contract despite a launch date of April 1 (the beginning of revenue generation) to ensure seamless onboarding, although company management believes its gross margin, which was a slight miss at 42.3 per cent compared to the Desjardins estimate of 44 per cent, will draw more in line with what it reported from its final quarter of 2021 moving forward.

“While CARE is not immune to inflationary pressures, we believe the company’s very low churn—about 4,400 members out of more than two million in the quarter— demonstrates its relatively strong pricing power,” Dubreuil said.

Meanwhile, the company’s net revenue came in at $20.7 million for the quarter to effectively be in line with the Desjardins estimate of $20.9 million, along with the consensus estimate of $20.6 million.

All told, the company exited the quarter with $64 million in pro forma cash after officially closing the acquisition of Tictrac, a London-based SaaS provider of a global health and wellness platform, on April 30.

“The team is executing very well on our growth strategy, building a robust and unparalleled integrated health platform that is resonating deeply with customers,” said Cherif Habib, Chief Executive Officer of Dialogue in the company’s May 9 press release. “In the first quarter, we continued to gain market share with our virtual EAP and signed more than 60% of our new customers to multiple services. With the recent acquisition of Tictrac, we are adding a wellness component to our platform that will allow us to engage members more frequently throughout their journey to better health and well-being. As in years past, 2022 is shaping up to be our most exciting one yet.”

In addition, Dubreuil pointed out that recent results from US telemedicine giant Teledoc Health, situated within Dialogue’s peer group, had put pressure on the Desjardins healthcare coverage, with some of Teledoc’s chief challenges being B2C and elongated sales cycles as HR departments are busy with the return to office.

“CARE’s management highlighted that it only operates in B2B and does not see similar sales cycle trends, aside from the expected additional delays because the company’s pipeline now includes larger potential clients,” Dubreuil said. “We believe the different structure of healthcare systems in Canada and the US protects Canadian operators from some of the commoditization risk we could be seeing in the US.”

The quarterly results have prompted Dubreuil to make revisions to his financial estimates, though he projects 2022 revenue to remain relatively stable at $104 million for a potential year-over-year increase of 52.9 per cent. Looking ahead to 2023, Dubreuil forecasts a minimal increase from $151 million to $152 million in revenue for a potential year-over-year increase of 46.2 per cent.

From a valuation perspective, Dubreuil projects the company’s EV/Revenue multiple to drop from the reported 3.7x in 2021 to a projected 2.4x in 2022, then dropping again to a projected 1.7x in 2023.

Meanwhile, Dubreuil has slightly downshifted his adjusted EBITDA projections, lowering his 2022 forecast from an $18.6 million loss to a $21.7 million loss. Dubreuil still projects a positive turn in 2023, but that figure was lowered from $6.4 million to a new projection of $2.1 million.

Dialogue Health Technologies has seen its share price drop by 46.6 per cent since the start of 2022, falling gradually after starting the year trading at $7.24/share and presently trading at a 2022 low of $3.87/share.

Share

Share Tweet

Tweet Share

Share

Comment